Ofcom Updates on Plan to Boost UK Full Fibre Broadband Investment UPDATE

The UK telecoms regulator has today set out more detail on how they intend to change market regulation in order to promote competition and investment in the roll-out of Gigabit capable “full fibre” (FTTP) broadband ISP networks, which will support the Government’s ambition for “nationwide” FTTP coverage by 2033.

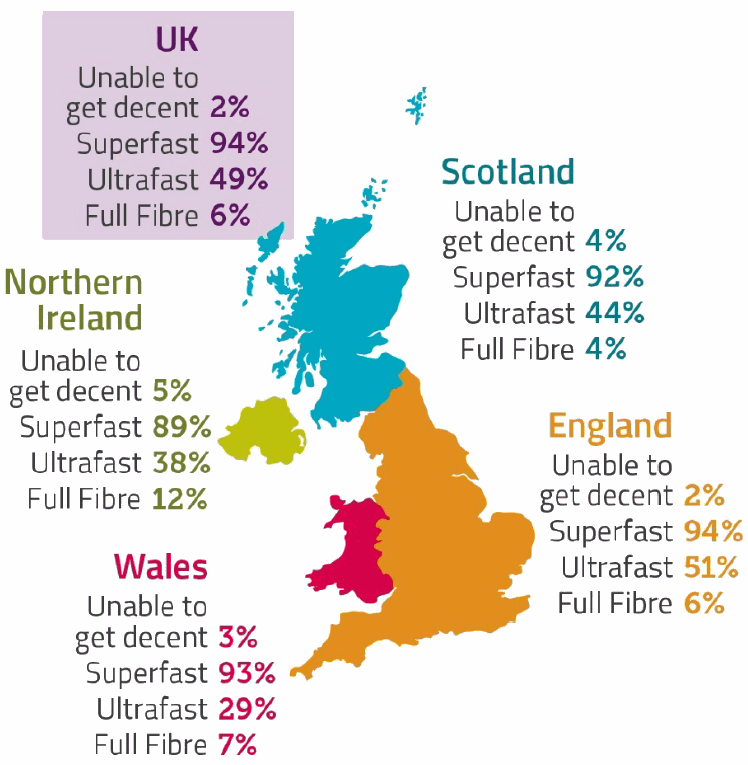

At present only around 6% of UK premises can access a Fibre-to-the-Premises (FTTP) network (up from 3% a year ago), although this is now rising rapidly thanks to various funding / subsidy initiatives from the Government, a softer Electronic Communications Code (here) and the 5 year business rates relief on new fibre.

A growing number of alternative network providers (Cityfibre, Gigaclear, Hyperoptic etc.) are now competing with Openreach (BT) and Virgin Media to help achieve the Government’s ambition. But further changes will still be required and many of these were summarised as part of last year’s Future Telecoms Infrastructure Review (FTIR) and Ofcom’s related consultation (here).

Advertisement

The aforementioned proposals represented a significant departure from Ofcom’s historical approach to economic regulation and were aimed at helping investors in the new “full fibre” market to make a fair return (i.e. “fair bet“) on the new networks. “We think these proposals will support network competition and investment in the more urban areas of the country: the first 70% of the UK,” said Ofcom.

Summary of the Key Proposals

1) Supporting a move towards unrestricted duct and pole access, giving companies greater flexibility to use Openreach’s telegraph poles and underground ducts.

2) More holistic consideration of business and residential markets, focused on promoting competition by incentivising companies to build networks.

3) Different regulatory approaches in different parts of the country, depending on the intensity of network competition.

4) Preserving incentives for Openreach to invest, in fibre across the country by having a fair package of regulatory measures.

5) A smooth transition from older copper networks to full fibre, while protecting consumers during the migration process.

6) Public intervention in remote areas where there is no prospect of network competition

7) Longer-term certainty for investors, lengthening the period of our telecoms competition assessments from three years to at least five.

So far the regulator has already launched consultations on points no. 1 above (here), which includes their separate Dark Fibre plans, as well as points 2 and 3 (here). Meanwhile today’s proposals aim to provide more clarity on 3, 4 and 5. The key issues being how Ofcom intends to preserve Openreach’s incentives to invest in new fibre networks, and how they handle the transition away from older copper lines. No new regulation will be added to already competitive areas and Ofcom is moving away from cost-based charge controls of copper services (i.e. encouraging ISPs like Sky Broadband and TalkTalk to go fibre).

Ofcom also says that the remaining 30% of “more rural areas“, where there is no prospect for competing networks and a weaker commercial case for investment, “should not be left behind“. Therefore they propose to support continued retail competition, while maintaining the incentives for Openreach to invest in full fibre by allowing them to “spread the costs of investment in fibre across a wider group of consumers.” (e.g. they could recover some investment costs from both copper and fibre products).

The above represents a radical change and is akin to utility rate of return regulation or a Regulated Asset Base (RAB) model. “This will enable Openreach the opportunity to profitably invest in full fibre at low risk,” said Ofcom.

Advertisement

Future 5G mobile networks will also need fibre in rural areas for their capacity supply, thus Ofcom are proposing cost-based access to Openreach’s Dark Fibre network in these areas and allowing a “reasonable return” on their investment (see link for no.1 above – future business connectivity review).

But of most interest this time around is the regulator’s approach to the transition from copper to fibre, which is an extremely complicated area due to the many competing interests from different ISPs and vulnerable consumers etc. We covered this in more detail as part of Openreach’s recent consultation on the subject (here) and Ofcom’s proposed approach is set out below.

Ofcom’s Proposal for Copper to Fibre Migration

We propose applying the following requirements:

a) Openreach is required to deploy its fibre network in an exchange area to provide 100% coverage. As such, all customers will have the choice of purchasing a fibre service prior to the focus of our regulation switching away from copper-services.

b) Openreach is required to provide a 40Mbps (10Mbps upload) service on its fibre [FTTP] network.

Our view is that to ensure a smooth transition for customers, there will need to be a period of time (subsequent to the above requirements being met), where we continue to regulate copper-based services prior to switching the focus of our regulation to a set of regulated fibre products. This needs to be sufficiently long to allow rival access seekers to inform their customers and manage the future changes to the focus of our regulation.

During that time we propose an overlap where we continue to regulate copper-based services in parallel to regulating fibre-base services. We propose that that this should be at least two years. In addition, we propose that at the start of this overlap period, Openreach is no longer required to provide new copper connections (including no longer being required to migrate a customer back to a copper service from a FTTP service).

We propose that when this two-year period has elapsed, we would lift price regulation on copper-based services and switch to regulating a set of fibre-based products only.

Broadly speaking Ofcom’s plan appears to mirror a lot of Openreach’s own industry consultation, which is no surprise since both sides will have spent a long time discussing the issue before publishing their consultations. However the final details won’t come until both processes have completed.

The regulator says that this should provide a “predictable framework” for “closing down Openreach’s copper network once fibre is built – underpinned by regulation – substantially reduces the risk for Openreach of deploying fibre.”

Advertisement

Ofcom’s said their goal is to “encourage and enable significant, long-term investment in full-fibre broadband to give customers a choice of networks where feasible, while allowing companies who build these networks to make a fair return.”

An Openreach Spokesperson said:

“We agree that certain conditions are needed to encourage further investment in full fibre networks, so this looks like a step in the right direction by Ofcom.

Openreach is hugely ambitious. We want to be the UK’s national full fibre broadband provider and we’re already getting on with the job of building at pace and scale throughout the country.

We’re also on track to hit our initial target of making FTTP available to three million homes and businesses by the end of 2020 and we’ll study the detail of Ofcom’s proposals before responding accordingly.”

The new consultation is expected to run until 7th June 2019 and the full details of their final approach will then be set out in December 2019. We also expect a new round of Quality of Service (QoS) standards, which may cover Openreach’s FTTP products too (still the subject to some debate).

Consultation: Promoting competition and investment in fibre

https://www.ofcom.org.uk/../competition-fibre-networks-approach-remedies

UPDATE 1:52pm

Added a comment from Openreach above.

UPDATE 30th March 2019

As requested by some readers, we did query with Ofcom the expectation for Openreach being “required to deploy its fibre network in an exchange area to provide 100% coverage.” Apparently “fibre” in this sentence is not only FTTP but can also be delivered via G.fast, which makes the target sound a bit more viable. In keeping with that the regulator confirmed that they “expect Openreach to cover an entire exchange area before we start to move the regulatory focus away from copper and onto fibre.”

This largely reflects that Openreach plan to “full cover exchange areas” where it deploys FTTP/G.Fast, as this is said to be the only way that it can retire its copper network and release the cost savings. Mind you it may be difficult to fully retire copper when you have a hybrid fibre and copper product like G.fast included into the coverage equation (i.e. they can’t retire the final copper drop in those areas).

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« ISP BT Bundles Free Google Home with UK Fibre Broadband Packages

Comments are closed