Ofcom – Gigabit Broadband Covers 87 Percent of UK as 5G Hits 97 Percent

Ofcom has today released their Connection Nations 2025 digital infrastructure report earlier than usual, which reveals that residential gigabit-capable broadband ISP networks now cover 87% of the UK (up from 84% in 2024), while outdoor 5G coverage from at least one mobile operator is available to 97% of premises (up from 95%). But rural cover remains weaker.

The latest CN2025 report typically offers a general overview of fixed line broadband and mobile network availability, as well as related service take-up and data usage from across England, Scotland, Wales and Northern Ireland, which is largely based off data that was gathered during July 2025 (varying between the results).

Before we begin, it’s important to note how Ofcom defines the different broadband performance classes. For example, “Decent Broadband” means a 10Mbps+ download speed with 1Mbps+ uploads (i.e. the Universal Service Obligation), while “Superfast” is 30Mbps+, “Gigabit” equates to 1Gbps+ (1000Mbps+) and “Full Fibre” essentially means a pure Fibre-to-the-Premises (FTTP/B) network (these are also gigabit capable).

Advertisement

As usual, we’ve split our summary of the key results from this report into categories for fixed line broadband and mobile networks.

Fixed Line Broadband Coverage

The rapid deployment of “full fibre” broadband networks by various providers continues to be the main area of growth and change during 2025 (Summary of UK Full Fibre Build Progress), which predominantly reflects the efforts of commercial investment in urban areas. But that is starting to change due to the Government’s £5bn state aid funded Project Gigabit programme.

The project, which aims to make gigabit speeds available “nationwide” (c.99%) by 2032, is starting to convert contract awards into tangible build activity across various rural areas. Admittedly, its impact is still small to modest, but it’s growing and the focus on rural connectivity is helping to lift some of the figures in this report. Upgrades via Project Gigabit can also lead to additional commercial coverage in nearby areas.

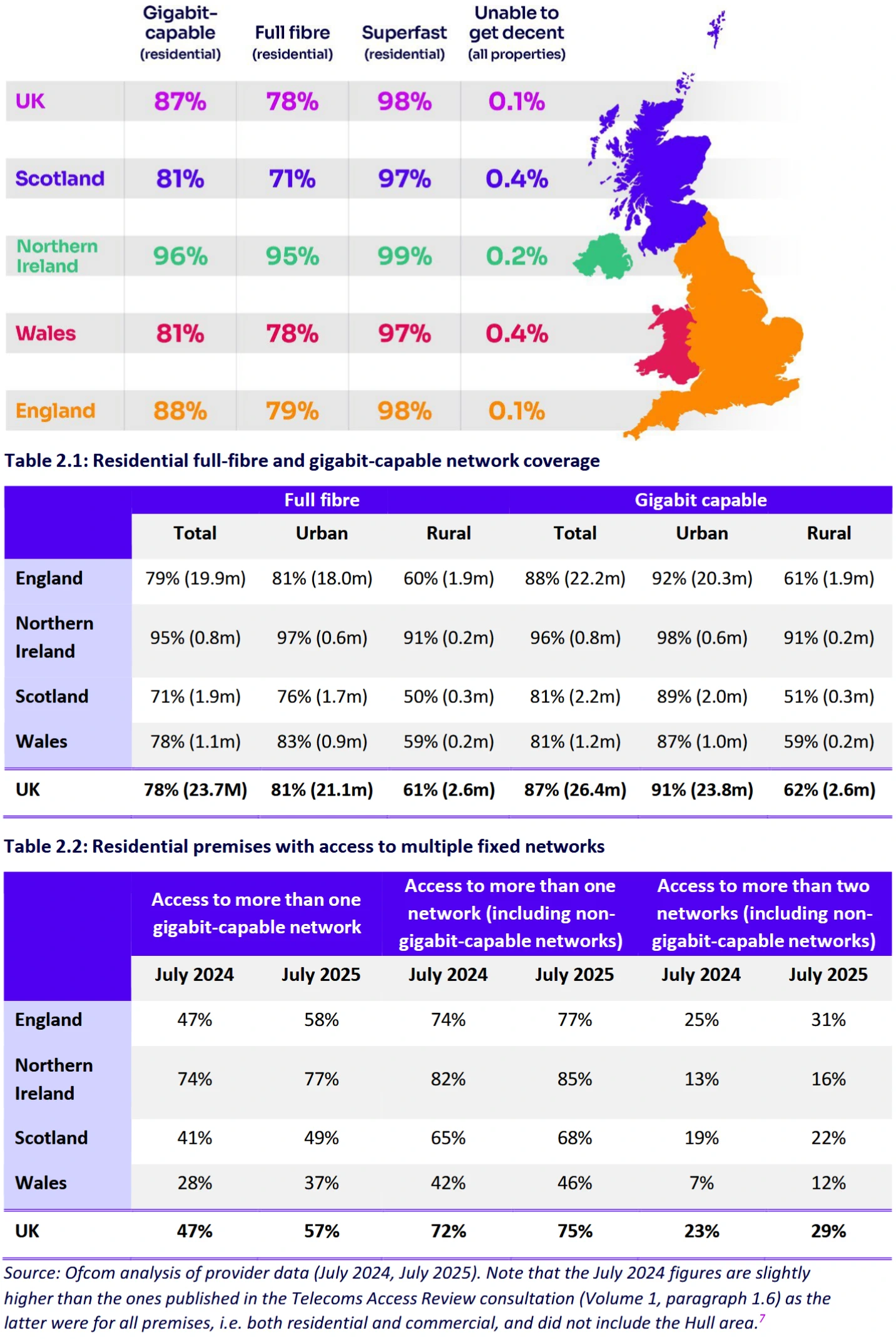

Overall, the picture today is that “full fibre” network coverage has risen from 10% of the UK in 2019 (3 million premises), then 18% (5.1m) in 2020, 28% (8.2m) in 2021, 42% (12.4m) in 2022, 57% (17.1m) in 2023, 69% (20.7m) in 2024 and now stands at 78% (23.7m) for 2025. As for “gigabit” coverage, which is driven by both FTTP and Virgin Media’s HFC network (there’s a lot of urban overbuild between these two), that has grown from 84% (25m) last year to 87% now (26.4m).

Advertisement

Elsewhere, “superfast” coverage has risen to 29.7m premises or 98% (up from 29.4m last year), which falls to 91% in rural areas (up from 89%). But the number of premises that cannot get a “decent broadband” service is 44,000 premises (down from 58,000 last year). But this includes 4G and fixed wireless coverage into the figure too, which reaches 1% (340,000 premises) when you only look at fixed lines (down from 385,000 in 2024).

Sadly, many of those that remain in sub-10Mbps areas are often too expensive for even the USO to fix (here and here), but this gap continues to fall. Ofcom predicts that the number of premises unable to get 10Mbps (decent) broadband could fall to around 36,000 by the end of 2026, mostly as a result of upgrades via publicly funded schemes (connection vouchers, project gigabit contracts etc.).

Ofcom also provides some useful data on the rural vs urban coverage split for superfast, decent broadband, full fibre and gigabit lines below – split by region.

Advertisement

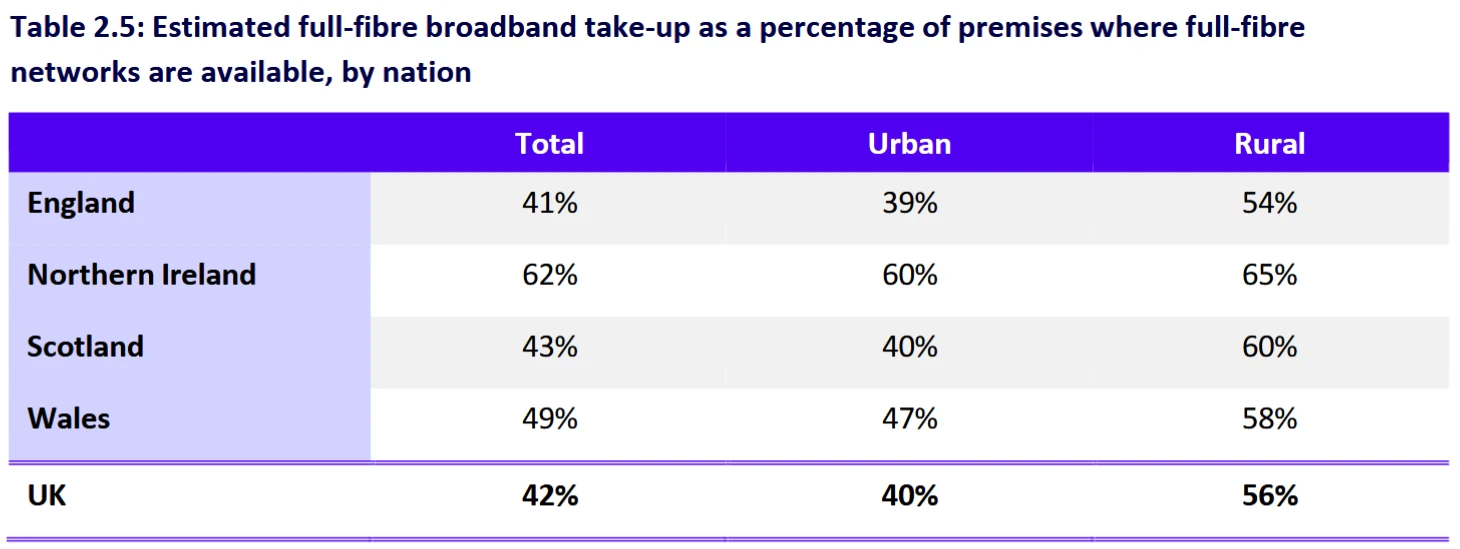

In terms of take-up, some 42% or 10.6 million premises have now taken up a “full fibre” network (up from 35% and 7.5m last year). But it’s also noted that 56% of premises in rural areas have taken full fibre (up from 52%), compared to 40% in urban area (up from 32%). The take-up of services on gigabit-capable networks, where they are available, is now at 56% (up from 49%). Over time, the gigabit and full fibre figures should align, once Virgin Media fully migrates from coax to FTTP.

Elsewhere, the average monthly data usage per connection is now 583GB (GigaBytes) across “all technologies” (up from 531GB), which rises to an average of 738GB for full-fibre connections (oddly this is down a bit from 766GB).

Ofcom’s report also provides some performance data for broadband services on different networks. Customers are moving to higher speed services, with UK “average maximum download speeds” now up from 223Mbps in 2024 to 285Mbps in 2025.

Out of the four nations, Northern Ireland continues to have the highest average maximum download speed of 325Mbps – reflecting the greater level of full fibre availability. This is followed by England on 288Mbps, Scotland on 273Mbps and Wales on 243Mbps.

Natalie Black, Ofcom’s Networks and Communications Group Director, said:

“The UK’s demand for data continues to grow as we live increasingly connected lives. For years, operators have been delivering 5G services while using old 4G networks to do most of the legwork. But now, the race to deliver the UK’s full 5G future is on.”

The regulator’s report also includes a few other interesting details. For example, legacy voice / phone (PSTN) connections now account for just 19% of all landline connections as consumers move to either a broadband-only home or digital voice / VoIP style solutions (down from 27% in 2024 and 41% in 2023). Around 3.2 million residential landline customers still use the PSTN. Most PSTN and related Wholesale Line Rental (WLR) services should have been migrated by December 2025, but vulnerable users have until 31st January 2027.

Mobile Coverage

The report includes coverage data for mobile networks too, such as via the usual 4G and 5G based platforms that most people should be familiar with. The UK has three primary network operators (MNO) – O2 (VMO2), VodafoneThree (Vodafone and Three UK) and EE (BT) – plus an assortment of virtual operators (MVNO) that piggyback off those.

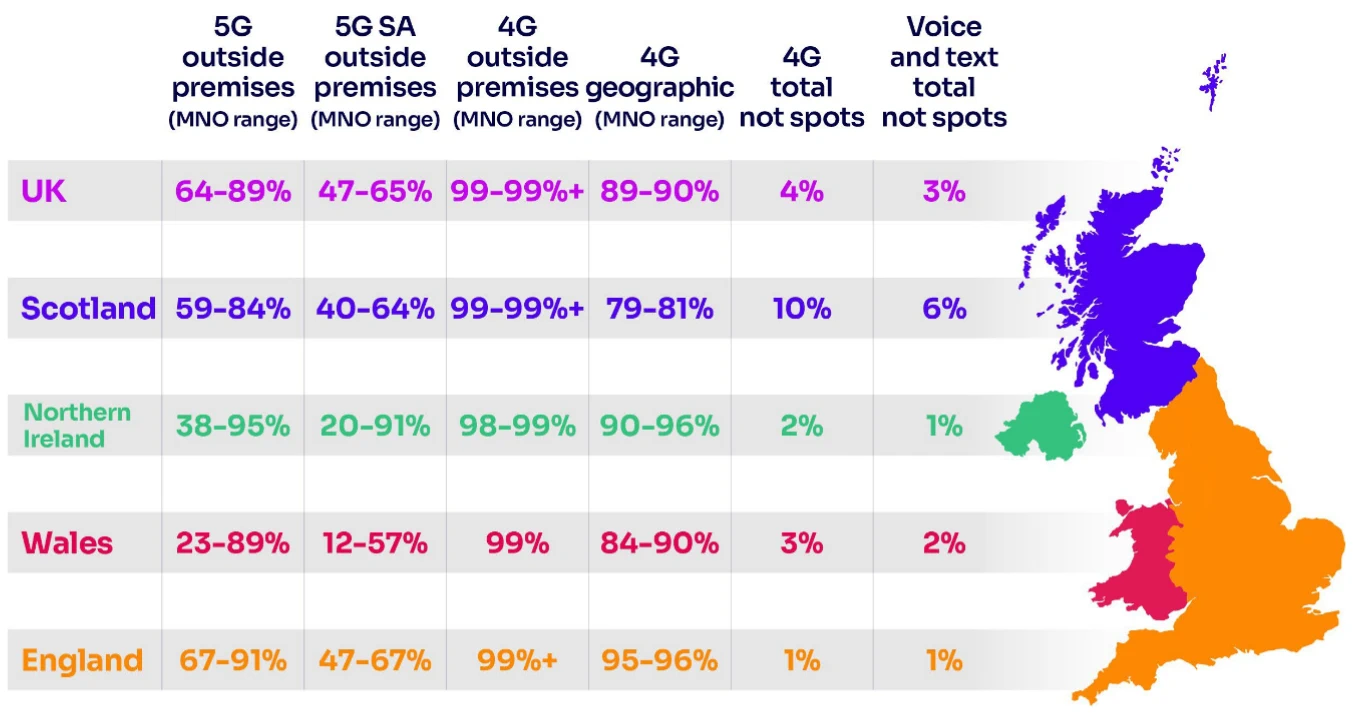

Ofcom found that between 89-90% of the UK’s landmass (geographic coverage) can now access a 4G network if you look across all operators (up from 88-89% last year) or 96% from just one operator (up from 95%). The £1bn Shared Rural Network agreement aimed to push geographic 4G coverage to 95% by the end of 2025 (here).

As for 5G, the regulator found that it is available from at least one MNO (operator) at around 94-97% of UK premises (up from 90-95% last year) or 64-89% from all operators combined (up from 61-79%). In addition, 5G was found to be deployed in 48% of sites in urban areas (up from 42%), compared with just 20% of sites in rural areas (up from 16%).

The deployment of mobile end-to-end 5G Standalone (5G+) sites (these remove all dependence upon slower 4G services) has also increased to around 12,000 sites this year (up from over 3,300 last year). 5GSA is thus now available across 83% of areas outside of premises in the UK, or 47%-65% when looking at the range across different mobile operators.

Total monthly mobile data traffic increased by 18% over the past year to 1,257 PetaBytes (PB), a growth rate broadly consistent with the previous year. 5G traffic also saw the largest growth, rising from 227PB to 348PB, an increase of 53%. Notably, 5GSA now accounts for approximately 31% of total 5G traffic, representing around 9% of overall mobile data traffic.

The MNOs also started switching off their 3G networks during 2024 and Ofcom expects all MNOs will have completed their 3G switch-off by the end of this year. But the number of customers using devices reliant on 2G or 3G connectivity has fallen only a little to 2 million (down from 2.1m last year), although many of those are now on 2G and not 3G.

Finally, Starlink’s satellite services are expanding as a new option for people and businesses to access broadband. In 2025, there were 110,000 connections across the UK (up from 87,000 in 2024). The majority of these customers are said to be in rural areas, with 12,600 of these premises in areas with no access at all to decent broadband from fixed lines or FWA services.

However, there is also take-up in areas where other broadband networks may be available, with 27% of these connections in locations which have access to full fibre, up from 24% last year. In the data submitted to Ofcom, Starlink also indicated it offered average download speeds of around 210Mbps (up from 160Mbps in 2024) and average uploads of around 20Mbps.

Elsewhere, we were able to find some geographic 4G coverage figures for individual mobile operators, which covers both 4G and 5G.

2025 Geographic UK Coverage by Operator (2024 Result)

4G

EE 90% (89%)

Vodafone 90% (89%)

O2 90% (88%)

Three UK 90% (89%)5G

EE 42-49% (35-42%)

O2 29-40% (21-28%)

Three UK 10-23% (9-23%)

Vodafone 9-17% (8-15%)NOTE: The range reflects Ofcom’s high vs very high confidence figures.

Otherwise, you can check out the full Connected Nations 2025 report online.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Survey Claims to Reveal Worst 10 UK Locations for Broadband Overspend

This is interesting My flat has access to three Fibres, Virgin, Openreach and You Fibre.

The flats behind me in the same post code have none! They are still on copper FTTC.

How do they balance this out?

If the address data supplied to Ofcom is correct then that is balanced out in the data

It is pathetic and proves how crap it all is, my Nephew lived in Bristol, his side of the road they had Virgin, the other side did not, that was the same flipping road.

This is why we should have had dark fibre years ago, but this country is so far behind in things. Sure, I was not that bothered about FTTP, but other people are and some other countries have had it for years.

I am surprised we have 5G in this country, not that it is any good if you are in a built up area.

Going on these figures that means just over 76 trillion bits of information pass through the average FTTP connection each year giving an average network utilisation of 2.4 megabits per second.

97% outdoor 5G coverage from at least one provider? In the UK? This UK? The one in this universe?

Yep, but this should not be confused with geographic coverage, which is much less forgiving.

Yep. Do network operators think that people just teleport from one built-up area to the next? Not that it’s any good in built-up areas either. It’s just shockingly poor everywhere and inadequate in every conceivable metric.

It is utter shambles. And no massaging of numbers will make it look pretty. The only saving grace is EE’s network which seems semi-competent in some areas.

Why does Ofcom take different approaches for fixed broadband and mobile. With Gigabit coverage its is clear that consumers can gain speeds of up to 1G but 5G theoretical coverage is meaningless as it does not indicate speed nor capacity and there is a big difference between N28 and N78 and between.

There are many areas with a visible but unusable 5G signal or one that is not selected (network policies assumed)

Utter nonsense

OFCOM need to update their definitions of broadband. In the US, anything under 100/20 is not considered as ‘broadband’. OFCOM calling 10Mbps ‘decent’ broadband is a joke. More people work from home now and need a good upload and download speed, with low jitter and latency. The USO seems to be set based on what is convenient to providers, not what the country should be aiming for.

(Using the term ‘broadband’ here in the colloquial sense as OFCOM are, not the technical sense).