UPDATE Ofcom in Major UK Strategic Review of all things Broadband and Telco

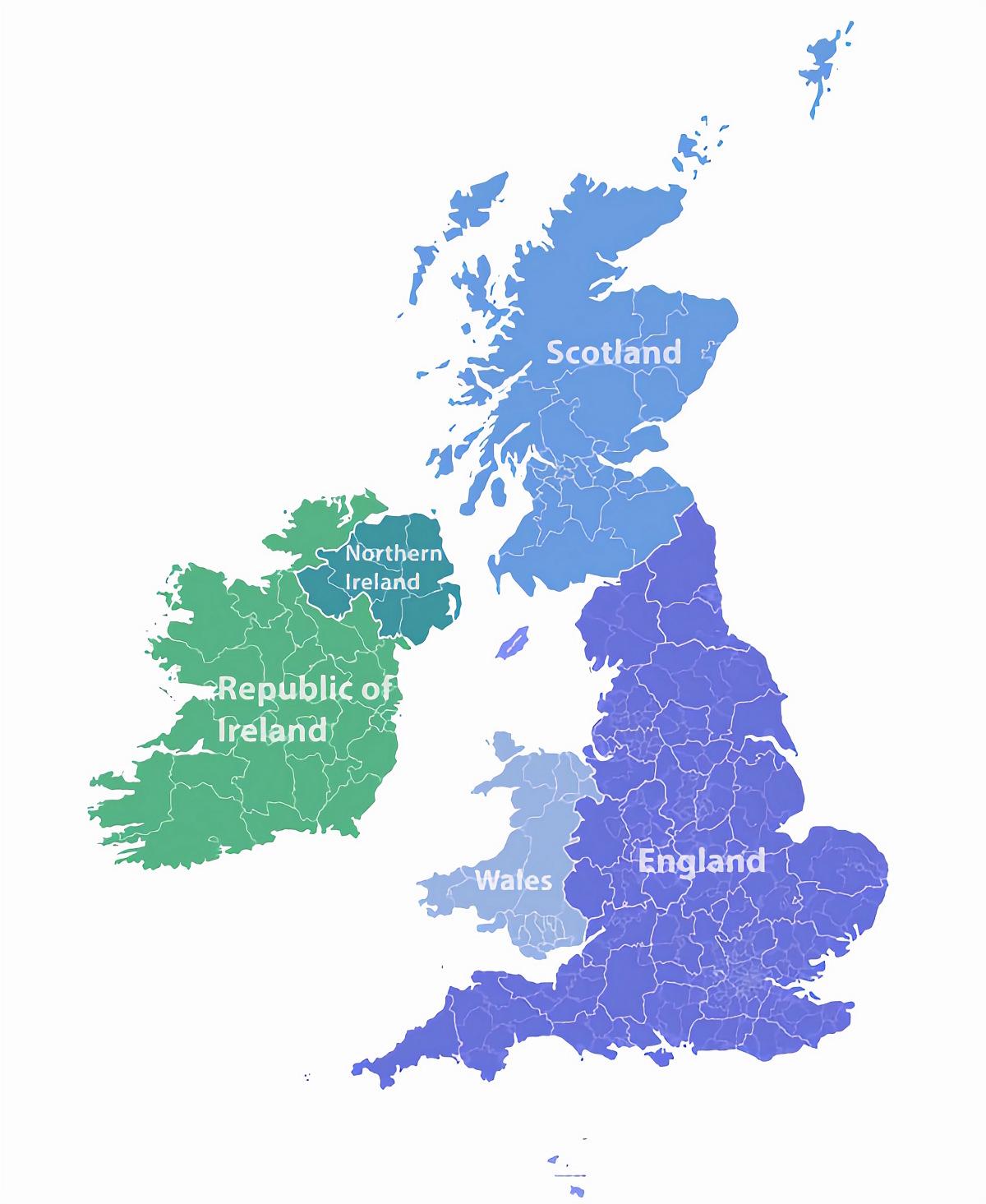

The United Kingdom’s national telecoms regulator has today announced the start of a major strategic review into the country’s digital communications market, which could have significant implications. It will look at everything from competition and investment, to future innovation and the availability of broadband, phone and mobile services.

Admittedly Ofcom are constantly conducting reviews of the UK’s various telecoms focused sectors, but this one will be more akin to their last major study that ran from December 2003 to September 2005.

The result of that review forced BT to, among other things, open up their national network to more competition through Local Look Unbundling (LLU) and also fostered the creation of BTOpenreach as a semi-separate network access operator (aka – “functional separation“).

Ofcoms 3 Key Points of Focus (Strategic Review)

1. Ensuring the right incentives for private-sector investment, which can help to deliver availability and quality of service;

2. Maintaining strong competition and tackling obstacles or bottlenecks that might be holding the sector back; and

3. Identifying whether there is scope for deregulation in some areas.

The 2005 Undertakings had a huge impact on the national telecoms market, which now benefits from a more diverse range of broadband ISPs with greater control over their systems, prices and services.

But many feel that this is still not enough, particularly the main beneficiaries of the last review (e.g. TalkTalk and Sky Broadband), with common examples consisting of Openreach’s control over who can conduct engineering work on its network, the calls for broadband to be added into the Universal Service Obligation (USO) and a perceived lack of flexibility in third-party ISP control of FTTC “fibre broadband” products and prices.

As a result some now demand the total separation of Openreach from BT, while others would simply be happy with greater control over the existing products that can be sold and even more access to the operators cable ducts etc. On top of that we wouldn’t be surprised if the issue of wavelength unbundled for pure fibre optic (FTTP/H) lines was also revisited, although that market remains small and thus is not likely to see strict regulation anytime soon.

It’s likely that Ofcom may even touch on BT’s desire to merge their Wholesale division into Openreach, which could create a number of competition concerns (here). All of these issues and more will likely be investigated by the regulators review.

Dido Harding, TalkTalk’s CEO, said:

“We are delighted that Ofcom is undertaking a proper strategic review of the market. Britain can have a fantastic digital future with better infrastructure and higher take up of broadband driving stronger economic growth, but the current industry structure is not going to deliver that.

A decade ago, Ofcom failed to break up BT and instead created Openreach. Whilst the last ten years have seen a lowering of prices and increased take-up, it is increasingly clear that the current market structure is not fit for purpose. BT’s proposed merger with EE threatens to make a bad situation worse. It will further starve Openreach of the focus and capital it needs and will extend BT’s dominance of the market. The larger group will have nearly 40% of the entire consumer telecoms market and nearly 70% of the wholesale market.

It is crucial that we now seize this opportunity to structurally separate Openreach. A fully independent Openreach focused exclusively on infrastructure would be incentivised to maximise coverage and improve quality of service for customers. It would end BT’s ability to erode competition, stimulating innovation, consumer choice and lower prices. Separation would accelerate investment in Britain’s digital infrastructure as other providers will have the level playing field they need to build the competing modern infrastructure that our economy desperately needs.”

Naturally BT, which has invested considerable money into its national infrastructure, will be resistant to any such ideas. In particular we wouldn’t be surprised if BT were to warn that any future plans to deploy faster connectivity, such as the 2016/17 and onwards roll-out of 500Mbps capable G.fast broadband to “most homes” (here), might be put at risk if Ofcom were to impose any major new regulation. But for now they’re being subtle.

A BT Spokesperson told ISPreview.co.uk:

“We welcome confirmation of this review, which was signalled by Ofcom last year. Ofcom has helped to create the world’s most competitive telecommunications market – one where prices are among the lowest while the speed and availability of superfast services leads Europe’s largest economies.

Its rules do now need to be simplified and modified given the market has changed out of all recognition. The UK needs an updated regime which will promote yet further investment whilst ensuring all companies can compete on an equal footing.

We look forward to engaging with Ofcom as it updates its rules to take into account the explosion in competition over the past decade.”

But the review isn’t just about BT and Ofcom will also look at the ever changing market for mobile communications (e.g. future 5G and current 4G) and the challenges faced by a struggling fixed line phone sector. On top of that it’s likely to examine KCOM (KC’s) continued hold over Hull (East Yorkshire) and whether Virgin Media’s move to expand their cable network to around 60% of the UK might expose them to new regulatory requirements (here), although anybody hoping for wholesale access to Virgin’s network might end up disappointed.

Ofcom has made clear that they intend to continue supporting the markets development by “providing a clear and strategic regulatory framework“, which they said would be designed to both promote competition and to support continued investment and innovation that can benefit consumers and businesses. So far the Government has not directed Ofcom to make any earth shattering changes, although if any review is going to produce one of those then it would surely be this.

Steve Unger, Ofcom’s Acting CEO, said:

“We have seen huge changes in the phone and broadband markets since our last major review a decade ago. Only five years ago, hardly any of us had used a tablet computer, high-definition streaming or 4G mobile broadband.

The boundaries between landline, mobile and broadband services continue to blur, and people are enjoying faster services on a growing range of devices. Our new review will mean Ofcom’s rules continue to meet the needs of consumers and businesses by supporting competition and investment for years to come.”

All of this comes at a time when the Government are developing a new Digital Communications Infrastructure Strategy, which is looking some 10-15 years ahead to see what kind of services we might all require in the more distant future (here).

Ofcom’s review will clearly be used to inform the above debate, although equally it might be the Government’s strategy that informs the regulator since they’re shortly expected to publish their proposals. But as ever the fast approaching 2015 General Election means we can all expect to see some big promises, albeit usually without much detail or budget to support them.

The first phase of Ofcom’s strategic review will examine “current and future market factors that may affect digital communications services, and current regulatory approaches“, which will begin with evidence gathering and industry engagement. Apparently Phase One should be finished by Summer 2015, with Phase Two (developing initial conclusions and draft proposals) due to complete by the end of 2015.

Ofcoms Strategic Review of Digital Communications

http://stakeholders.ofcom.org.uk/telecoms/policy/digital-comms-review/

UPDATE 9:08am

Added a comment from BT above.

UPDATE 9:53am

A new analyst note from Macquarie, which is close to TalkTalk’s position, has set out which issues they think Ofcom’s review should focus on.

Macquarie’s Analyst Note

· BT’s network design is very suitable for VDSL (FTTc) technologies and the glide patch to g.fast. However with other European operators rolling out FTTh, is the current UK broadband lead sustainable?

· Is BT’s move to IP fast enough? BT recently announced a plan to move to an all-IP network in the UK by 2025; Swisscom has a target of 2017 and Deutsche Telekom in 2018.

· In the UK VDSL (BT Infinity) is a premium product (additional £10-20 pm). In France there is no premium.

· In certain markets there is no need to pay for a “line access” fee – this fee in the UK is around £16-70 pm depending on which operator.

· How does Virgin Media’s plan to roll-out FTTh to another 4m homes (+30%) impact the market dynamics?

· How does Ofcom ensure businesses such as CityFibre have the room to execute on their business models without being throttled by Openreach?

· Is there merit is separating Openreach from BT? BT Consumer has OCF margins of 20% compares with TalkTalk at 7.2%.

· How does Ofcom treat Openreach in geographies where it is the monopoly provider of infrastructure? Is there merit in regional regulation?

· BT UK (BT ex Global Services) has a proforma OCF margin with EE of 25%. This compares with DTE at 22%, ORA at 23%, KPN at 19% and Belgacom at 13%.

· In FY 04/05 BT UK’s OIBDA margin was 38%, OCF margin was 17% and absolute capex and OCF were £2.44bn and £2.28bn. In FY 14/15 we target BT’s OIBDA margin at 47%, OCF margin at 30% and absolute capex and OCF at £1.8bn and £3.3bn.

The mention of Virgin Media’s roll-out being “FTTh” appears to be slightly confusing as, while there might be a bit of FTTP, it’s mostly still based off their cable DOCSIS network.

Overall Macquarie expects TalkTalk and Vodafone to gain from any changes.

UPDATE 2:23pm

A few more industry comments have arrived.

Greg Mesch, CEO of CityFibre, said:

“CityFibre welcomes Ofcom’s announcement for a full strategic review of digital communications. The past decade has seen major improvements in service competition, but at the very high cost of underinvestment in digital infrastructure by BT. In infrastructure terms, the UK communications market is under performing, with one of the lowest shares of fibre-connected buildings in Europe. BT’s new focus on content and mobile will further exacerbate this problem.

CityFibre is one of the few companies that is truly investing and building next generation digital infrastructure – our rollout of UK Gigabit Cities is underway. To accelerate this programme and deliver meaningful infrastructure competition, this strategic review must consider the optimal structure for pro-competitive fibre investment. The creation of a true level playing field for infrastructure investment, whether that means structural separation of BT or not, is crucial if the UK is to get the digital infrastructure it deserves.

This is an opportunity through which we can engineer the right infrastructure environment to attract investment, catalyse innovation and improve services for business and consumers.”

Malcolm Corbett, CEO of INCA, said:

“In our view the Strategic Review needs to consider the option of a fully structurally separated infrastructure organisation. This can be achieved in a way that promotes investment in competitive infrastructure providers and creates beneficial outcomes for all industry players whether delivering comms infrastructure or offering services to businesses and consumers. Enabling our industry to operate more competitively – including re-use of publicly funded infrastructure – will itself encourage more investment and lead to better outcomes for our communities and the UK as a whole. The review should also consider mandating a copper switch-off date which would provide certainty to investors in new digital networks.

Any moves towards structurally separating OpenReach from the rest of BT will require involvement from the Competition and Markets Authority, therefore we urge Ofcom to engage in early discussions to ensure that this option can be properly developed.”

UPDATE 13th March 2015

A comment from Sky, which mirrors TalkTalk’s.

Jeremy Darroch, Sky’s CEO, said:

“Structural separation of Openreach is at the heart of creating a sustainable industry; one that provides the capacity and incentive to invest whilst also harnessing the power of multiple competing retailers to drive higher take up and lower prices for customers.

Ofcom must now take the opportunity to address Openreach’s conflict of interest as a subsidiary of BT or risk extending the problems that are affecting the industry and its customers today.”

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook and Linkedin.

« UK ISP Internet Piracy Website Blocks Expand to Proxy Server Link Sites

Latest UK ISP News

- FTTP (5530)

- BT (3518)

- Politics (2542)

- Openreach (2298)

- Business (2266)

- Building Digital UK (2247)

- FTTC (2045)

- Mobile Broadband (1977)

- Statistics (1790)

- 4G (1668)

- Virgin Media (1621)

- Ofcom Regulation (1465)

- Fibre Optic (1396)

- Wireless Internet (1391)

- FTTH (1382)

Comments are closed