Average UK Spend on Home Telecoms Services Falls as Data Use Rises

Ofcom has today published their 2019 Communications Market Report (CMR), which reveals the latest information about the take-up and impact of Fixed Line Broadband, Phone, Mobile, TV and Radio services across the United Kingdom (England, Scotland, Wales and N.Ireland).

Much of the data in the regulator’s new report tends to summarise information that has already been released, such as via their annual fixed broadband ISP speeds and connected nations (infrastructure) studies. On top of that Ofcom’s CMR is typically quite broad and due to that we’ll tighten our focus by summarising the key broadband, mobile (3G / 4G) and internet connectivity data points instead (i.e. those that we haven’t covered before).

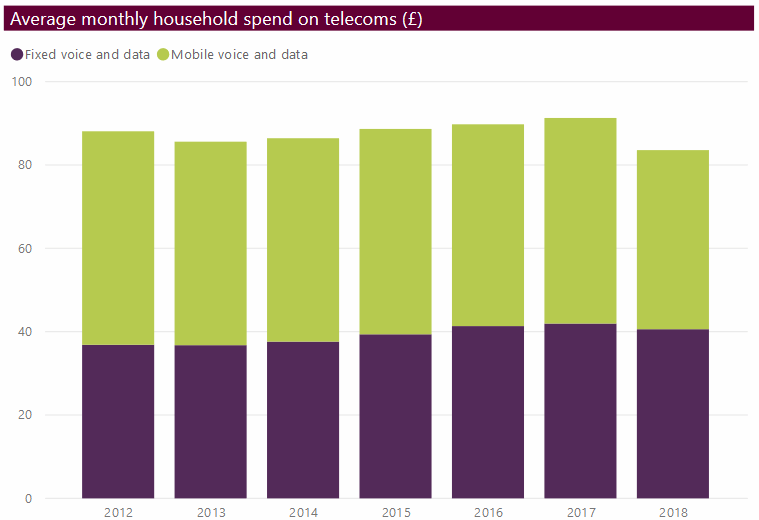

On that front one of the biggest changes this year has been the relatively sharp fall in average UK household spend on telecommunications services (i.e. broadband, phone and mobile). Overall households spent an average of £83.56 per month on these during 2018 (down from £91.27 in 2017) and this equates to about 3.3% of the total average monthly household spend (all services/products etc.).

Advertisement

In keeping with the above change it’s noted that the UK telecoms sector generated £33.84bn in revenue during 2018, which is also down from £36.90bn a year earlier. In both cases the main cause of this fall seems to stem from retail mobile services, although there were also smaller declines in revenue from retail fixed line and wholesale services.

The total volume of voice calls has also fallen, although people are using their mobiles more for calling and using their landlines less. The volume of minutes originating from fixed-line connections fell again in 2019 (by 17%), while the volume of minutes originating from mobiles went up by 5%. Losses in revenues from fixed voice services contributed to the 4% real-term decline in fixed telecoms revenues year-on-year.

Likewise it’s noted that more than 5 billion fewer traditional SMS (text) and MMS (picture) messages were sent in 2018 than 2017, which is largely because people are increasingly moving their chats to cheaper internet based Instant Messaging (IM) services like Facebook Messenger and WhatsApp. Elsewhere we also get a useful summary of telecoms take-up.

Advertisement

Household Take-up of Telecoms Communications Services

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

| Mobile telephony | 94% | 94% | 95% | 95% | 95% | 96% | 96% | 96% |

| Fixed telephony | 84% | 84% | 84% | 84% | 86% | 82% | 81% | 79% |

| Internet connection | 79% | 80% | 82% | 85% | 86% | 88% | 87% | 87% |

| Fixed broadband | 72% | 72% | 73% | 78% | 79% | 82% | 80% | 80% |

| Internet on mobile (personal) | 39% | 49% | 57% | 61% | 66% | 66% | 72% | 71% |

| Mobile broadband dongle or datacard | 13% | 5% | 8% | 6% | 4% | 2% | 2% | 5% |

Fixed broadband connections by technology (millions)

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

| ADSL | 15.98982 | 15.39154 | 14.39274 | 13.24891 | 11.49298 | 9.550457 |

| Cable | 4.394293 | 4.541444 | 4.700524 | 4.923828 | 5.109959 | 5.225155 |

| FTTC | 2.315572 | 3.709993 | 5.441818 | 7.090019 | 9.09648 | 11.26917 |

| FTTP | 0.03888 | 0.049306 | 0.110029 | 0.191961 | 0.316093 | 0.510807 |

| Others | 0.018 | 0.018 | 0.018 | 0.018906 | 0.027919 | 0.030525 |

| Total | 22.75656 | 23.71028 | 24.66311 | 25.47362 | 26.04343 | 26.58611 |

One other piece of information that wasn’t in Ofcom’s other reports (it should have been in their Connected Nations study but wasn’t) concerns monthly mobile broadband usage. Overall the average volume of data consumed per 3G / 4G mobile user is 2.9GB (GigaBytes), which is up from 1.9GB in 2017, 1.3GB in 2016 and just 0.9GB in 2015. Data use seems to be increasing ever more rapidly as mobile connections get faster.

By comparison fixed line broadband users consumed an average of 240GB per month last year, which is up from 190GB the year before (this has already been reported but it’s useful for a comparison). As usual much of the growth in mobile and fixed line data use is still being driven by online video content.

Advertisement

Overall 58% of people watched on-demand video services, up from 53%. This is driven by increased use of subscription video-on-demand services such as Netflix and Amazon Prime Video. There was no change in the proportion of people watching the PSB broadcasters’ free catch-up services (BBC iPlayer, ITV Hub, All4 and My5), and for some age groups, this even declined.

A summary of other findings from the CMR’s telecoms section can be found below.

Key Telecoms Findings (CMR 2019)

* There were 26.6 million UK fixed broadband connections at the end of 2018, an increase of 0.5 million (2%) compared to the previous year.

* By the end of 2018, there were 15.6 million superfast broadband connections (i.e. lines providing actual speeds of 30Mbit/s or higher), an increase of 2.2 million year on year. The average residential download speed increased by 18% to 54.2Mbit/s in the year to November 2018.

* The number of superfast fibre-to-the-cabinet (FTTC) connections overtook the number of ADSL standard broadband connections for the first time during 2018, and superfast connections accounted for 59% of all fixed broadband lines at the end of 2018.

* There were 0.5 million full-fibre connections at the end of the year, an increase of 0.2 million compared to 2017. This reflects growing availability of full-fibre services: our Connected Nations Spring 2019 update shows that 7% of UK premises could access full fibre broadband services by January 2019, up from 3% a year previously.

* Nearly three-quarters (72%) of mobile connections were 4G at the end of 2018, up from 66% a year previously. EE and Vodafone have already launched commercial UK 5G services, with Three’s 5G network due to go live in August 2019 and O2’s later in the year.

* Average fixed and mobile data consumption increased rapidly in 2018, with average data use per fixed broadband line increasing by 26% to 240GB per month, and average monthly use per mobile data connection increasing by 25% to 2.9GB.

* Widespread smartphone take-up means that consumers have access to other forms of communication such as email, web-based messaging services (e.g. WhatsApp and Facebook Messenger) and social networking sites. This contributed to a further decline in the use of SMS and MMS messages in 2018, down by 5 billion messages (6%) to 74 billion in 2018.

* Pay-monthly continued to be the most common type of mobile subscription in 2018; the proportion of subscriptions that were pay-monthly increased by 2pp to 72%.The total number of landlines fell by 0.2 million (1%) to 32 million in 2018, as a fall in the number of business lines was partially offset by an increase in residential lines.

Ofcom 2019 CMR

https://www.ofcom.org.uk/../cmr-2019

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Three UK Offer Unlimited 4G Data and Alexa AI Router for £13 Monthly

Openreach Encourages UK ISPs to Cancel Late Ethernet Orders »

Comments are closed