PAC Warn Pace of Rural UK 4G Mobile Rollout Project is Unsustainable

The Public Accounts Committee (PAC), which is responsible for overseeing UK government expenditures to ensure they are effective, has warned that the current build pace of the £1bn industry-led Shared Rural Network project (i.e. extending 4G mobile (broadband) coverage to 95% of the UK by the end of 2025) “may not be sustainable“.

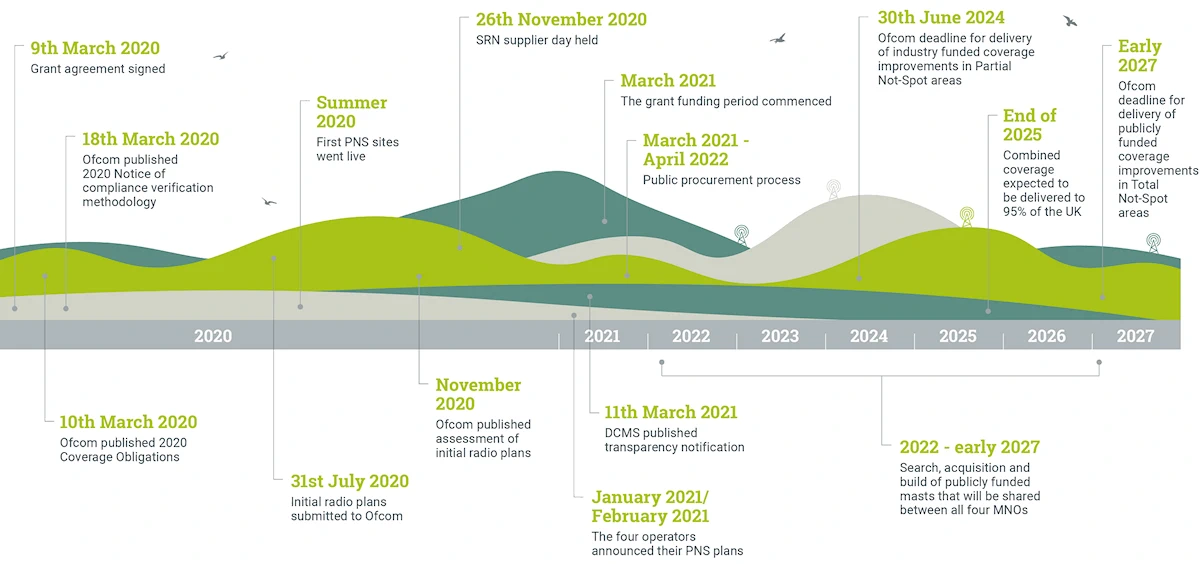

The SRN – supported by £501m of state aid and £532m from operators – involves both the reciprocal sharing of existing masts in certain areas and the demand-led building and sharing of new masts in others between the operators (MNO). The goal is to extend geographic 4G coverage (aggregate) to 95% of the UK via at least one operator by the end of 2025 (falling to 84% for areas where you’ll be able to take 4G from all providers).

Most of the early work on the SRN has involved private investment from the main mobile network operators (i.e. Vodafone, O2 (Virgin Media), EE (BT) and Three UK), although in recent months we’ve also seen government-funded mast upgrades taking place in other parts of the UK. According to the latest data from Ofcom, geographic 4G coverage from at least one operator is currently said to stand at 93.1%.

Advertisement

However, as has already been well reported (here, here and here), part of the SRN is known to be facing a big delay and this concerns the first target for the delivery of industry funded coverage improvements in Partial Not-Spot (PNS) areas (i.e. areas which receive coverage from at least one operator, but not all). This needs to be achieved by June 2024, when 4G must cover 88% of the UK’s landmass, yet O2, Vodafone and Three UK are known to have called for an “18-month extension” to this (note: EE has already completed it, months ahead of schedule).

By contrast, the second target, which is not yet facing a delay, reflects a deadline for improvements in Total Not-Spot (TNS) areas by early 2027. Just to be clear, Ofcom’s licence obligations commit each operator to increase its 4G coverage to 88% of UK landmass by June 2024 – and to 90% by January 2027 – with these individual obligations supporting the overall target of 95% by December 2025.

What does the PAC say?

The PAC’s report finds that, to meet the 95% target, “progress will need to continue at the same rate as the past year, even though the remaining locations will be even harder to reach and connect“. The problem is that this “pace may not be sustainable“, which is partly due to the aforementioned delays. But the report also identifies some other issues.

Advertisement

The Government’s £501m investment is said to be “subject to cost pressures, which combined with delivery challenges means installing new masts will cost more than expected“, yet the Department (DSIT) is “not yet certain by how much the programme’s costs will rise” as a result of these pressures and what impacts that may have (i.e. on targets and how much of any cost increase will be borne by the taxpayer).

Furthermore, the Department has not confirmed which specific areas are in the 5% of the UK that will not have 4G connectivity, and it “does not yet have a plan to ensure people in these areas are not left behind“. In addition, public reporting of mobile connectivity across the UK was found to be “not fit for purpose” and Ofcom’s data for measuring connectivity “often does not reflect people’s experience“. None of that will come as a particular surprise because it remains incredibly difficult to measure mobile coverage, which can vary due to all sorts of reasons (e.g. weather, tree growth, new buildings, spectrum band selection, end-user device capabilities etc.).

As a result of this, the government currently lacks information on whether mobile network operators are on track to meet targets to improve connectivity for road users and premises, and has insufficient data to judge whether connectivity on UK railways is improving. Ofcom are known to be looking at making improvements in how they measure coverage, but there are limits to how far they may be able to go with this before it becomes impractical or uneconomic.

Finally, the report also touches on the related area of 5G connectivity, although the PAC said they were “unconvinced” about what the government had achieved to date for its £400m investment in the technology or how it will demonstrate related progress. In fairness, 5G has suffered a lot due to the Government’s sudden U-turn to ban Huawei’s kit, which caused lots of delays and extra costs for most mobile operators.

Advertisement

In addition, the PAC suggests that the government look at how to harness the new generation of Low Earth Orbiting (LEO) broadband satellites to support their other policies, which is of course something that is already happening via various different rural mobile and broadband trials with OneWeb (Eutelsat) and Starlink (SpaceX).

Conclusions and Recommendations

The Full Report includes a series of recommendations to help address the challenges being faced by the SRN programme, which will be something that the next government will need to respond to and – due to the General Election – we don’t yet know for sure what that will look like.

However, ultimately it will be Ofcom’s responsibility to take a view on whether the licence obligations have been met and what, if anything, they want to do about that. The regulator plans to run a progress assessment during the summer and will then reach a conclusion a couple of months later, during the early autumn.

In theory, Ofcom could fine the operators up to 10% of their global turnover, if the roll-out is delayed. But in reality, the regulator is expected to be “reasonable” in their judgement. This is important because some of the delays come from external factors, such as rejected planning applications by local authorities, which are a politically tedious area. Not to mention issues with obtaining power supply and fibre backhaul – particularly in remote rural areas.

Furthermore, the ultimate SRN completion date of 2027 was set to allow some contingency for the inevitable complexities and delays that often flow from mobile infrastructure projects (much as we’ve seen many times before). Put another way, it’s technically possible for the first PNS target to be missed and yet operators could still achieve the final TNS target on time, but only time will tell.

PAC’s Seven SRN Recommendations

Recommendation 1:

The Department and BDUK should work closely with the mobile network operators to ensure that government:

• Gets the information it needs from the operators to gain certainty on the cost increases; and

• Uses this information to inform decisions on how cost increases will be managed while at the same time ensuring that coverage targets are met.

• Fully considers emerging new technologies such as low orbiting satellites to ensure investments produce the most cost-effective results.Recommendation 2:

Now that the proposed locations of Shared Rural Network masts are more certain, the Department should revisit its cost benefit analysis to determine more precisely who will benefit, and how, from its investment in 4G connectivity. It should use this information to inform final decisions on mast locations and numbers and to communicate the case for investment to stakeholders.

Recommendation 3:

With clearer information about the proposed location of masts, the Department should now confirm which areas of the UK will still not have 4G connectivity once the Shared Rural Network programme is complete. It should assess the impact of this on communities in these areas and develop a plan for alternative ways of ensuring they get the connectivity they need.

Recommendation 4:

The Department should take urgent action to ensure that it has meaningful data on mobile coverage that reflects people’s actual experience.

As part of this it should:

• Work with Ofcom to develop ways that consumers and businesses can directly report coverage gaps in real-time to help build a more realistic and detailed picture of mobile coverage across the UK;

• Ask Ofcom to examine any cases where areas have lost all mobile connectivity following 3G switch off; and

• Ensure that mechanisms for measuring access to 5G coverage are fit for purpose.

Recommendation 5:

The Department should work with Ofcom and the mobile network operators to ensure that it can report publicly on progress against its targets for increasing 4G connectivity on roads and premises.

Recommendation 6:

Working with Ofcom and the Department for Transport, the Department should make a plan for more frequent collection of coverage data on the UK rail network to help it prioritise the rail lines where improvements in coverage is most needed. This information should be published on a regular basis so that rail travellers have clearer information on the coverage they will experience.

Recommendation 7:

The Department should set out more clearly what it has achieved from its investment to date in 5G, as well as setting more meaningful and measurable targets for assessing its progress in supporting the roll-out of standalone 5G mobile coverage.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Vodafone Extends 4G Mobile to 250 UK Rural Locations Under SRN

Hmm… Sounds like EE pulled out their finger and got the job done while the other MNOs dragged their feet. In my mind now is the time for Ofcom to levy a fairly substantial financial penalty on the non-compliant MNOs to demonstrate the importance of compliance with license obligations, although we know they’re toothless so…

In being fair, EE did enter the SRN with the strongest geographic 4G coverage of any UK mobile operator, after having initially invested more than their rivals into improving rural 4G coverage. Not to mention the ESN impact.

Well EE did get the Emergency Services Network contract – ESN replaces the Airwave network. To provide the coverage they were funded by HMG to provide more coverage over the landmass of the UK rather than the population But even at 88% of the landmass coverage they don’t come close to the Airwave network coverage (@ 95%+). If EE has the 93.5% coverage that is better.

Be interesting to see how well the ESN works when Airwave is out of the picture.

‘Sharing’ of masts. Think you will find the great majority of Masts are already shared; OK the antenna’s for the different service providers may not all be at the same height and performance characteristics. Just look at the head frames at most sites or the tops of tall buildings.

Or should we asking sharing the Transmitter/Receivers? That would would be cheaper to provide in sparsely populated areas for all networks, the cost involved in increasing the capacity of a BTS is less than a new complete installation. It would make the call routing and cost sharing interesting but would it be that difficult?