Ofcom Sets Out Changes to Fuel UK Full Fibre Broadband Rollout

The national telecoms regulator has today followed yesterday’s Future Telecoms Infrastructure Review (here) by setting out the core regulatory changes that they intend to pursue, which will support the government’s new plan and aim to spread Gigabit capable “full fibre” (FTTP) broadband ISP networks to all by 2033.

At present only around 4% of homes and businesses in the United Kingdom can access a pure fibre optic service via Fibre-to-the-Premises (FTTP) style technology, which is capable of delivering speeds of 1000Mbps (1Gbps) and well beyond into the future. The government has since made clear that they want 15 million premises to have access to this by 2025 and then nationwide to all by 2033 (here).

Yesterday’s FTIR report made clear that the gov expects it to be commercially viable for two or more providers to invest and deploy such networks for the first 80% of premises, provided the right support is given to encourage investment. After that it noted that the next 10% might be able to support a commercial deployment, albeit only from a single operator, while the final 10% would require public funding (est. £3bn to £5bn).

Advertisement

Overall the report said that the total cost of a national roll-out would likely be £30bn, although it’s worth considering that some of this cost will have already been completed as part of existing hybrid fibre and fibre optic deployments. The rollout of this is already underway by various ISPs (Summary of Full Fibre Broadband Plans and Investment) and is now ramping up.

Ofcom’s Changes

Suffice to say that the FTIR report proposed various changes and now Ofcom has followed that by today setting out what regulatory tweaks it will be consulting upon in order to support that plan.

Key Regulatory Full Fibre Changes

• More holistic consideration of business and residential markets to address areas where telecoms operators still have ‘significant market power’. We will focus on incentivising companies to build networks by opening up infrastructure to competing operators. This should be complemented by regulation where necessary to protect consumers and competition.

• Supporting a move towards unrestricted duct and pole access. Companies will have greater flexibility to use Openreach’s telegraph poles and underground ‘ducts’, to lay fibre networks that serve residential customers or business customers. At present, duct and pole access is restricted to networks focusing primarily on the residential [and small business] market.

• Different regulatory approaches in different parts of the country. We will vary our approach depending on the intensity of network competition in different areas. This will support widespread availability of full-fibre across the UK, even in the most remote areas. Where competing networks emerge, there will be scope for greater deregulation.

• Longer-term certainty for investors. We will lengthen the period of our telecoms competition assessments, from three years to at least five.

• Public intervention in remote areas where there is no prospect of network competition. While competitive investment will drive fibre investment in remote areas, regulation is only part of the solution to securing better broadband for people across the country. The Government has recently announced a proposal to intervene to support full-fibre network construction in these areas.

• A smooth transition from older copper networks to full fibre. As copper phone and broadband networks are replaced by fibre, regulation will need to consider how services on the old networks are priced, and the value of the assets recovered over time. During the transition period, we will prioritise stable regulated products and prices, and consistent quality of service. Consumers will need to be protected during the transition –for example, by ensuring that vulnerable people receive appropriate assistance during the migration process.

• Preserving incentives for Openreach to invest. We will ensure that Openreach has the opportunity to make higher returns where a risky investment is successful, to compensate it for taking that risk. We applied this ‘fair bet’ principle to Openreach’s superfast broadband investments, resulting in a 10-year period of pricing flexibility, and Openreach earning cumulative returns significantly higher than its cost of capital.

Under this plan Ofcom said they would consult in the autumn on unrestricted access to Openreach’s cable duct and poles (aiming to have the new measures in place from the start of 2020) and they’re due to consult on a “final” Business Connectivity Review soon (some regulation will be put in place from April 2019 to last for two years), which will re-examine the leased line market and take a second stab at a Dark Fibre Access (DFA) product after the first one failed (here).

The organisation also clarified their new approach to handling regulation. “We plan to consult in the autumn on how we should define geographic areas as either competitive, potentially competitive or non-competitive. By April 2021 we plan to have regulation in place, covering wholesale access to broadband networks, that varies by geographic area,” said Ofcom.

Advertisement

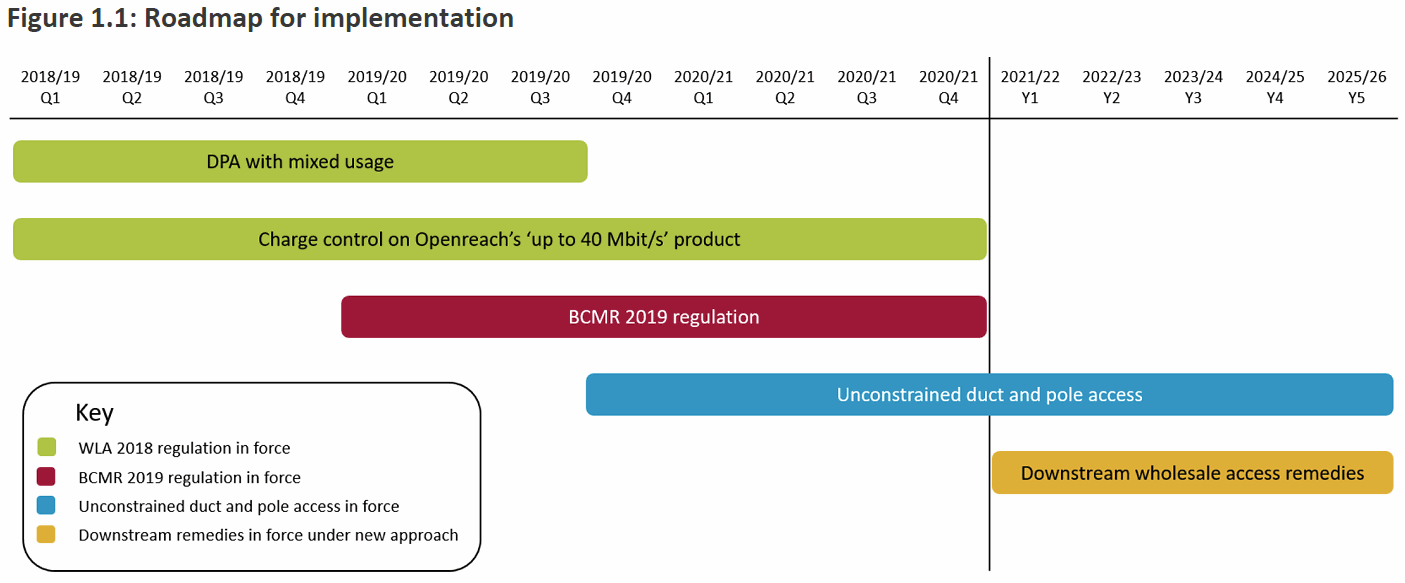

This new regulation will replace their previous Business Connectivity Market Review (after the “final” one above) and Wholesale Local Access Reviews, and under the new rules will be in place for at least 5 years. They will consult on proposals ahead of this new regulation during 2019 and 2020. A general roadmap is below.

Interestingly Ofcom appears to disagree with the government’s admittedly quite optimistic view that the market should be able to deliver FTTP / FTTH networks to the first 80% of premises with their proposed changes. “Our initial view is that up to 60% of premises are in areas that could be attractive to new entrants building fibre networks,” said the regulator.

On the above point it’s worth remembering that the commercial market struggled to bring slower speed hybrid fibre services (FTTC, HFC DOCSIS etc.) to more than 76% of premises and those were much cheaper, as well as faster, to deploy than FTTP. The existing £1.6bn+ Broadband Delivery UK programme thus tended to focus on the final 30%.

Advertisement

In other words, even with the above changes we think that commercial operators will struggle to do 80% by themselves and 60% seems much more realistic before intervention is required (i.e. a bigger public funding bill to reach 100%). As ever though the devil will be in the detail and today’s update from Ofcom merely reflects a general summary of their future approach, which means we’ll have to wait for the consultations in order to get the necessary detail.

The regulator is of course separately already working to choose ISPs and design the funding solution for implementation of the Government’s 10Mbps (1Mbps upload) minimum broadband speed under a new legally-binding Universal Service Obligation (USO), which is expected to reach a conclusion before the end of 2018 (here).

Ofcom’s FTIR Regulatory Proposals

https://www.ofcom.org.uk/../investment-full-fibre-broadband.pdf

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« ISP TalkTalk Hails Broadband Improvement from ASSIA DLM System

Openreach Slash Wholesale Fibre Broadband Prices for UK ISPs »

Comments are closed