Devon and Somerset UK Consult on Superfast Broadband Plan

The troubled Connecting Devon and Somerset project has opened a public consultation on their recent Open Market Review (OMR), which examined the current and future level of “superfast broadband” (30Mbps+) coverage in the two counties and set out a proposed intervention area, ahead of seeking suppliers for a new contract.

The CDS scheme has had more than a few big stumbles over the years. The problems began in 2015 after a possible Phase 2 deployment contract with Openreach (BT) – mostly using FTTC technology – was abandoned due to disagreement on the targets and funding (arguably CDS wanted more than BT seemed able to deliver within the tight timescale).

The fallout from 2015 caused a long delay, although Gigaclear and Airband eventually scooped up a number of new Phase 2 contracts between 2016 and 2017. Sadly it became clear in October 2018 that Gigaclear’s rollout – mostly using “full fibre” FTTP technology – had fallen significantly behind schedule (in some areas by 2 years) and CDS ended the contract in September 2019 due to being unable to agree a “credible” recovery plan (here).

Advertisement

The move to end Gigaclear’s deal has also left a number of areas across the two counties with unfinished builds and exposed fibre cabling, such as in Uplyme, where the locals have complained about it being an “eyesore“. In those areas CDS has asked Gigaclear to “remove their equipment if they don’t need it for their commercial roll-out” (ideally it would be better to find a way of finishing part-built areas, so the work isn’t wasted).

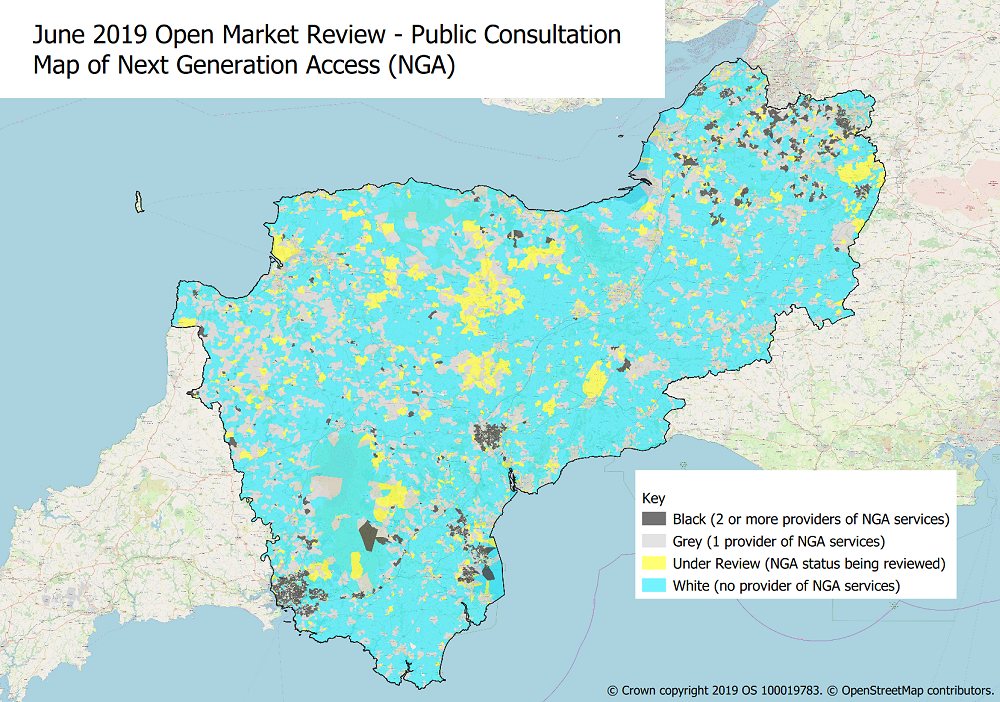

As things stand CDS is now working toward constructing yet another procurement process to contract a supplier who can complete and hopefully go beyond the work that Gigaclear still had left to do under Phase 2. As part of that effort the team have already conducted an OMR (i.e. used to identify which areas will need help) and are now consulting upon their proposed intervention area for the future contract (here).

The New Consultation

The CDS consultation notes how their OMR helped to identify around 115,000 premises that cannot currently access superfast or close to superfast speeds, which they say are “at risk of not being served” by any commercial operators – at least within the next 3 years – unless action is taken.

The future procurement for a new supplier is said to be supported by a pot of public funding worth of up to £56m and, given the UK government’s current focus, is likely to demand more Fibre-to-the-Premises (FTTP) technology or other “gigabit-capable” technologies. Public funding sources include BDUK, Local Authorities, LEP and the CDS proportion of clawback (gainshare) sums from the Phase 1 contract with BT.

Advertisement

CDS currently aims to launch a procurement in December 2019 via Devon County Council’s Pro-Contract Procurement Portal and if all goes well (i.e. take with a pinch of salt given the history of CDS) then the intention is award contracts by the end of 2020 (November has been mentioned before), which means that the rollout itself may not begin until sometime in 2021.

The project team may also choose to run more than one procurement to facilitate the introduction of some of the identified public funding including clawback sums from BT. Hopefully CDS will be more cautious this time and ensure that the operators they select are able to scale to their requirements. Alternatively they might offer more LOTS and choose a wider selection of providers than before in order to spread the risk.

Previously it’s been suggested that around 16 suppliers may have expressed a tentative interest in the future procurement process and we imagine that includes the likes of Airband, BT, Jurassic Fibre, Truespeed and a few smaller players. Meanwhile the wait goes on for those who originally expected to be covered by Gigaclear’s Phase 2 contract.

Advertisement

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« JT Win World Communication Award for FTTH Rollout on Jersey

Comments are closed