BT Group’s UK FTTP Broadband Cover Hits 5.8 Million Premises

The BT Group has published their Q2 2021/22 results, which reports that their consumer ISP division now has a total of 945,000 broadband customers on their Fibre-to-the-Premises (FTTP) network (up from 860K last quarter), while Openreach has grown their UK FTTP coverage to 5.78m premises (up from 5.16m). Build costs have also fallen.

Once again, it’s been another busy quarter for BT, which has seen them pick Adam Crozier to replace Jan du Plessis as Chairman (here), face more takeover speculation from Deutsche Telekom and Altice UK (here and here), confirm a plan to build 300 Wi-Fi Street Hub Kiosks (here), move their Net Zero target forward to 2030 (here), enable Wi-Fi on their new TV Box Pro device (here) and fail to block a £600m class action claim – related to the alleged overcharging of landline-only phone customers (here). BT also signed a deal to harness OneWeb’s LEO broadband satellites (here).

As for network access provider Openreach, they’ve continued to move exchanges away from old copper-based analogue phone services and on to a new all-IP network (here), waived some broadband installation fees for low-income homes (here), tested a “new” Air Wand solution to boost their FTTP rollout (here), suffered a string of copper cable thefts in Essex (here) and expanded their FTTP rollout in N.Ireland (here).

Advertisement

On top of that Openreach announced another large batch of new FTTP rollout locations (here) and has begun to trial new pricing for their FTTP on Demand product (here). Finally, they introduced a controversial new discount on FTTP rental prices (here) – TalkTalk, Sky Broadband and 8 other UK ISPs have already signed-up to that.

The Latest Results

In corporate terms, the biggest development this time around has been BT’s confirmation that they have delivered on their £1bn of gross annualised cost savings (job cuts etc.) – at a cost of £571m (below the £900m of costs they expected), which is some 18-months ahead of their March 2023 target.

The catch now is that BT might feel encouraged to pursue further efficiency savings, which could carry with it additional job losses, and that may test their recent agreement with the CWU union (here). But in the meantime, they’ve moved to keep shareholders happy by reinstating their dividend today.

“We are therefore bringing forward our £2bn gross annualised savings target to FY24 from FY25, with further savings in FY25, within the expected cost of £1.3bn,” added the operator.

Advertisement

Financial Highlights – BT’s Quarterly Change

* BT Group revenue = £5,238m (up from £5,070m)

* BT Group profit after tax = £429m (up from £2m)

* BT Group total net debt = £18,241m (decreased from £18.566m)

BT doesn’t report full customer figures for their own retail broadband ISP division, but they have started doing it for their ultrafast services. BT Consumer reported that they had 945,000 FTTP customers (up from 860K last quarter) and EE’s “5G Ready” base now stands at 5,279 million (up from 4.088m). Speaking of mobile, EE’s 5G network now spans around 40% of the UK’s population.

Meanwhile, some 81.9% of BT’s fixed consumer base now take a “superfast broadband” service (down slightly from 82% last quarter as users move to FTTP) and this drops to 7.3% (up from 6.6%) for their “ultrafast broadband” (100Mbps+) products – includes both G.fast and FTTP. We also noted that 21.7% of BT’s customers are also now taking both mobile and broadband (converged), which is up from 21.5%.

Openreach’s Network

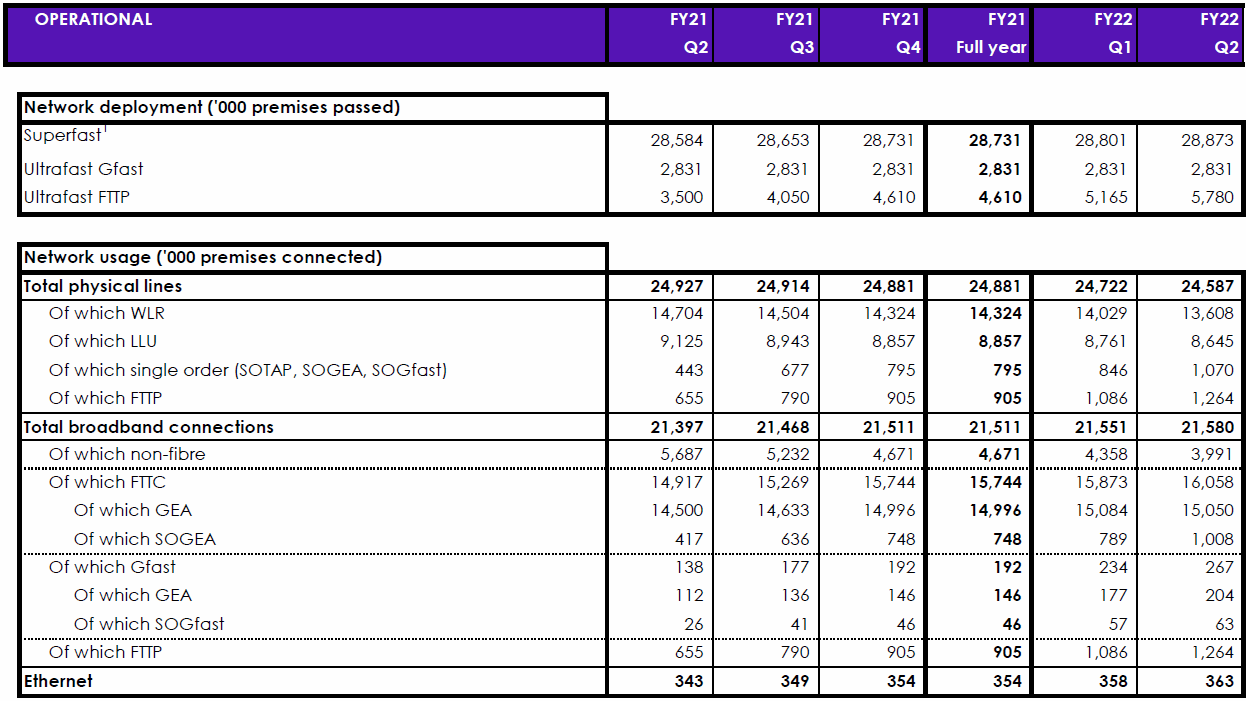

The table below offers a breakdown of fixed line network coverage and take-up by technology on Openreach’s UK network, which covers the totals for all ISPs that take their products combined (e.g. BT, Sky Broadband, TalkTalk, Zen Internet, Vodafone etc.).

Advertisement

The rollout of full fibre (FTTP) lines has clearly continued to grow and added +615,000 premises in the quarter (up from +555K last quarter). As for take-up, we normally expect the rapid deployment of new networks to suppress take-up figures, but Openreach’s FTTP continues to buck this trend. The result reveal that 1.264m FTTP connections have now been made (up from 1.086m last quarter) and that equates to a take-up of 21.87% (up from 21.03% last quarter) – this is impressive.

Philip Jansen, CEO of BT Group, said:

“These results demonstrate an acceleration of pace in the transformation of BT. We are creating a better BT for our customers, the country and our shareholders. We’re going further and faster on the UK’s next generation connectivity; we’re modernising BT and bringing down costs; and we’re reinstating the dividend today, as planned.

After a record six months, Openreach has now rolled out full fibre broadband to almost 6m premises and continues to lower its build cost. Its three largest customers are signed up to the new pricing offer as we see rapid adoption of what will be the UK’s first nationwide full fibre network spanning 25m premises by 2026. Meanwhile, our 5G network now covers over 40% of the UK’s population and we have over 5.2m 5G ready customers. Together, our networks provide our customers with an unrivalled level of connectivity.

While we are serving our customers better than ever, BT is also changing rapidly internally. We have hit our £1bn cost savings target 18 months early, which allows us to bring forward our FY25 target for £2bn of savings to FY24. This is all part of creating a leaner BT with simplified processes and improved customer experiences.

BT is on track and with results in-line with our expectations, we are today confirming our financial outlook for FY22 and FY23. Looking further out, as we pass the peak of our fibre build and move towards an all-fibre, all-IP network, we expect a reduction in capex of at least £1bn and lower operating costs of £500m. From these two factors alone, by the end of the decade we expect an expansion of at least £1.5bn in normalised free cash flow compared to FY22, and that’s before any benefits from increased revenue and further transformation efficiencies. Our progressive dividend policy will be underpinned by these increased cash flows as we move to sustainable growth going forward.”

One particularly interesting piece of information in these results is that the expected average build costs of their FTTP network have been lowered to £250 – £350 per premises passed (excludes new builds and net of subsidies), which helps to explain why they’ve been able to raise their coverage targets. The figures are down from their previous estimate of £300 to £400.

In keeping with that, BT had indicated in May 2021 that they were exploring the idea of creating a joint venture to fund the rollout of FTTP to an additional 5 million premises, but have now decided not to proceed. “We have conducted an extensive review and held discussions with prospective investors, however with FTTP build costs coming down and take-up ahead of expectations, we have decided to retain 100% of the project for shareholders and to remain fully focused on driving build and take-up,” said the report.

In addition, we get a good idea of the impact that the Government’s new “Super Deduction” tax break will have on their network rollouts. BT now expect around £5bn of carried forward tax losses from FY23 as a greater proportion of capex qualify for the cash tax super-deduction. We also note that capital expenditure hit £2,563m, up 30%, albeit primarily due to investment in spectrum (Ofcom’s recent 5G mobile auctions).

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Virgin Media O2 Adds 67,000 More Premises to UK FTTP Cover

no mention of selling bt sport

The falling build costs are going to put a lot of pressure on the altnet’s backers investment.

“and that’s before any benefits from increased revenue and further transformation efficiencies.”

If it is going to happen I expect it will fall within the further transformation efficiencies.

Sky have now signed up to Equinox, doesn’t this development dismiss the rumour that Sky are going to partner with VMO2 on FTTP?

Not at all. Makes sense to do both. I would’ve been surprised if they hadn’t signed up to Equinox.

Indeed, under Ofcom’s rules Openreach can’t play much in the way of hard ball, so there’s no reason why Sky can’t do both.

Don’t see a tie up between VMO2 and Sky, on FTTP myself. Sky have moved heavily into content, and are moving toward a streaming model, highlighted by the Sky Glass announcement; Why would they get involved in a risky FTTP venture, when they can build broadband volumes over Openreach, and get a good discount for the trouble?

Sky have now contractually separated Broadband and TV services for customers, which may mean they are looking at offering TV streaming irrespective of the ISP, and running an broadband ISP service separately.

Adding everything up, where’s the evidence that Sky and VMO2 are looking at a joint venture, other than speculative articles?

Until they actually announce something solid evidence isn’t going to appear.

A reason to invest is control. Could’ve just purchased from BT Wholesale but wanted to save costs and have more control over the products being sold. Buying from Openreach Sky get what BT Group want them to have which is usually what BT Wholesale/Retail want to sell.

Getting into bed with VM also provides leverage in negotiations with Openreach.

A reminder that Sky is owned by Comcast. Comcast have a cable network passing 60 million premises.

It’s perfectly possible also that Sky will not invest but will use VMO2’s wholesale products. Over VMO2 they’ll be able to sell multiple gigabit symmetrical services at competitive prices. There’s zero prospect of Openreach either going over a gigabit or going even close to symmetrical any time soon.

My house is currently fed by Openreach FTTC, with my ISP being Sky, at approximately 35 mb/s. We have three Televisions in the house and stream in multiple rooms simultaneously without issue. 1 GB/s is easily overkill for 99.9% of residential users. It’s been well publicised that Openreach have been trialing XGS-PON, so the capability will be available to offer more than 1Gb/s. Also since Openreach FTTP is passive, from the Exchange to the customer site, there’d be nothing stopping Openreach offering symmetrical 100GB channels, or even Terabit capacity, using Wavelengths out of Band from the PON DWDM Wavelengths.

https://www.ispreview.co.uk/index.php/2020/02/openreach-test-xgs-pon-ahead-of-symmetric-fttp-speed-trial.html

So I don’t understand why you say:

“Over VMO2 they’ll be able to sell multiple gigabit symmetrical services at competitive prices. There’s zero prospect of Openreach either going over a gigabit or going even close to symmetrical any time soon.”

With DWDM offering enough Bandwidth capability to serve any customer with whatever capacity they require, Openreach can serve any customer Traffic requirement. Apparently the capacity of a single Fibre is around 1 petabit per second per optical mode, not that I see that capacity will ever be required on Access network.

Ex Telecom Engineer says:

November 4, 2021 at 9:28 am

Don’t see a tie up between VMO2 and Sky, on FTTP myself. Sky have moved heavily into content, and are moving toward a streaming model, highlighted by the Sky Glass announcement; Why would they get involved in a risky FTTP venture,

======================

Ex-T-E – The more recent speculation wasn’t on a tie up involving ownership/creating a new venture – it was to be a customer of a wholesale version of the VM Broadband network much like they are with Openreach.

I do think that any Wholesale division of VM could be tempting to Sky if VM aggressively undercut Openreach costs. This puts Openreach on notice during negotiations.

“Ex-T-E – The more recent speculation wasn’t on a tie up involving ownership/creating a new venture – it was to be a customer of a wholesale version of the VM Broadband network much like they are with Openreach.”

Actually the recent speculation was implying a joint Fibre venture between VMO2 and Sky. The Telegraph article also mentioned talks about wholesale deals between VMO2 and Talk Talk/Vodafone.

“The prospect of a full-fibre investment partnership with Sky strengthened after Dana Strong, the former Liberty Global and Virgin Media executive, became boss of the company earlier this year.”

https://www.telegraph.co.uk/business/2021/10/03/sky-closes-broadband-investment-deal-virgin-media-o2/

As I said previously, highly speculative articles with current events contradicting that particular Sky/VMO2 narrative.

Ex-T-E – I stand corrected. I misread articles from last month and focussed on the Wholesale side. Sorry for the confusion.

It’s pretty simple really: VMO2 will offer a competitively priced symmetrical service. Openreach have no intention of doing so in order to protect their EAD revenue.

I’m aware they did trials of XGSPON. It get deployed?

They could offer 2:1 ratio on the existing network. To get 5:1 carries a big premium right now.

I have asked contacts at Openreach. They have no plans to increase upload speeds.

Whether it’s required or not is irrelevant. It’s a selling point.

Also entirely irrelevant that 100G can be purchased.

I’m talking about the residential products Sky are likely to want to sell in volume. Symmetrical 500 is better than 500/70. Symmetrical 900 superior to 900/110. XGSPON is superior to GPON. What the glass is capable of doesn’t matter, what matters is the products available.

VMO2 offer the right products at the right price Sky will use them.

As a reminder, also, Sky really like control. The drama over VULA over GEA comes to mind. Sky and TalkTalk both wanted it as close as possible to LLU.

If they were to invest in VMO2’s build it’s reasonable to think they’ll be able to build their own products and services on the entire estate in return for the cash and anchor tenancy.

There are, no question, valid reasons for Sky to invest. Equinox is irrelevant. It’s still more expensive than CityFibre’s wholesale products and less flexible than the products Sky could negotiate for. Equinox saves a few £ per month per line but pricing isn’t the only consideration.

Suppose VMO2 offer a product whereby Sky can have video traffic prioritised across the network to guarantee quality of their TV services regardless of how heavily the customer is using Internet services as one example.

VMO2 already use IPTV a bunch and it cannot be impinged on by broadband usage. Ditto telephony. Both have separate prioritised bandwidth. Sky can set the rules if they’re investing. Not so easy if another wholesale customer.

“There are, no question, valid reasons for Sky to invest.”

I’m so convinced that Sky aren’t interested in a Fibre Joint venture with VMO2, i’d put money on it.

“Suppose VMO2 offer a product whereby Sky can have video traffic prioritised across the network to guarantee quality of their TV services regardless of how heavily the customer is using Internet services as one example.”

Prioritising Traffic flows, across core networks, isn’t anything new; QOS for prioritising voice and Video Data is common across all router/switch networks. VOIP data needs prioritising as a matter of urgency, since high latency results in echo. Real time streaming uses UDP, as retransmission is pointless. The most important considerations with Video and Voip is sufficient core router and backbone capacity, keeping latency and Jitter to a minimum. BT’s core network capacity is massive, and they’ll use QOS for prioritising UDP Video and Voice traffic, just like VMO2 will.

“VMO2 already use IPTV a bunch and it cannot be impinged on by broadband usage. Ditto telephony. Both have separate prioritised bandwidth. Sky can set the rules if they’re investing. Not so easy if another wholesale customer.”

If VMO2 move to a full FTTP model, everything will share the PON data stream, there’ll be no separate TV and Voice connectivity, unless VMO2 want to have high operating costs due to maintaining many different delivery systems.

> It’s pretty simple really: VMO2 will offer a competitively priced symmetrical service.

That’s *extremely* unlikely, given that VMO2 can’t even deliver anything above 50M upload even to their own customers.

Customers who demand symmetric services are very vocal but in a tiny, tiny minority – and probably the heavy-usage customers the ISPs don’t want too.

NE555 what VM offer on their hybrid network or via RFoG using DOCSIS bears no relation to the capabilities of an XGSPON-based solution.

Ex-TE adaptive streaming usually flows over TCP now, UDP tends to be more for video conferencing and you completely missed my point. I wasn’t talking about core networks but the bit going into the home. It will use the same PON but different traffic can be sent, and OLTs can ensure that one class of traffic always gets through even if a user is saturating their broadband service.

Get a Steam download going and see how your 4k streaming rolls for why this is desirable. Steam can and does use multiple gigabits if capacity is there.

I said nothing about a separate delivery system. I mentioned different traffic classes. You are aware these are a thing and you can map multiple services with different QoS over GEM ports, right?

It was purely an example either way. Equinox has no requirements in terms of volume, only proportion of orders that are FTTP. If there’s a more cost effective and flexible option that better suits needs Sky must at least take a look.

I wish someone would nick the copper round here. We have been told any single new-build has to have copper line installed if it needs to be planned, even if FTTP is available next door. Only then can we order an FTTP line.

Congratulations BT. An impressive set of results in many areas of your business.

Completely unimpressed. This is a catchup, BT should have been at this stage of fibre deployment more than a decade ago, the majority in this country still has no FTTP access.

Completely predictable post.

Thankfully they don’t need to impress you. But the city like it. Shareprice up 15p

Gnewton

Completely unimpressed. This is a catchup, BT should have been at this stage of fibre deployment more than a decade ago,

the comment clearly proves you have no comprehension or understanding of building an FTTP network — and the costs and build time back at that time was astronical – (many times the current build cost)

Ex Telecom Engineer

35mbps isnt close enough for even two 4k streams

what a stupid statement.

Most aren’t that bothered about 4K content, in fact I’m more than happy to watch SD, or 1080P. There’s nothing stupid about suggesting my 35Mb/s broadband is adequate, only fan boys would stupidly suggest otherwise. As it currently stands, “Ultrafast” broadband isn’t available on my road, and I’ll be in no hurry to upgrade when it does become available, unless my provider offers the upgrade for free.

When are we likely to see cheaper Ultrafast packages due to Equinox? My contract is coming to an end soon so don’t want to sign up just before discounts come in.