BDUK Analysis Shows Benefits of UK Phase 3 Superfast Broadband Project

The Government has posted an updated State Aid evaluation of the previous ‘Superfast Broadband Programme’ (UK National Broadband Scheme), which specifically examines the final Phase 3 of the project to extend “superfast” (30Mbps+) coverage – run between 2016 and 2022. Suffice to say, it finds various economic and coverage benefits.

The SFBB programme – managed by the Building Digital UK agency – was first setup back in 2010 to help extend high-speed broadband connectivity to areas that were not expected to benefit from commercial rollouts (note: commercial coverage of “superfast” lines reached c.76% and SFBB helped to go beyond that toward 98% today).

The programme was split into three phases (see below) and has since been superseded by the government’s new £5bn rural-focused Project Gigabit scheme, which lifts the performance target to 1000Mbps (200Mbps on uploads). The final phase (3) of the SFBB programme also involved a lot more Fibre-to-the-Premises (FTTP) lines, while most of Phase 1 and 2 were dominated by slower Fibre-to-the-Cabinet (FTTC / VDSL2) tech.

Advertisement

BDUK Phases One (Finished Spring 2016)

Supported by £530m of public money via the Government (mostly extracted from a small slice of the BBC TV Licence fee), as well as significant match funding from local authorities and the EU. The public funding is then roughly matched by BT’s private investment. Overall it helped to extend “superfast broadband” (24Mbps+) services to cover 90% of premises in the United Kingdom.

BDUK Phase Two

Supported by £250m of public money via the Government, as well as match funding from local authorities, Local Growth Deals and private investment from suppliers (e.g. BT, Gigaclear, Airband, Call Flow etc.). This phase extended superfast broadband services to 95% of premises in time for the end of 2017, but some newer contracts are on-going (e.g. the Welsh Government’s new programme).

BDUK Phase Three

Similar to Phase Two, albeit without a solid coverage target, and funded under a new state aid judgement covering contracts awarded after 2016 (State aid SA. 40720 (2016/N)). So far, contracts awarded under Phase 3 by early-2022 have involved over £1bn in public funding (various sources) and mostly focused on extending FTTP coverage. These went to various operators including Openreach, Gigaclear, Airband, Quickline, Truespeed, Wessex Internet and Fibrus.

Just to be clear about something. BDUK published the first version of this evaluation report back in 2021 (here), but at the time Phase 3 was still ongoing and thus the data they had was incomplete – only extending up to 2018. The latest report uses data up to 2021, which is thus much more reflective of the impacts it has had (most of the contracts were at completion in 2021). The report itself was pieced together by analysis from Ipsos UK.

Key Impacts Summary – BDUK Phase 3

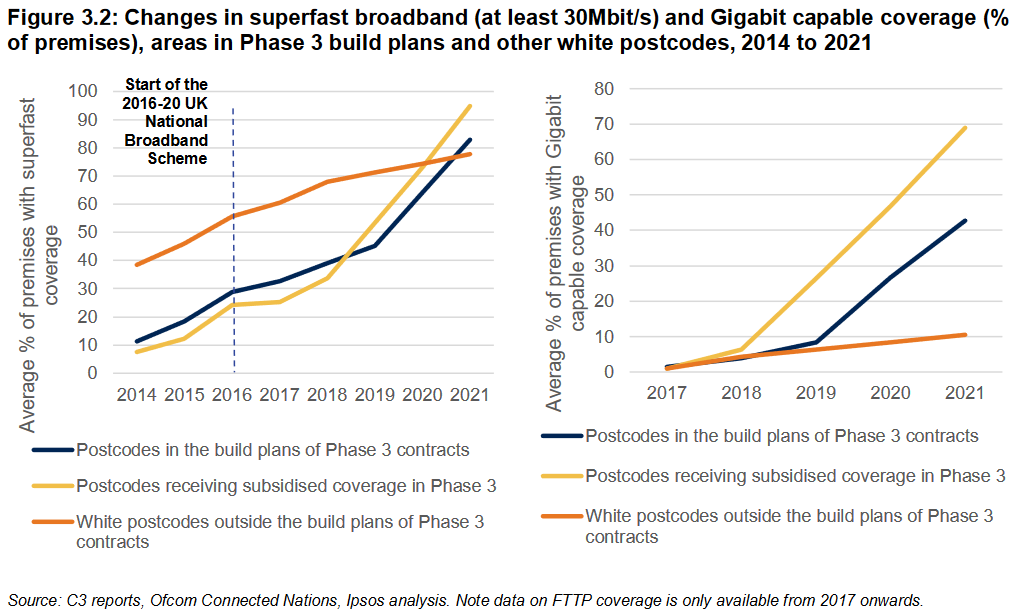

➤ Subsidised coverage increased the share of premises in the programme area able to access superfast speeds by 44 to 48 percentage points, and the share of premises with gigabit capable coverage by 43 to 59 percentage points.

➤ The Programme is estimated to have increased the number of premises that can access superfast broadband services (30Mbit/s or above) by 202,000 to 247,000 by the end of September 2021. The associated rate of additionality ranges from 69 percent to 85 percent.

NOTE: Additionality reflects the share of premises benefitting from coverage that would not have in the absence of the BDUK programme (i.e. some commercial builds also expanded their coverage after the BDUK state aid builds, which otherwise might not have occurred).

➤ Subsidised coverage is estimated to have led to 193,000 to 298,000 additional premises with FTTP/Gigabit capable coverage. The rate of additionality ranges from 66 percent to 102 percent (with most estimates in the region of 90 percent).

➤ Phase 3 contracts led to a significant increase in the maximum download speeds of connections taken by households and/or businesses by September 2021 (34 to 60 Mbit/s).

➤ As with the national pattern, FTTC is the dominant technology for NGA connections, representing most of the connections in Phase 3 areas – however, this percentage is lower than the national average (around 40 percent in 2022 in Phase 3 areas compared to 50 percent nationally). FTTP connections represent a higher proportion of the market in Phase 3 areas than nationally in 2022 (24 percent in 2022 compared to 10 percent nationally). This suggests that the take-up of FTTP connections nationally is lower than take-up in Phase 3 areas – which would be expected given that the Phase 3 Superfast Broadband contracts are required to provide gigabit capable networks, and the majority of contracts are doing this through FTTP technologies.

➤ The gross public sector cost per additional covered premises over three years was £1,418 for Phase 3 contracts. After allowing for clawback (i.e. public investment returned by operators as take-up by customers increases), this will fall to £1,225 to £1,276 per premises passed (depending on whether take-up stabilises at 60 or 85 percent in the long-term).

➤ The present value of net public spending required to deliver the Superfast Broadband Programme over the lifetime of Phase 3 contracts was estimated to be £273m in nominal terms. But it is said to have resulted in some key economic benefits (remember – the economic impact of faster broadband is a hard thing to guage with any accuracy, so take with a pinch of salt):

▪ Local employment impacts: Subsidised coverage from Phase 3 was estimated to have increased employment in the areas benefitting from the programme by 0.88 percent, leading to the creation of 6,261 local jobs by March 2021. The programme as a whole was estimated to have led to 23,700 more local jobs up to March 2021.

▪ Turnover: Subsidised coverage also increased the turnover of firms located in the areas benefitting from Phase 3 of the programme by 1.6 percent by 2021, increasing the annual turnover of local businesses by £827m per annum. Estimates for the whole programme suggested that turnover of firms in areas benefiting from coverage increased by 1.4 percent (equating to around £2.6bn).

▪ House prices: The programme led to an increase in house prices (of between £1,900 and £4,900) suggesting that buyers valued the technology.

At the national level, the programme is estimated to have resulted in:

▪ Economic benefits: Phase 3 is estimated to have led to a cumulative total of £7.2m in productivity gains between 2016/17 and 2021/22. This rises to between £20.8m and £23.1m over the 2016/17 to 2030 period. Additional economic benefits from the reduction in long-term unemployment is estimated to be £5.5m between 2016/17 and 2021/22, rising to between £15.7m and £17.4m over the 2016/17 to 2030 period.

▪ Social benefits: Based on its impacts on house prices between 2016/17 and 2021/22, the programme is estimated to have led to social benefits valued at between £370.3m and £946.9m.

➤ The estimated Benefit to Cost Ratio (BCR) was between £1.76 and £4.57 per £1 of net lifetime public sector costs based on its impacts between 2016/17 and 2021/22. BUT this assumes that the house price premium is a reasonable approximation of the average welfare gain associated with the programme, and that the house price premium can be applied to all premises in the upgraded areas. The width of the range is driven largely by modelling uncertainty regarding the size of the house price premium associated with subsidised coverage. Allowing for future economic benefits to 2030, the BCR is estimated to rise to between £1.87 and £4.70 per £1 of net public sector spending.

The full report can be read here, including lots of additional data. But we did find that a fair bit of potentially useful information had been redacted, probably due to issues of commercial sensitivity with some of the contracted operators. One area where this happens quite a bit concerns contract clawback, although there is still some useful information.

For example, the value of actual public spending associated with Phase 3 contracts by the end of March 2022 was, as above, estimated at £273.3m (with a present value of £239.2m in 2016/17). But these contracts were also expected to return £27.5m to £7.8m to the public sector via clawback (with a present value of £21.6m to £28.9m). This gives an estimated net cost to the public sector of £236.0m to £245.8m (with a present value of £210.2m to £217.5m). However, it should be noted that these estimates do not include administrative costs to BDUK, Local Bodies, or network providers.

Advertisement

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« County Broadband Donate £10k Worth of Computers to Digital Essex

The government of last 10+ years certainly nailed investment into FTTP. It’s been a huge success that the government seems to get little credit for.

That’s true if your metric is “money thrown at FTTP”.

If your metric was “efficient upgrade of infrastructure to offer universal FTTP” then it’s been a catastrophic failure, with expensive and unneeded duplication of physical networks, and a long wait before higher cost properties ever see FTTP.

Up on the Isle of Skye many communities have missed out.

Struan is still an ADSL 2+ exchange and 4g is no better.

That particular exchange serves 140 residential and 10 business.

Unfortunately with numbers that small ill guess your going ADSL to FTTP

Much of rural Devon and Somerset is still waiting for Phase 2..

Phase 2 has been a success in the most rural or rural parts of NI.

Project Stratum deserves praise.

It’s not universal, I got lucky, but when you do, the speeds are unbelievable (500mbps) in the complete sticks.