BT Group Grows FTTP to 13.81m UK Premises as Openreach Picked for Project Gigabit

The latest BT Group H2 FY24 results to March 2024 reveal that Openreach’s UK full fibre (FTTP) broadband ISP network added 1 million premises to their coverage in the quarter to cover 13.812m, while EE’s 5G mobile covers 75% of the population (up from 72% in H1), the PSTN (analogue phone) migration won’t complete until Jan 2027 and Openreach is named “preferred bidder” for Type C Project Gigabit contracts.

The group’s retail divisions – including BT, EE and Plusnet – don’t publish full customer figures for their own ISP, but they do report data for their latest technologies. The ISP stated that they had 2.428 million FTTP customers (up from 2.08m in H1) – plus 200k business customers – and EE’s 5G connections now stand at 9.495 million (up from 8.953m). On top of that, the operator reports that broadband consumers gobbled an average of 429.5GB of data per month in H2 (up from 389GB), which falls to 16.2GB for post-paid mobile users (down from 16.8GB)

Overall, some 69.8% of BT’s fixed consumer base take a “superfast broadband” product (down from 72.5% in H1) and 24.4% (up from 20.8%) have adopted one of their “ultrafast” products – the latter includes both G.fast and FTTP, which largely reflects FTTP cannibalising customers from slower (FTTC and ADSL) packages. We also noted that 22.9% of BT’s customers are now taking both mobile and broadband (converged), which is down from 23%.

Advertisement

Financial Highlights – BT’s Half-Yearly Change

* BT Group revenue = £10,421m (up from £10,414m in H1 FY24)

* BT Group total reported net debt = £(19,479)m (decreased from £(19,689)m)

* BT Group profit after tax = £11m (down from £844m)

Openreach’s Network

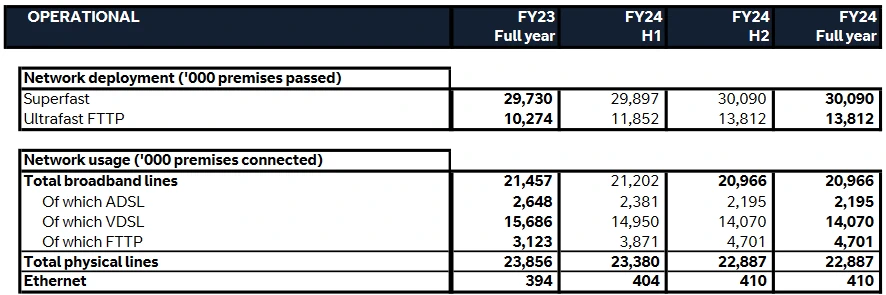

The table below offers a breakdown of fixed line network coverage and take-up by technology on Openreach’s UK network, which covers the totals for all ISPs that take their products combined (e.g. BT, Sky Broadband, TalkTalk, Zen Internet, Vodafone etc.).

As usual, the rollout of their Fibre-to-the-Premises (FTTP) lines continues to grow, with 1 million premises being added in the quarter and that’s up from 950,000 last quarter. As for take-up, some 4.7 million FTTP broadband connections have been made on Openreach’s network (up from 3.87m in H1), which equates to a take-up of 34% (up from 33% in H1).

The rapid rollout of a new network almost always tends to suppress the take-up figure, thus Openreach continues to do extremely well to buck that trend – all despite an increasingly significant amount of competition from rival networks. This also goes to highlight the challenge AltNets are facing in peeling consumers away from the resident industry giant’s own full fibre network.

Advertisement

Allison Kirkby, CEO of BT Group, said:

“BT Group built and connected customers to our next generation networks at record speed and efficiency over the past year, while continuing to grow revenue and EBITDA. Having passed peak capex on our full fibre broadband rollout and achieved our £3 billion cost and service transformation programme a year ahead of schedule, we’ve now reached the inflection point on our long-term strategy.

This delivery and greater capex efficiency gives us the confidence to provide new guidance for significantly increased short term cash flow and sets out a path to more than double our normalised free cash flow over the next five years. This enhanced cash flow allows us to increase our dividend for FY24 by 3.9% to 8.0 pence per share. We’re also setting a further £3bn of gross annualised cost savings to be reached by the end of FY29.

As we move into the next phase of BT Group’s transformation, we are sharpening our focus to be better for our customers and the country, by accelerating the modernisation of our operations, and by exploring options to optimise our global business. This will create a simpler BT Group, fully focused on connecting the UK, and well positioned to generate significant growth for all our stakeholders.”

The latest report also includes an interesting reference to the Government’s £5bn Project Gigabit broadband roll-out programme, which buried in the text states that the “Department for Science, Innovation and Technology has notified Openreach of its preferred bidder status for Project Gigabit cross-regional supplier contract (Type C).” This development isn’t a surprising one, but it’s the first time we’ve seen it confirmed.

Just to recap. The newer Cross-Regional (Type C) contracts are a bit of a different animal from prior (local and regional) ones under the project. The idea of this is to appoint a single supplier to target premises (i.e. subsidise the design, build and operation of a new gigabit network) in areas where no or no appropriate market interest has been expressed before to the Building Digital UK (BDUK) agency, or areas that have been de-scoped or terminated from a prior plan.

Such areas are often skipped due to being too expensive (difficult) for other, often smaller, suppliers to tackle. The good news is that BDUK formally launched the first procurements for Type C contracts on 27th July 2023 and more are planned to follow. The expectation has always been that these would go to one of the biggest network operators and today’s news largely confirms that.

Take note that BT now only publishes detailed results biannually for H1 and H2 (financial quarters), thus they release very little data for the other two quarters and that similarly means we will only be able to do two detailed reports every year instead of four.

Advertisement

Just a quick reminder. BT introduced a new metric in 2023, which predicted that their total labour force would shrink from 130,000 to between 75,000 and 90,000 by 2030. The operator also predicted that Openreach’s FTTP coverage would grow to between 25-30 million premises and deliver take-up of between 40-55% by this same date. The latest report includes a quick progress update on this.

BT Group’s Progress Against Strategic Metrics:

• Total labour resource decreased by 10k to 120k; target of 75-90k

• FTTP premises passed increased by 3.5m to 13.8m; target of 25-30m

• Openreach take-up increased to 34% and retail take-up increased by 0.8m to 2.6m; targets of 40-55% and 6.5-8.5m respectively

• 5G UK population coverage increased to 75% and 5G retail connections increased by 2.4m to 11.1m; targets of >98% and 13.0m-14.5m respectively

We have successfully delivered our £3bn gross annualised cost savings, announced in May 2020, 12 months early and at a cost of £1.5bn, £0.1bn lower than forecast. We plan to further transform our cost base and improve our productivity by delivering a further £3bn gross annualised cost savings by the end of FY29, including a further £0.6bn of savings from the current transformation programme as it concludes in FY25, at an overall cost to achieve of £1bn. We expect c.40% of the £1bn cost to achieve in FY25, the remainder is spread across the years.

One other interesting titbit that we pulled out of the new report is where BT confirms that they “now expect to have migrated all customers off the PSTN by the end of January 2027“, which reflects their revised target for shifting customers off the old analogue phone network and on to new digital phone services. The previous goal was to complete this by the end of 2025, but it’s been clear for a while now that the process would take longer.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« BT to Close Enniskillen Contact Centre with Loss of 300 Jobs

Preferred bidder for Type C Project Gigabit contracts, yeah, that sounds about right. i wonder how many people involved in Project Gigabit have shares or are involved in in Openreach.

It’ll be more about the fact that BDUK need to find a solution, one that can work quickly and at scale to help meet the coverage targets, for the premises that nobody else seems to want to tackle. The structure and scale of Type C only really makes it viable for the biggest players like OR, VMO2/nexfibre and CityFibre. The latter may find such areas too risky, while VMO2 rarely ever involve themselves in big state aid builds and so that leaves Openreach.

Where I am no one other then openreach is going to provide fibre.

I just wish this whole process would be speeded up.

23% down to 22.9% is hardly significant.

Surely the major reason behind OR’s better-than-average take up figures for FTTP is that customers can change technology without changing supplier? It certainly shouldn’t need that detailed (and presumably expensive) report produced earlier this week.

A million new properties have FTTP available to order in a quarter – 65 working days. And they also activate over 400,000 customer FTTP connections in the same time.

That build rate is astonishing.

A bigger civil engineer project than HS2 or CrossRail.

Impressive from BT and Openreach . Keep this momentum up and its a very bright future for them

I would rather Openreach be the installer, as if something goes wrong (eg. storm damage) they are quicker to fix the issue given their size. Months ago there was storm damage in N.Ireland and it took Fibrus quite a while to fix it due to their limits on what they could do. Personally i have no issues with Openreach and BT despite their slower upload speeds.

Impressive to be named preferred bidder without being listed as an approved supplier in Project Gigabit?

https://www.gov.uk/government/publications/bduks-dynamic-purchasing-system-dps-appointed-suppliers-list/bduks-dynamic-purchasing-system-dps-appointed-suppliers-list

Impressive to link to the supplier list for a different procurement

If they’re building at that rate hopefully our roads estimate of June for order is correct.

They haven’t started any work yet though. They also said it would be live last April too so I’m not holding my breath.

Shares currently up 16% so finally some cheer for the long suffering shareholders.