89% of UK Covered by 30Mbps Broadband, But Only 1.7% See “Full Fibre”

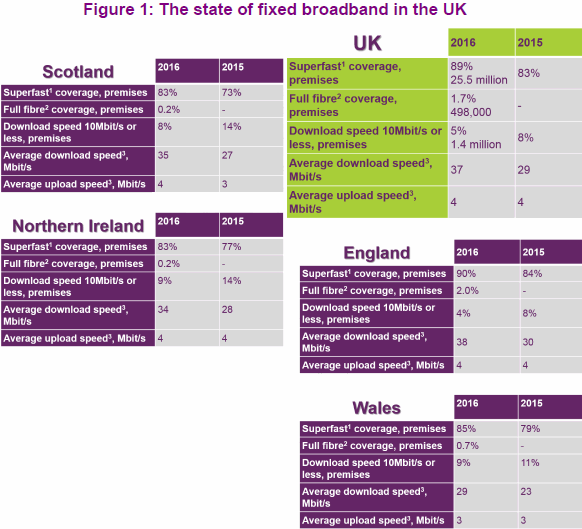

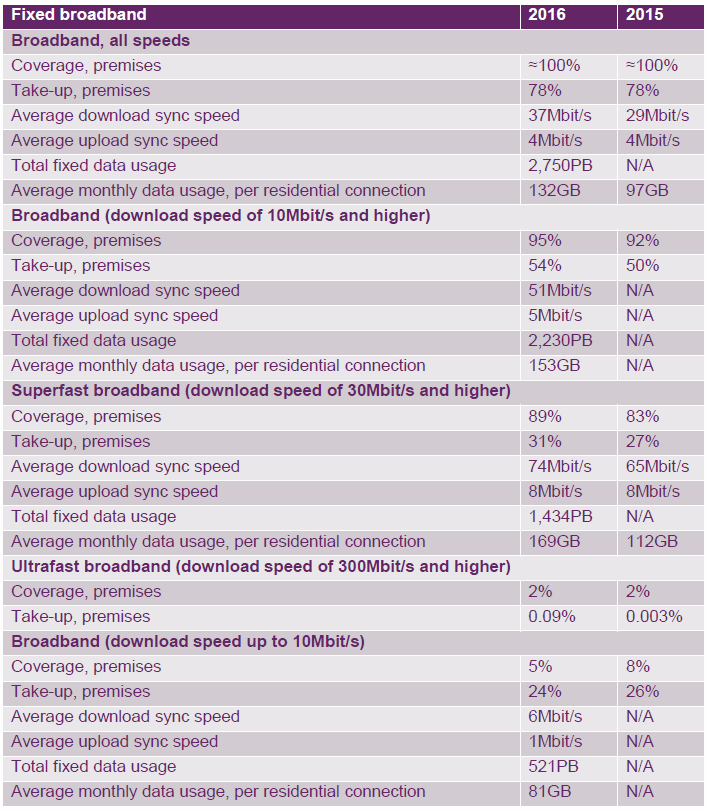

Ofcom has today published their annual Connected Nations 2016 report, which confirms that 89% of UK premises are now within reach of a fixed line superfast broadband service (up from 83% in 2015), with take-up hitting 31% (up from 27%). But only 1.7% (498K premises) can get “full fibre” (FTTP/H).

Just to troll us before Christmas, the regulator has also released their International Communications Market Report 2016 (ICMR), which compares broadband and other communication services in the United Kingdom against 17 other countries, but we’ll come back to that one later. Oh and there’s the outcome of their USO consultation too, but let’s deal with everything one at a time.

The eagle-eyed among you will no doubt notice that Ofcom’s statistics for superfast broadband coverage are a bit behind the official Government figure of 91%, but that’s largely because their report uses the higher speed definition of 30Mbps+ (the BDUK / Gov prefer 24Mbps+) and is also based off older data.

Advertisement

Much of the above fixed line “superfast” coverage is being delivered via KCOM’s network in Hull and Openreach’s (BT) national platform, usually via their FTTC + FTTP “fibre broadband” footprint. On top of that Virgin Media’s cable and fibre (DOCSIS) network reaches around half of UK premises, albeit mostly in urban areas. All operators are currently expanding their coverage, including smaller altnets (e.g. Hyperoptic, Gigaclear, B4RN etc.). Interestingly Ofcom estimates that around 3% (780,000 premises) of those taking an FTTC service cannot receive superfast speeds.

Otherwise the study also highlights how “ultrafast” (300Mbps+) broadband speeds are available to just 2% of premises, although we expect that to reach about 50%+ once Virgin Media officially begins offering their 300Mbps or 350Mbps package to homes (apparently their business focused HomeWorks+ upgrade doesn’t count).

It’s also noted that of the 498,000 premises passed (1.7%) for “full fibre” FTTP/H coverage, some 450,000 of the total are in England. Another interesting fact is that in 2015 around 8% of UK premises (2.4 million) were unable to receive broadband speeds faster than 10Mbps, but this has now fallen to 5% (1.4 million premises) and those may fall within the Government’s planned broadband Universal Service Obligation (USO).

The growth in take up of superfast broadband has led to an increase in average speeds across the UK. The average download speed of all active connections in the UK is now 37Mbps, an increase of 28% from 29Mbps in 2015. Speeds are lower in rural areas, where there is a lower availability of superfast services. The average download speed in the UK’s rural areas is just 21Mbps, which represents an increase on the speed last year, which was 13Mbps.

Advertisement

Download speeds have also risen for those consumers that subscribe to superfast services. The average download speed of superfast services in the UK is now 74Mbps, up from 65Mbps in 2015. Sadly Ofcom “do not yet have sufficient data to estimate the average speeds of ultrafast or full fibre services, but will explore ways to calculate this in future reports“.

We should point out that Ofcom’s analysis of broadband speeds is based on the information provided by ISPs regarding the “sync speed” of each active line (i.e. not actual speed tests), which is arguably more of an optimistic estimate than the real-world testing that they do in their other annual broadband speeds report (those use a custom router installed in several thousand homes).

In addition, the average monthly data volumes per household on fixed broadband connections have increased by 36% over the past year, from 97 GigaBytes (GB) to 132GB. We should add that the total data usage per household for “superfast” connections is even higher at 169GB (up from 112GB).

Mobile

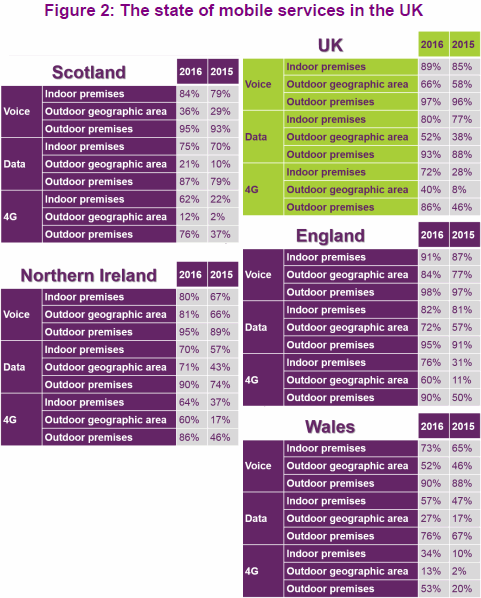

The report also examines the coverage of mobile networks, such as via the usual 2G, 3G and 4G based platforms that almost everybody should now be quite familiar with.

Advertisement

Overall 82% of UK outdoor premises can now receive a 4G signal and this drops to 72% for indoor coverage and just 48% for outdoor geographic coverage. Mind you 4G is still being rolled out and there’s a lot of work left to do.

Most of the early 4G deployments have been focused on urban areas. As a result, geographic 4G coverage in the UK’s rural areas is only 37% of landmass, compared to 89% in towns and cities. Coverage inside premises, where many consumers use their phones, remains relatively low, even in urban areas; 72% of UK premises (21 million) receive a 4G signal from all operators indoors.

Steve Unger, Ofcom Group Director, said:

“Mobile and broadband coverage continued to grow this year, but too many people and businesses are still struggling for a good service. We think that is unacceptable.

So we’re challenging mobile operators to go beyond built-up areas, and provide coverage across the UK’s countryside and transport networks. Today we’ve also provided technical advice to support the Government’s plans for universal, decent broadband.”

With growing coverage and greater take-up, 4G is also driving greater volumes of data downloads and uploads. The average volume of data consumed per subscriber is now 1.3GB per month, up from 0.9GB in 2015.

International Comparison

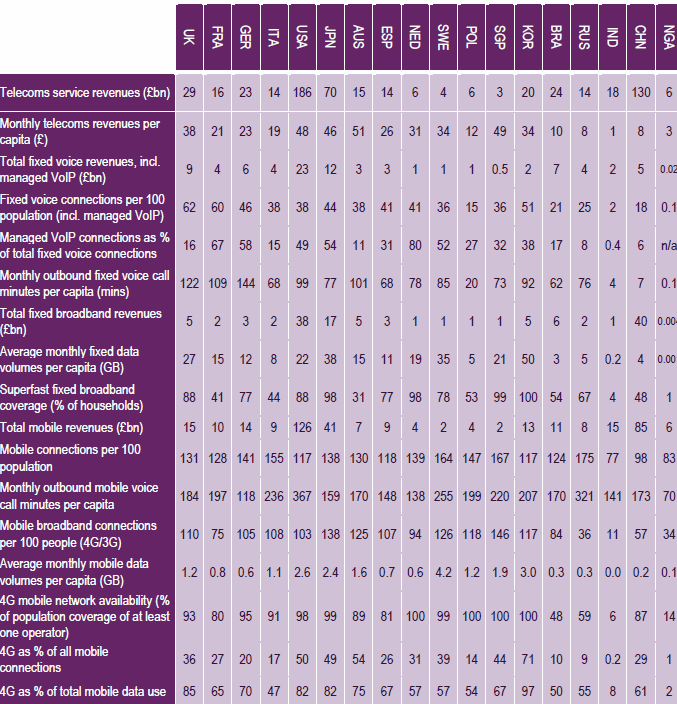

Ofcom has separately published a useful international comparison of the UK against 17 other counties. For example, household penetration of fixed broadband reached 80% in the UK, which puts us fifth among the comparator countries.

Likewise the only countries to beat us for “superfast broadband” coverage were Japan (98% of households), the Netherlands (98%), Singapore (99%), South Korea (100%) and the USA drew level with the UK.

The story for 4G Mobile coverage is a bit more mixed, which isn’t a surprise because the UK was late to the party, after legal threats and squabbles between mobile operators pushed the auction of related spectrum (800MHz and 2.6GHz) back by several years. As a result of all that the mainstream roll-out didn’t really begin until late 2013.

Sadly Ofcom has bludgeoned us half to death with the release of several huge reports today and that means that we can’t give maximum attention to each one, but if you have a couple of days spare then feel free to read through these two (there’s lots of juicy data inside). We’ve also posted the general summary of fixed broadband and superfast broadband stats below.

Ofcom’s 2016 Connected Nations Report

https://www.ofcom.org.uk/__data/assets/pdf_file/0035/95876/CN-Report-2016.pdfOfcom’s 2016 Communications Market Report: International

https://www.ofcom.org.uk/__data/assets/pdf_file/0026/95642/ICMR-Full.pdf

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Gigaclear Reach 2,000 Premises Passed with 1Gbps FTTP in Essex UK

Ofcom Reveals its Options for the UK 10Mbps Broadband USO »

Comments are closed