Ofcom Sets Initial Views on Future of UK Mobile and Spectrum

The telecoms regulator, Ofcom, has today published two new discussion papers that set out their “initial thinking” on how UK mobile markets might develop and how networks may need to evolve to meet future demand. But they do not currently propose any major new regulatory interventions or new consumer pricing rules.

At present the UK is home to four primary mobile network operators (MNOs) – EE (BT), O2 (VMO2), Vodafone and Three UK. All four are currently in the process of deploying ultrafast 5G based mobile broadband networks, as well as testing new technologies (e.g. OpenRAN) and expanding existing 4G services into rural areas via the £1bn Shared Rural Network (SRN) project (here).

The good news, for MNOs at least, is that Ofcom’s first discussion paper doesn’t propose any major new regulatory interventions, but they do seek better information for customers (e.g. on network quality) and will support changes that result in a quicker, more widespread, rollout of “high-quality networks.”

Advertisement

Ofcom’s Initial Views

We are not proposing new regulatory interventions in mobile markets at this stage. Instead, we will continue to monitor how competition evolves and assess any key risks that might affect the delivery of good outcomes. But we are ready to engage and take action where necessary. We also:

• plan to develop better information for customers so they can make more informed choices about their provider. We will continue our work through our Mobile Reporting Project to provide customers with further information on network quality; and

• invite further input on the potential wider benefits to society that might warrant intervention to support a quicker, more widespread rollout of high-quality networks than that which the market is likely to deliver.

We will take steps to clarify our future regulatory approach, to create as much certainty as we can to support investment. Specifically:

• We propose to set out more explicitly how we have considered investment when making policy decisions. This will help to underline the importance we place on investment.

• We are confirming that we do not expect to introduce new consumer pricing rules. We have a strong set of consumer protection rules in place, which providers must comply with. We also want to see them delivering against the Fairness for Customers commitments without the need for further regulatory intervention. We will continue to monitor the performance of mobile providers against the commitments, as well as other developments impacting consumers, such as affordability. Although we have no plans to intervene further, we will be ready to act if new problems emerge.

• We are clarifying our position on mobile consolidation. The question of whether a particular merger is likely to result in a substantial lessening of competition depends on the effectiveness of competition that can be expected in the market after the merger, rather than just the number of competitors. Our stance on a potential merger would therefore be informed by the specific circumstances of that particular merger, taking into account how markets are evolving.

In addition, we are currently carrying out a review of the UK’s net neutrality framework, which impacts the way operators manage their networks and the services they can offer. We expect to publish our initial findings in Summer 2022.

The reference to “clarifying our position on mobile consolidation” is interesting. In the past, Ofcom and the EU blocked a potential merger between O2 and Three UK, partly due to a fear that it would weaken competition and result in higher prices for consumers. But this was overturned in 2020 by the European Court of Justice (here) – albeit too late for the deal.

Since then, O2 has decided to tie the knot with Virgin Media instead, and Brexit has reintroduced fresh uncertainty over the regulatory position on such deals. Both Vodafone and Three UK were recently reported to have flirted with the idea of a merger (here), although this came to nothing. But that idea might be explored again if Ofcom were to signal some acceptance.

Robert Finnegan, CEO Three UK, said:

“At Three, we are committed to building a big network for our customers. More than 300 locations now have 5G live, covering 32% of the population, and we are committed to rolling out thousands more over the next few years. But we could do so much more if the environment was better geared towards investment.

As things stand, the UK does not have the quality of mobile infrastructure it deserves. Investment is spread too thinly across too many players, meaning our networks are sub-par by international standards. Consolidation in the industry could change that. Moving from four to three mobile players in the UK would mean better, smarter investment in the networks which would, in turn, improve the quality and scale of connectivity in Britain and would unleash more competition. Ultimately, this would better for customers and UK PLC who would benefit from more choice and better deals.

We will be discussing these benefits of consolidation with Ofcom in the context of its Mobile Strategy Review. We welcome Ofcom’s clarification that it has no fixed position on mobile consolidation, and its recognition that what matters is the effectiveness of competition rather than just the number of competitors.”

The regulator said they recognise there is “considerable uncertainty” about the way mobile markets will develop over the next 5-10 years, and will thus welcome further evidence and views in response to this discussion document. “We then plan to set out our conclusions by the end of 2022,” said Ofcom.

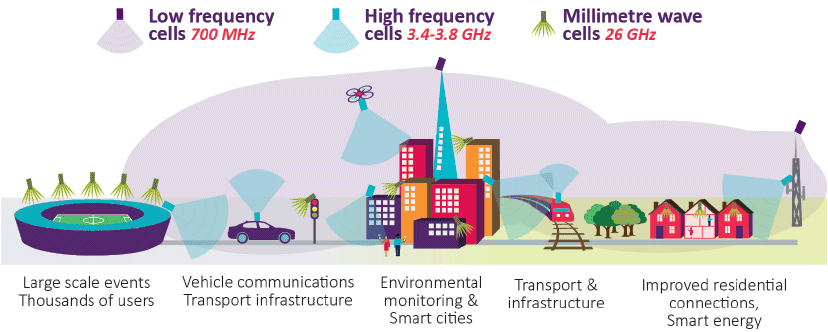

Ofcom has also published a second discussion paper today, which complements the above one and examines their proposed future approach to mobile spectrum and meeting data demands, which proposes plans to auction off mobile spectrum in the mmWave bands to boost 5G speeds and will look to encourage network densification (likely to be of more benefit to dense urban areas, since mmW signals are fairly short range).

Advertisement

Overall, Ofcom anticipates that these strategies, together with existing mobile spectrum holdings and spectrum already planned for release, are likely to be “broadly sufficient to meet future demand to 2030“, with a “greater level of uncertainty” beyond 2030.

Ofcom’s Initial Views

In this document we set out our initial thinking for discussion and seek stakeholder views – we are not making any proposals at this stage. We hope to encourage longer-term thinking about how public mobile networks in the UK may need to evolve to meet future demand, in light of expected growth and demand for spectrum from other users. In summary we note:

• Mobile data traffic has grown by an average of 40% year on year in recent years and we expect it to continue to grow. However, there is a high degree of uncertainty about the rate of future growth, particularly beyond 2030.

• Mobile networks will need to evolve to meet future demand and deliver the quality of experience needed by consumers and businesses. There are a number of ways in which they might do this, including:

1. More extensive deployment of existing spectrum holdings and planned future spectrum for mobile e.g. in the millimetre wave (mmWave) bands. We will consult on our approach to making mmWave spectrum available shortly;

2. Using technology upgrades to increase the efficiency of the spectrum they use;

3. Network densification – deploying more cell sites – in particular using small cells to leverage the capacity offered by the large bandwidths available from mmWave spectrum.

We suspect that getting the big MNOs to agree on the densification idea will not be an easy task, not least because this makes such networks much more expensive to build, supply and maintain. On the flip side, you can’t really expect to get the best multi-gigabit mobile broadband speeds without going down this route, since the mmW bands are the only ones that have enough spectrum spare to feed future demand, but their range is weak.

The other catch with densification, as already mentioned earlier, is that it’s really only viable in dense cities and towns. But in more rural and sub-urban areas, mmW bands really don’t make much sense at all, except perhaps when used for targeted Fixed Wireless Access (FWA) style links to connect homes and businesses, as opposed to in the mobile environment.

Advertisement

At the same time, outside of the 4G-centric SRN project, it’s not as if mobile operators are being put under much pressure to build faster. For example, the Government’s official target for 5G is to see the “majority of the population covered by … 2027,” which is a disappointingly low bar to set (a majority could be anything above 50% and the UK is already in that sort of ballpark today).

Ofcom recently reported that 5G is available from at least one MNO (operator) in the vicinity of around 42-57% of UK premises (here). Finally, the regulator said they would consult on this until Friday 8th April 2022 and set out their initial conclusions by the end of 2022.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« BT Group Plans to Outsource UK Supply Chain Operation to GXO

I don’t see the spectrum availability being any issue. But its a shame there is no regulation or at the very least some requirement to provide a minimum standard of backhaul, that and addressing a framework to resolve over-contended masts in certain area’s.

It’s all well and good building a network of “pretend” 5G, but if its got to be supported by enough backhaul to provide delivering a solid viable service for customer, Especially so when NSA 5G launches and increases the bandwidth requirements even further still.

The lack of forward thinking here by the telco’s is hampering the future of the technology IMHO, when it could be the standard go to for home broadband.

Ofcom does set some minimum performance requirements on mobile, which could indirectly be seen as impacting backhaul, but these are nothing noteworthy. Off-hand I can’t remember what the details were. But I think setting a minimum standard of backhaul itself would be quite difficult on mobile, since every area and deployment is different.

Fleecing operators at spectrum auctions and yearly licensing fees has consequences.

Thanks Mark and OFCOM, not a single mention of 4G/5G mobile networks playing a role as a Rural Broadband solution. Makes a refreshing change 🙂

very true, and also far cheaper than laying fibre I reckon.

Any idea when we going to start using millimetre wave ?

Any idea why we aren’t already? Probably because OFCOM hasn’t figured out a way to monetize it yet.

Well Ireland, USA and Germany all just have three mobile operators and nothing bad has happened as a result so provided that any merged Vodafone-Three company delivers on much needed infrastructure I think it would be better for UK Plc.

operators need to consolidate their spectrum into larger continugious blocks, via further spectrum trades, to better overall performance and service quality.

You mean in simple terms that such a move would improve the 4G/5G coverage of the mobile users?

It wouldn’t. Enough backhaul to and from the masts would be far more beneficial.

All hail ofcom the kingpin.

Hmm, are we heading slowly back to duopoly? Vodafone & Cellnet. The UK is a joke, what have the networks been doing for the last 10 years? theyre still running 3G lol and some towns dont even get a 3G signal outdoors.