Sponsored Links

Tiscali Reveals 2007-2010 Business Plan

Posted: 12th Oct, 2006 By: MarkJ

Tiscali's board of directors has approved its 2007-2010 business plan, which will see the ISP concentrate on its UK and Italian wings. We've listed the key points below:

The strategy makes no clear mention of a UK sale, which may suggest that the ISP is likely to do as predicted and give the market another bash on its own.

# A Concentration of the core business in Italy and in the United Kingdom

# New positioning, from ISP to full-service provider, delivering telecommunication and media integrated services to the end customer through a full network and service IP model combining product innovation and marketing aggressiveness

# Annual revenue growth of 20%; over EUR 1.4 billion in 2010

# Increase of EBITDA margin from 14% to 26% within the plan time span

# Net profit and cash flow from 2008

# Fully financed plan through asset disposal, with a further decrease of debt in excess of EUR 150 million in the next 12 months

Industrial plan 2007-2010

According to the new strategy the plan involves focusing on the two countries Italy and United Kingdom where the Group is already relying on the points of strength outlined below:

* large existing customer base: over 3 millions customers, of which 1.6 million ADSL subscribers;

* high growth rate of the broadband market;

* deep knowledge of the brand;

* strong position of portals with over 10 billions of e-mails exchanged every year and more than 800 millions of web-pages visited;

* a full-IP proprietary network, with ULL coverage of over 30% of households in both countries (a market of approximately 15 million lines to conquer);

* a regulatory framework granting new opportunities to infrastructured operators.

Targets

On the basis of the new business plan, the targets set out for 2010 are as follows:

* Revenue growth of 20% totalling over EUR 1.4 billion in 2010

* Increase of the EBITDA margin from 14% to 26% within the plan time-span

* Over 3 million ADSL subscribers, of which approximately 2 millions ULL and about 500,000 triple play

* Net profit and cash flow generation from 2008

# New positioning, from ISP to full-service provider, delivering telecommunication and media integrated services to the end customer through a full network and service IP model combining product innovation and marketing aggressiveness

# Annual revenue growth of 20%; over EUR 1.4 billion in 2010

# Increase of EBITDA margin from 14% to 26% within the plan time span

# Net profit and cash flow from 2008

# Fully financed plan through asset disposal, with a further decrease of debt in excess of EUR 150 million in the next 12 months

Industrial plan 2007-2010

According to the new strategy the plan involves focusing on the two countries Italy and United Kingdom where the Group is already relying on the points of strength outlined below:

* large existing customer base: over 3 millions customers, of which 1.6 million ADSL subscribers;

* high growth rate of the broadband market;

* deep knowledge of the brand;

* strong position of portals with over 10 billions of e-mails exchanged every year and more than 800 millions of web-pages visited;

* a full-IP proprietary network, with ULL coverage of over 30% of households in both countries (a market of approximately 15 million lines to conquer);

* a regulatory framework granting new opportunities to infrastructured operators.

Targets

On the basis of the new business plan, the targets set out for 2010 are as follows:

* Revenue growth of 20% totalling over EUR 1.4 billion in 2010

* Increase of the EBITDA margin from 14% to 26% within the plan time-span

* Over 3 million ADSL subscribers, of which approximately 2 millions ULL and about 500,000 triple play

* Net profit and cash flow generation from 2008

The strategy makes no clear mention of a UK sale, which may suggest that the ISP is likely to do as predicted and give the market another bash on its own.

Search ISP News

Search ISP Listings

Search ISP Reviews

Latest UK ISP News

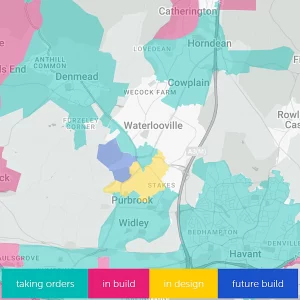

Cheap BIG ISPs for 100Mbps+

150,000+ Customers | View More ISPs

Cheapest ISPs for 100Mbps+

Modest Availability | View More ISPs

Latest UK ISP News

Helpful ISP Guides and Tips

Sponsored Links

The Top 15 Category Tags

- FTTP (6798)

- BT (3881)

- Politics (3074)

- Business (2766)

- Openreach (2663)

- Building Digital UK (2512)

- Mobile Broadband (2475)

- FTTC (2142)

- Statistics (2127)

- 4G (2092)

- Virgin Media (2024)

- Ofcom Regulation (1779)

- 5G (1732)

- Fibre Optic (1604)

- Wireless Internet (1595)

Sponsored

Copyright © 1999 to Present - ISPreview.co.uk - All Rights Reserved - Terms , Privacy and Cookie Policy , Links , Website Rules