Sponsored Links

UK Home and Business Broadband ISP Connections Top 20 Million in Q2 2011

Posted: 07th Dec, 2011 By: MarkJ

Ofcom has released its latest quarterly Telecommunications Market Data Tables Q2 2011, which reveals that the UK is now home to a total of 20,266,000 fixed line broadband ISP connections. That's a quarterly growth of +346,000 since Q1-2011 and slightly up from the +340,000 added in Q4-2010 (still well below Q3-2010's +459,000).

Ofcom has released its latest quarterly Telecommunications Market Data Tables Q2 2011, which reveals that the UK is now home to a total of 20,266,000 fixed line broadband ISP connections. That's a quarterly growth of +346,000 since Q1-2011 and slightly up from the +340,000 added in Q4-2010 (still well below Q3-2010's +459,000). Meanwhile BT Retail's market share has also seen yet another rise, inching forwards by +0.2% (27.8%) to reach a total of 28% in Q2-2011. Aside from that it's interesting to note that growth between the different broadband platforms has experienced a radical shift since Q1-2011.

Until recently the main growth has almost always come from BT , Virgin Media (cable) and cheaper LLU based broadband providers ( Sky Broadband , TalkTalk , O2 etc. ) but that's now begun to change. For the first time LLU services saw a decline, as did cable.

UK Fixed Line Broadband ISP Connections Q2-2011Elsewhere BT Retail continued to grow at a steady pace, while BT-based (exc. LLU) ISPs ( Zen Internet , AAISP etc. ) suddenly reversed their long decline with a sharp rise. Part of the reason for this could be that LLU ISPs have been slow to offer superfast broadband (FTTC etc.) services, while BT-based (exc. LLU) ISPs have had it for awhile.

BT Retail DSL - 5,682,000 (Q1-2011 = 5,543,000)

Other DSL (exc. LLU) - 2,731,000 (Q1-2011 = 2,511,000)

Virgin Media (Cable) - 4,065,000 (Q1-2011 = 4,078,000)

Other inc. (LLU DSL) - 7,787,000 (Q1-2011 = 7,788,000)

It's clear that O2 , Orange and TalkTalk UK's earlier losses have dragged LLU growth down, with the latter being due to a raft of appalling service, billing and support problems. It will be interesting to see if the trend continues into Q3-2011 because recent financial results have pointed to future growth.

The information also revealed that retail fixed line voice revenues managed to fall from £2.3bn in Q1 to £2.2bn in Q2-2011. However the total number of fixed lines has held stable at 33.3 million. Some 29.1 billion minutes of fixed-originated calls were made during Q2, down from 30.9bn in Q1.

By contrast mobile phone based voice and data ( Mobile Broadband ) services managed to generate revenues of £3.7bn, which is up from £3.5bn in Q1-2011. Mobiles also accounted for 30.7 billion minutes of calls (down from 31.0bn in Q1).

The total number of UK mobile phone connections also fell again from 81.1 million in Q1 to 80.8 million in Q2 and 5.0 million (6.2%) of those were Mobile Broadband Datacards or USB Modems (Dongles), which is up slightly from 6.1% in Q1.

Search ISP News

Search ISP Listings

Search ISP Reviews

Latest UK ISP News

Cheap BIG ISPs for 100Mbps+

150,000+ Customers | View More ISPs

Cheapest ISPs for 100Mbps+

Modest Availability | View More ISPs

Latest UK ISP News

Helpful ISP Guides and Tips

Sponsored Links

The Top 15 Category Tags

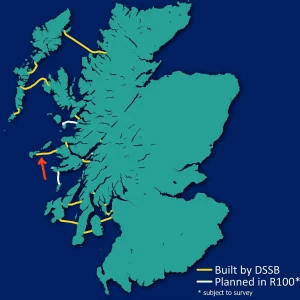

- FTTP (6713)

- BT (3862)

- Politics (3032)

- Business (2731)

- Openreach (2626)

- Building Digital UK (2486)

- Mobile Broadband (2433)

- FTTC (2131)

- Statistics (2098)

- 4G (2061)

- Virgin Media (1997)

- Ofcom Regulation (1761)

- 5G (1691)

- Fibre Optic (1586)

- Wireless Internet (1581)

Sponsored

Copyright © 1999 to Present - ISPreview.co.uk - All Rights Reserved - Terms , Privacy and Cookie Policy , Links , Website Rules