Sponsored Links

O2 UK and BE Slowly Reach 671600 Fixed Line Broadband ISP Subscribers

Posted: 26th Feb, 2011 By: MarkJ

Mobile operator and ISP O2 UK ( Be Broadband ) has released its latest fourth quarter results (Q4-2010) to the end of December 2010, which saw their total fixed line broadband subscriber base climb from 663,800 in Q3 to 671,600 (+7,800 net additions) now.

Mobile operator and ISP O2 UK ( Be Broadband ) has released its latest fourth quarter results (Q4-2010) to the end of December 2010, which saw their total fixed line broadband subscriber base climb from 663,800 in Q3 to 671,600 (+7,800 net additions) now.The good news is that O2 is still growing its fixed line broadband service, the bad news is that their latest Q4 growth is significantly down on previous quarters. For example, O2 added +17,600 in Q2 and +13,800 in Q3; as a result Q4's growth was around half that of the previous quarter.

TELEFÓNICA O2 UK (Q4 2010)

The Company’s total mobile customer base (excluding Tesco Mobile) reached 22.2 million at the end of 2010 (+4.3% year-on-year), driven by a robust 9.8% year-on-year increase in the contract segment. Mobile net additions stood at 912 thousand in 2010, with 254 thousand in the fourth quarter. At the end of 2010, contract customers represented 47% of the base (+2.4 percentage points year-on-year).

Telefónica O2 UK’s wireline retail broadband Internet accesses reached 0.7 million lines at the end of December 2010 (+13.5% year-on-year).

Revenue growth accelerated in the fourth quarter to 9% year-on-year in local currency (+8.5% and +6.0% year-on-year in the third and second quarter, respectively) to reach 7,201 million euros in 2010 (+6.5% year-on-year in local currency). Mobile service revenues stood at 6,513 million euros in 2010, with a solid 5.6% year-on-year increase in local currency, which ramped up to 7.9% year-on-year in local currency in the fourth quarter. The continued growth of non-P2P SMS data revenues should be highlighted, with growth of 31.7% year-on-year in local currency in 2010. As a result, total data revenues as a proportion of mobile service revenues stood at 40% in 2010.

Operating income before depreciation and amortization (OIBDA) increased 4.9% year-onyear in local currency to 1,830 million euros in 2010. OIBDA margin reached 25.4% for the year.

CapEx increased 14.7% year-on-year in local currency in 2010 to reach 717 million euros, as the Company continued to further enhance its mobile network capacity and coverage, including the recent refarming of the 900MHz spectrum, to give its customers the best user experience. Operating cash flow (OIBDA-CapEx) reached 1,113 million euros in 2010.

The Company’s total mobile customer base (excluding Tesco Mobile) reached 22.2 million at the end of 2010 (+4.3% year-on-year), driven by a robust 9.8% year-on-year increase in the contract segment. Mobile net additions stood at 912 thousand in 2010, with 254 thousand in the fourth quarter. At the end of 2010, contract customers represented 47% of the base (+2.4 percentage points year-on-year).

Telefónica O2 UK’s wireline retail broadband Internet accesses reached 0.7 million lines at the end of December 2010 (+13.5% year-on-year).

Revenue growth accelerated in the fourth quarter to 9% year-on-year in local currency (+8.5% and +6.0% year-on-year in the third and second quarter, respectively) to reach 7,201 million euros in 2010 (+6.5% year-on-year in local currency). Mobile service revenues stood at 6,513 million euros in 2010, with a solid 5.6% year-on-year increase in local currency, which ramped up to 7.9% year-on-year in local currency in the fourth quarter. The continued growth of non-P2P SMS data revenues should be highlighted, with growth of 31.7% year-on-year in local currency in 2010. As a result, total data revenues as a proportion of mobile service revenues stood at 40% in 2010.

Operating income before depreciation and amortization (OIBDA) increased 4.9% year-onyear in local currency to 1,830 million euros in 2010. OIBDA margin reached 25.4% for the year.

CapEx increased 14.7% year-on-year in local currency in 2010 to reach 717 million euros, as the Company continued to further enhance its mobile network capacity and coverage, including the recent refarming of the 900MHz spectrum, to give its customers the best user experience. Operating cash flow (OIBDA-CapEx) reached 1,113 million euros in 2010.

It may be worth pointing out that O2 UK has referenced that same wireline retail broadband figure of "0.7 million lines" in their official results for the best part of 2010. In reality you have to dig a lot deeper into their EXCEL spreadsheet data to find the exact (correct) figure.

The operators recent move away from offering "unlimited" broadband services could be playing a part in their declining rate of growth. Customers appear to have been less receptive to the replacement packages. Likewise their new website feels, at least in part, like a bit of a muddle. The new "Download as much as you want" slogan and conflicting Fair Usage Policy (FUP) don't exactly help matters either.

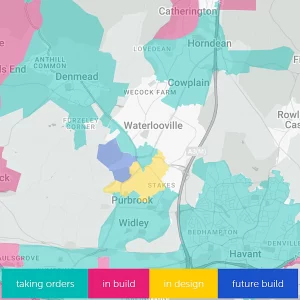

Meanwhile O2's future plans for its fixed line broadband service remain uncertain. It's known that the ISP is looking at superfast FTTC services but nothing concrete has been announced. Likewise the incoming March 2011 price hikes will do little for their future churn and could trigger a larger fall.

Despite the current problems it's still important to point out that, unlike most of their mainstream ISP competition, O2 is still the most highly rated of all the big broadband providers. It's even one of the highest rated among smaller ISPs. They might not be as competitively priced as a few years ago but the quality is still there, at least for most customers on their unbundled ( LLU ) deals.

Search ISP News

Search ISP Listings

Search ISP Reviews

Latest UK ISP News

Cheap BIG ISPs for 100Mbps+

150,000+ Customers | View More ISPs

Cheapest ISPs for 100Mbps+

Modest Availability | View More ISPs

Latest UK ISP News

Helpful ISP Guides and Tips

Sponsored Links

The Top 15 Category Tags

- FTTP (6798)

- BT (3881)

- Politics (3073)

- Business (2766)

- Openreach (2663)

- Building Digital UK (2511)

- Mobile Broadband (2475)

- FTTC (2142)

- Statistics (2126)

- 4G (2092)

- Virgin Media (2024)

- Ofcom Regulation (1779)

- 5G (1732)

- Fibre Optic (1604)

- Wireless Internet (1595)

Sponsored

Copyright © 1999 to Present - ISPreview.co.uk - All Rights Reserved - Terms , Privacy and Cookie Policy , Links , Website Rules