2018 Infrastructure Report Shows State of UK Broadband and Mobile

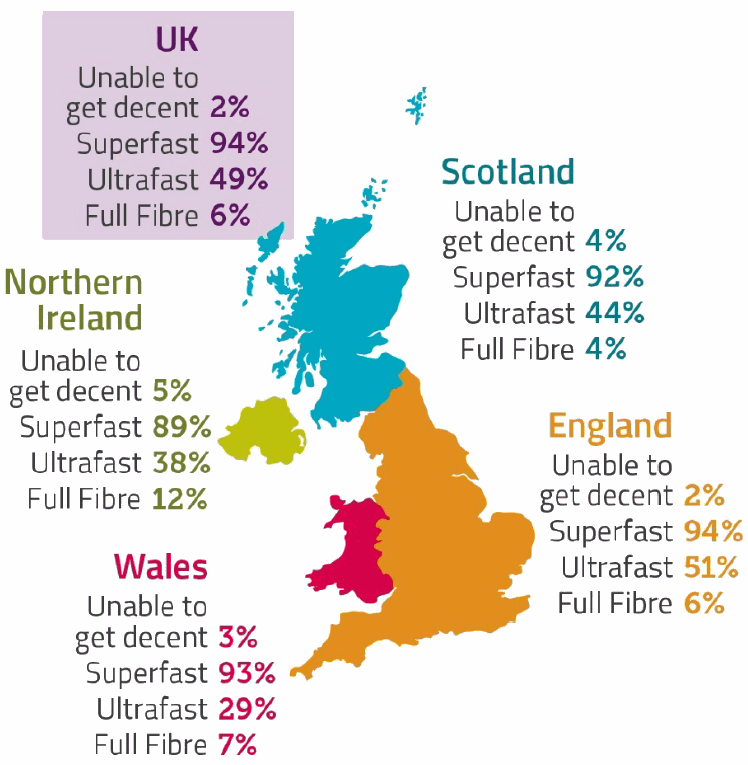

Ofcom has released their annual infrastructure report, which reveals that just 2% of the UK (677,000 premises) cannot access a 10Mbps capable fixed line broadband ISP service (down from 4% in 2017), while “full fibre” (FTTP) is available to 6% (up from 3%) and geographic coverage of 4G mobile has hit 66% (up from 43%).

The Connection Nations 2018 (PDF) report, which has been designed to provide a general summary of broadband and mobile network availability (as well as performance) from across England, Scotland, Wales and Northern Ireland, is largely based off data that was gathered during the autumn.

Overall the picture Ofcom presents this year is one of gradual improvement, which is to be expected now that both fixed line “superfast broadband” and 4G mobile networks have reached a strong level of network maturity (i.e. these are now primarily focused on tackling the final few remote rural areas, which tend to be significantly more expensive and take much longer to reach).

Advertisement

Ofcom’s Definitions of Network Performance

Decent Broadband (Universal Service Obligation)

Areas that can access a broadband download speed of 10Mbps+ (Megabits per second) and uploads of 1Mbps+.Superfast Broadband

Areas that can access a broadband download speed of 30Mbps+.Ultrafast Broadband

Areas that can access a broadband download speed of 300Mbps+.Full Fibre

Areas that can access a pure fibre optic (FTTP/H) network right to their home or business, which are usually capable of Gigabit (1000Mbps+) speeds.

We should point out that most of the Government’s older Broadband Delivery UK contracts tend to define “superfast broadband” by the slightly lower figure of 24Mbps+, although this only represents a difference of around 0.5% in network coverage vs 30Mbps+. Meanwhile Ofcom’s definition of “ultrafast” has always been odd since almost everybody else pegs it to start at 100Mbps+.

Fixed Line Broadband

The big story of 2018 has undoubtedly been the rise in aggressive competition between “full fibre” ISPs, which seem to be jumping over each other to see who can roll-out the most fibre optic lines (Summary of UK Full Fibre Plans). Many of those are commercial deployments that have only really begun at any scale this year, which are predominantly focused on urban areas.

The Government has set a related aspiration for “nationwide” coverage of FTTP/H networks to be achieved by 2033 (here), although this would require the market to be adding around 2 million premises (not overbuild) to the national coverage every year for the next decade or more and at present we’re nowhere near. Nevertheless the rise from 3% to 6% (1.8 million premises) coverage is still a significant jump over the lacklustre growth of previous years.

Meanwhile “superfast broadband” coverage has now reached 94% under Ofcom’s definition, which is important because this in turn means the gap that the 10Mbps+ Universal Service Obligation (USO) needs to fill is also shrinking and will continue to reduce before the start of 2020 (i.e. when the USO comes into force).

Advertisement

We should point out that at this stage Virgin Media’s cable (HFC DOCSIS) network is still the one most responsible for increasing the national coverage of “ultrafast” speeds, particularly since a lot of the new “full fibre” deployments are primarily overbuilding Virgin’s existing network and it’s a similar story for Openreach’s new hybrid fibre G.fast technology.

Kim Mears, Openreach’s MD for Strategic Infrastructure, said:

“This year we’ve spent millions of pounds delivering upgrades to thousands more homes in the most challenging parts of the UK. We’re doing that through a combination of commercial investment, subsidised partnerships and community schemes, and we’re using innovative techniques like drones to connect people that were previously unreachable.

It’s good to see that work is having an effect, with 98% of the country now able to order a ‘decent’ fixed broadband service and the vast majority able to order superfast. But there’s clearly more to do. We’re keen to continue working with the Government, Ofcom and the wider industry to get those few remaining not-spots upgraded and, with our Fibre First approach, we’re prioritising the deployment of future-proof Fibre to the Premises technology throughout the UK.”

In terms of take-up, some 45% of connections are now “superfast” services (up from 38% last year and 31% in 2016). Similarly, although 98% of premises have access to a “decent broadband” 10Mbps+ service, only 65% of premises actually have an active broadband connection that delivers this.

The growth in take-up has naturally led to an increase in average speeds across the UK. The average download speed of all active connections is now 49Mbps (up from 44Mbps in 2017), although this falls to 7Mbps for uploads (up from 6Mbps). The digital divide also remains present, with the average download in urban areas being 51Mbps and only 32Mbps in rural locations.

In addition, the average monthly data volumes per household on fixed broadband connections have also increased over the past year, jumping to 240 GigaBytes from 190GB last year. The median value of data use on fixed lines has also increased by almost 50% to 124GB from 84GB last year (i.e. this suggests that users with faster connections are using a lot more data).

Advertisement

Rising data consumption is one of the key reasons why so many “unlimited” ISPs hike their prices because it impacts their cost of provision.

Mobile Networks

The report also examines the coverage of mobile networks, such as via the usual 2G, 3G and 4G based platforms that most people should now be familiar with. The UK has four primary network operators (MNO) via O2, Three UK, EE (BT) and Vodafone, plus a plentiful supply of virtual operators (MVNO) that piggyback off those.

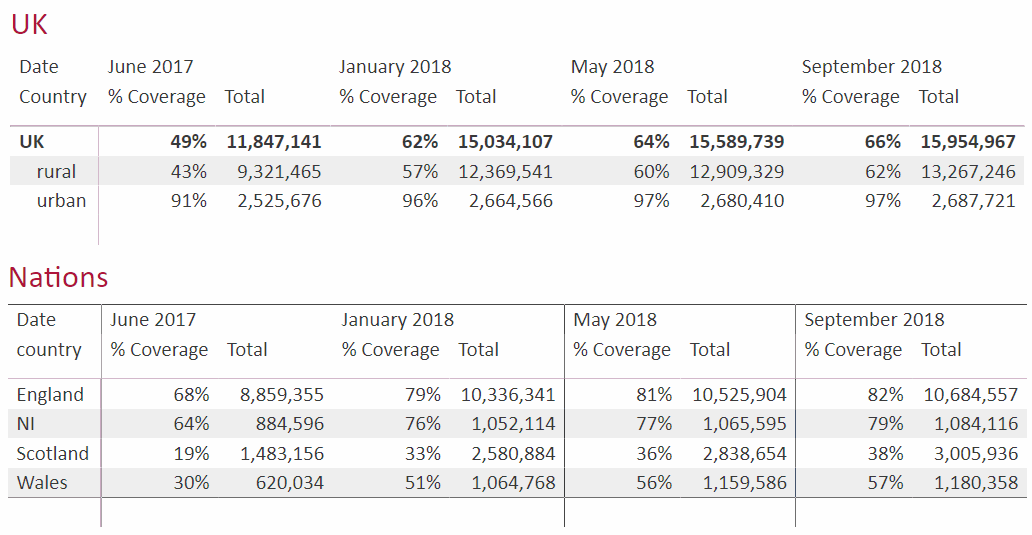

Overall Ofcom found that 92% of premises (indoor) in the UK should be about to make a mobile voice call (up from 90% last year) across all operators and this drops to 77% for 4G data connections (up from 65%). Meanwhile the outdoor geographic coverage of 4G services across the UK is still painfully low at 66% (up from 43%) from all four mobile operators or 91% from at least one operator.

Within this, individual operator coverage varies, with the highest being 84% and the lowest 74%.

Current 4G Coverage by Operator (% UK Land Area)

Most network operators are currently reaching maturity in their 4G deployments, although EE has set itself a goal for landmass coverage of 95% by the end of December 2020 (currently c.91%). However geographic 4G coverage in rural areas from all operators is only 62% and this rises to 97% in urban locations.

Geographic 4G Coverage from All Operators (Regions)

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Cityfibre Hail Largest £1.12bn Debt Financing for UK Full Fibre Rollout

Comments are closed