Brace for HUGE UK Broadband and Mobile Price Hikes in 2022

The surge in UK inflation is threatening to result in one of the biggest annual price hikes in broadband ISP, phone, mobile and calling charges seen in years, which could hit customers of BT, EE, Plusnet, Vodafone, O2, TalkTalk, Shell Energy, KCOM and others with rises of around 9% come March-April 2022 (double the usual level).

Annual price hikes are of course nothing new in this market, as well as many others. Often there are legitimate reasons for prices to go up, not least because ISPs are frequently adding all sorts of new services (e.g. FTTP), developing new systems, facing higher charges from suppliers, implementing costly new Ofcom rules and consumers are also gobbling significantly more data every year.

In short, service improvements and catering for rising demand can be an expensive challenge, which means that, ultimately, customers will often end up paying more. But how communications providers account for this can vary like the wind, with related contract terms often appearing to change more frequently than the dishevelled locks of Boris Johnson’s hair.

Advertisement

For example, over the past couple of years’ all of the aforementioned providers have linked future price increases to the rate of inflation – Consumer Price Index (CPI) – each year. As a result, nearly all of the named providers typically inform customers that they will increase prices by a set rate of 3.9% (3.7% on TalkTalk and ‘up to’ 3% on Shell Energy) + the CPI rate of inflation as published in January each year (February for O2).

One catch with this approach is the fact that new or upgrading customers will now be aware of any future increases when they join, which is good but makes it harder to take advantage of Ofcom’s rule against mid-contract price hikes (GC1.6). This applies when an increase constitutes a “material detriment” to your service, such as those that go above the level of inflation (i.e. granting you the option to exit an existing contract penalty free).

In addition, most providers also adopt double standards with their x% + CPI approach. In other words, they’re happy to pass on any increases in CPI or RPI to their customers, but if inflation ever went negative then none of them would pass those savings on to consumers (i.e. they’d just charge the x% figure without the CPI/RPI change).

The 2022 Inflation Nightmare

Last year, the aforementioned approach of inflationary linked price hikes saw related broadband and mobile operators increasing their prices by around 3.9% + CPI of 0.6% (i.e. a total annual increase of 4.5%) during the spring, which wasn’t all that different from the old model of static annual increases – this tended to result in annual hikes of 4-6% (usually notified to customers 1 month before implementation).

Advertisement

However, since January 2021, there has been a dramatic and sustained surge in inflation. This has been largely driven by rising fuel and energy costs, as well as the wider supply and demand issues that have pushed up prices in other areas. The latter was also impacted by the higher cost of post-Brexit trade and a rapid post-COVID19 return to normal economic activity etc.

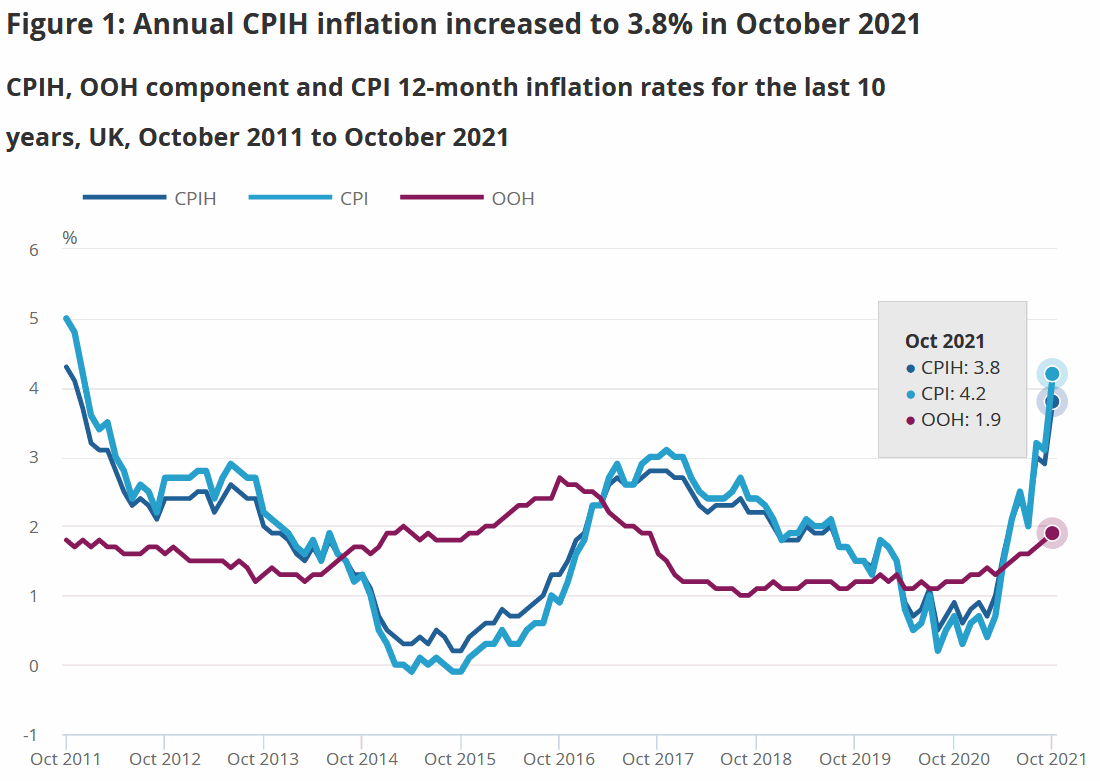

As can be seen above, the CPI figure for October 2021 (as published in November) hit 4.2% (RPI hit 6%) and some reports indicate that it could peak at around 5%. The forecast suggests that CPI will continue on this trend for at least the next few months, which means that the rate due to be published next month – the one most ISPs will use to set their price hikes against – isn’t likely to be dramatically lower than c.4% (vs just 0.6% last year).

In other words, most of the aforementioned providers currently look set to introduce a dramatic annual price hike of around 8% and probably more, which is roughly double last year’s total increase of c.4.5%. Admittedly, such a high degree of inflation will be adding extra costs for ISPs too, but there’s no escaping that consumers are definitely going to feel the impact of this on their bills next year.

Advertisement

Customers of O2, which uses the slightly different 3.9% + RPI model, may face an even more dramatic rise if RPI continues to increase beyond 6%. Meanwhile, Sky Broadband (Sky Mobile), Virgin Media and Three UK currently still seem to be adopting the old method of static annual price increases (e.g. Three UK has already informed customers that their prices will rise by 4.5% in April 2022).

Ofcom is unlikely to help here because their Fairness Commitments, which are supported by most of the major broadband and mobile providers, merely requires signatories to “offer customers packages that … have a fair approach to pricing” and ensure “prices are clear and easy to understand.” But the language is ambiguous and doesn’t specifically tackle price hikes, as well as being more aimed at “vulnerable” users.

Alternatively, customers could try contacting their ISP directly and haggling for a lower price when a hike hits (Retentions – Tips for Cutting Your Broadband Bill), although your mileage may vary. Likewise, there are still some providers around, often smaller players, that don’t play the annual price hikes game or which are much more transparent with their policies.

Last year we conducted a snap poll with 300 of our readers, which questioned what approach to annual price increases they’d begrudgingly favour. Most respondents (54%) voted for a set rise by c.4-6% each year, provided it was clearly stated in the contract. By comparison, only 30% were happy with the old approach of surprise annual hikes (could be 2% to 6%+, you never know until the ISP announces it) and just 16% liked the current x% + CPI method.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« A Snapshot of Openreach’s UK Network Traffic – Past 13 Months UPDATE

You’re using abbreviations like OOH and CPIH in the graph but nonwhere in the article

do you explain what those terms mean.

They aren’t relevant. Only CPI and RPI are the key figures that isps use.

I Agree the key should have been stated if incl. in a chart. regardless if they were not quoted in this article, others may arrive at a seperate conclusion or had a different interpretation if the information being displayed were correctly labelled. Paint the whole picture or whats the point?

This is a case of moneyprintergobrrrr

This is the result of cheap liquidity, currency debasement via QE and failed fisical policies. Things are going to get really bad.

remember the 80’s? Well, whats coming will make what happened in the 80’s feel like a cakewalk. There is a Tsunami of Fiat money sloshing around as they have massivly expanded the M2 Money supply. Bond markets are begining to faulter, Massive squeeze for all consumers The Evegrand debt crisis is coming to a head. 2022 is going to be when all those chickens come home to roost. Opt-out of the corrupt fiat system.

Money printer go brr has consequences…

Cost-push inflation due to, say, a pandemic messing with global supply chains alongside demand-pull from deferred spending isn’t helping either.

The first nothing to do with money printing, the second little to do with it as it’s not really ended up in the real economy but asset prices.

@Mike Well that was incredibly dumb and cringe.

Its perfectly fine, the Office of national statistics will help cover it up. At this rate they’ll need another acronym as CPI and RPI won’t cut it any more, or will have to remove gas and fuel from the comparisons!

A month and a bit before the energy cap pricing is announced, kicking in in April 2022.

Wage increases officially outpaced by CPI inflation again so that real wage boom really lasted.

Reducing inflation is out of the BoE’s hands for a bit. Government could make some changes but aren’t going to.

for garbage internet not gonna pay any cent. First give me gigabit speeds.

You just used Internet you’re presumably paying for to write that?

That you again, Phil?

@skambutis

Welcome to the UK my friend how long have you been here?

Please note – we use pounds and pence not cents here which may be why you’re having issues 🙂

My contract for Plus net ends at the end of next month, If they can give me a real good deal I may stay with them, the thing is I want a 12-month contract, less than that if I can, but not paying stupid prices. We have full fibre being laid out, and it is suppose to be by me in the spring.

If prices are going up, then I may as well pay the higher price for faster broadband, even if I don’t really need it.

Plusnet are easy to haggle with and will offer £20/month for a 60MB connection. However it is a long contract (24 months). They are planning on rolling out full fibre (fttp) early next year (Feb/Mar) so could upgrade if you are in a suitable area.

Pulse8 also offer 1 month contracts too. Although you will need to change your router. i moved from plusnet to them and could not be happier.

‘I am glad I have a leased line – My price won’t rise but it does cost more’

Still going with this stuff, Pete C? It not get old after 20+ years?

I will wait and see what happens, but I may just go with Now broadband for 12 months, it is cheap enough.

but thanks peeps.

Plusnet have said they are going to FTTP early 2021, mid 2021, late 2021, why should we believe they will do it early 2022.

They take us for barmpots!

I spoke to plusnet today about my own contracting ending a week before the price increase in late feb (had an new contract offer via email at the weekend).

Any deal they give me late feb will see a 9% price hike from the 1st of March (based on current estimates).

This is where when entering into a new contract, the price increase shouldn’t happen until the anniversary of the contract (Ofcom???), if someone signed up on the 2nd March, the deal they get won’t see a price increase for 12 months, if you take a new contract like me a week before, I’ll get hit a week later, hardly fair in that respect.

They tried to use the line, well anyone signing up will pay a higher price, i said I’ve never witnessed that, the price of their packages have been cheaper or on par with deals i’ve seen during the past 5 years after price increases for existing customers.

I asked about FTTP as it looks like they’re now providing their own edition of superhub 2 modem that BT provide to FTTP customers, the contracts department admitted there has been no announcement on FTTP.

Would be great if they linked CPI to wages as well

> Would be great if they linked CPI to wages as well

Their CEOs’ wages for sure are linked

Certainly would be though sadly unrealistic.

County broadbands prices pretty much went up 25% after first year with them! Moving back to EE and paying 50% less !

Thank-you for highlighting this. I tried to get the BBC to include a paragraph on these clauses in a recent piece on the impact of inflation, but they preferred to stick to simpler examples from the supermarket.

The irony is that these formulas serve to further increase inflation by guaranteeing massively above-inflation price rises: which are themselves measured as inflation!

My current BT Broadband deal was taken before they added the +3.9% clause. Thankfully it was a Halo deal that guaranteed the price would not rise at the end of the minimum period, so I have been able to stay-put and avoid the change.

I am hesitant to take out any contract that guarantees an annual above-inflation price rise, so this is going to heavily influence my choice of provider in-future, and the recommendations I give my friends and coworkers.

EE contract ending in June so will be sim only from then. Finally getting FTTP at home so the EE will be minimal tariff as no need for 100gb anymore. BB is heavily discounted by staff discount so fingers crossed I can avoid paying more next year.

These inflation increases are likely to drop out just as fast but the suppliers will not cut their prices when they do

BT will be getting a lot of cost savings from going to VOIP. Even the old copper could be sold at a hefty profit. They will also Have less need for batteries and generator sets at the exchanges and of course they will need far less exchanges

Thanks Blobis de Spaffer Johnson.

Oh great, increase for a sub-standard service, no 5G, no fttp for at least 2 years

Frankly, it will be tough once 100 meg is available as standard from 2-3+ suppliers.

Who will pay £40pm when we are not far from £90pm for 1 gig connections?

Few retail customers really need better than 100 meg. I will perhaps upgrade to 300meg, but then I am an electronic nerd who wants 300 to 500 meg for video and work 3D renderings.

I hope this doesn’t affect the Cuckoo ISP too, they said they intended to keep prices as they are (£30 P/M for FTTC, no contract).

I haggled with Plusnet last year and managed to get a 12 month contract for the same price as a 24m

At a 10% inflation rate (which many economists think is a truer figure, not CPI or RPI), the “half-life” of your savings is just seven years or so. That’s why governments love inflation, over a few decades it evaporates away the national debt.

Evaporates away private debt, too. A lot of people are carrying huge mortgages again.

A quarter of UK government debt is index-linked, which wasn’t the case in the 1970’s. Unfunded public sector pension liabilities, effectively the same as debt, are also linked to inflation.

Today, inflation only has a positive effect on the UK’s public finances when it’s caused by rising domestic wages. Imported inflation, eg. caused by printing money rather than rising wages, has a negative effect.

And just think how much money they can earn selling that debt or speculating on it eh…. the mind boggles!

Don’t understand why people lock themselves into mobile contracts – first pick the underlying infrastructure (EE or VF) then either 1p mobile (plus Boosts if needed) on EE or Voxi on VF. Simples…