UPD Sky, TalkTalk and Vodafone Moan of £140m Delay to Cheaper Broadband

Broadband providers Vodafone, TalkTalk and Sky Broadband have complained that Ofcom’s delay to the introduction of their recently proposed wholesale price reduction on Openreach’s (BT) 40Mbps (10Mbps upload) Fibre-to-the-Cabinet (FTTC / VDSL2) service could cost consumers £140 million.

On 31st March 2017 the telecoms regulator, Ofcom, launched their ‘2017 Wholesale Local Access Market Review’ and as part of that they proposed to make a number of changes to help “promote competition and protect consumers from high prices” (here).

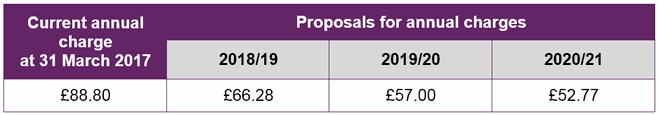

One of those changes involved imposing a significant price reduction on Openreach’s 40/10 FTTC “fibre broadband” product, which Ofcom described as being the “most important package” for consumers.

Advertisement

The news should have been good but three of the markets largest telecoms operators – Sky Broadband, Vodafone and TalkTalk – have complained via the FT that Ofcom’s decision to delay the start of their review, until after a deal had been struck with BT over the future of Openreach, meant that their FTTC proposals arrived about a year late and this carries a cost.

A Vodafone Spokesperson said:

“As a result of the 12-month delay in implementing this initial charge control and the subsequent delay in further reductions, UK consumers are being over-charged by around £140m. This windfall gain will allow Openreach to invest in FTTP to cover a city the size of Cardiff.”

Openreach has already complained that the regulator’s proposed price cut does “not appear to incentivise more investment in ‘full fibre’ networks” (Ofcom hopes to foster more FTTP/H with their wider selection of regulatory changes) and they believe that their current prices are fair.

The regulator has promised to evaluate the new claim, although off-hand we can’t recall many occasions in the past where rivals have complained about the hypothetical impact of a delayed review in quite this way. It will be interesting to see if the Ofcom makes any related changes when they issue their final statement during early 2018.

Advertisement

Separately the regulator has also launched a probe into BT’s compliance with their 2016 Business Connectivity Market Review (here), which imposed a number of quality of service requirements. One of these, known as the ‘upper percentile limit’, required that no more than 3% of orders for relevant wholesale Ethernet services completed in the period 28th April 2016 to 31st March 2017 should be delivered in more than 159 working days (subject to a number of adjustments, such as taking account of customer caused delays). Ofcom is now examining whether BT has complied with this obligation.

UPDATE 3:33pm

One of the ISP’s has responded to our hails and clarified that the £140m claim may reference a new charge control that would have regulated MPF (LLU) prices from this April, which now won’t hit until April 2018.

The information appears to be confidential and I’ve been asked not to share the details, although current MPF pricing stands at £85.29 +vat per year (Openreach price list) and the ISPs appear to be saying that, following Ofcom’s own analysis, this should be reduced to around £80 (i.e. if this is not done then the providers claim BT would unfairly profit by up to £140m due to the delay).

Advertisement

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« UK Liberal Democrats Pledge 30Mbps+ for All by 2022 and 2Gbps+ FTTP

Comments are closed