Netomnia Adds Two Kent Towns to 2023 UK Full Fibre Rollout

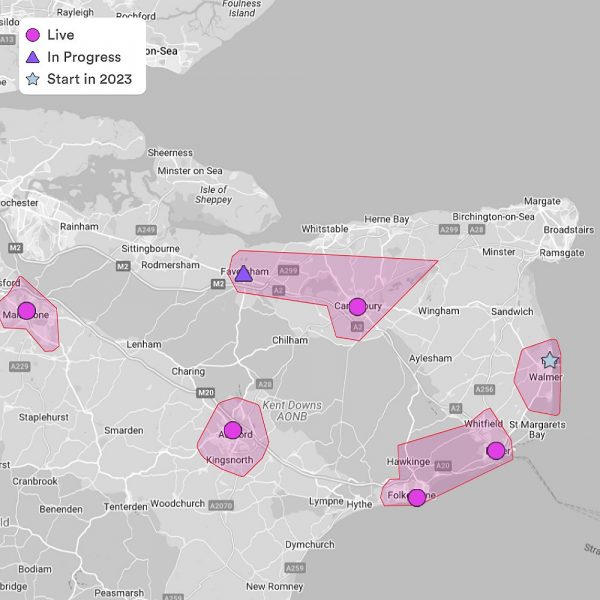

Network operator Netomnia – supported by UK ISP YouFibre – has just quietly added two new towns in Kent (England) to the 2023 rollout plan for their 10Gbps capable Fibre-to-the-Premises (FTTP) broadband network, which has already been extended to cover 410,000 UK premises (up from 300k in November 2022).

The operator, which is currently present in parts of 35 towns and cities (with many more in-planning), ultimately aims to reach 1 million premises across England, Wales, Scotland and Northern Ireland by the end of 2023. Indeed, they already revealed their full coverage plan for this year, but the good news is that they’ve just added two new towns to the list.

The two new neighbouring towns are Deal (population of around 31,000) and Walmer (population of around 7,000), which are both just up the road from their existing deployment in Dover (homes are already live there). We should point out that Openreach has already delivered extensive FTTP coverage across both locations, although they appear to be the only gigabit-capable competition for Netomnia.

Advertisement

The service, once live, is typically supplied to consumers via YouFibre, which offers unlimited usage, symmetrical speeds, a Wi-Fi router, free installation and 24/7 UK based support. Customers pay from just £21 per month on a 24-month term for their unlimited 150Mbps package (£25 thereafter), which rises to just £29.99 if you want their top 920Mbps plan (£40 thereafter). The latter is also on an offer of £1 a month for the first 3 months.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Virgin Media UK IP Phone Customers Still Facing Ghost Calls Bug

Plusnet Named Best UK ISP by 2023 Broadband Genie Awards »

Interesting that they don’t cover some other parts, From what I’ve seen (and my area specifically) the two main providers don’t seem to want to cover the area.

They won’t if it’s not easy/cheap.

That’s the thing, VM has so far done a few postcodes not that far away however seems to have skipped past this area when they could of supplied it. OR are awhile away from doing anything near this area with a previous postcode saying up to december 2026 on the checker.

Where did this come from? They don’t show on Netomnia’s list of areas in the South East: https://www.netomnia.com/areas/south-east . Interestingly I’ve seen them doing works in Tonbridge (not to be confused with the nearby Tunbridge Wells), however Tonbridge doesn’t appear on their list either.

A BT exchange nearby must be in their list then. The list just shows where their racks are located to serve customers. But they aren’t bound by BT exchange areas.

https://www.netomnia.com/rollout

Is it just me, or is building your altnet in a town that’s already served by OR FTTP and loads of ISPs an act of madness?

Netomnia prices are attractive but not world-shattering, and not massively better than best deals on OR especially when incentives are taken into account. I’ve nothing against Netomnia, but I really can’t say how the economics stack up by over-building OR FTTP. Maybe the whole business case is to build it and flog it to VM, who could add Netomnia’s XGS-PON assets to their Nexfibre business, although there’s still a huge question over cost per property and conversion rates when anybody who was desperate for high speeds has already got them.

Surely there’s plenty of towns still not on OR’s near term plans, nor VM or other altnet?

Netomnia does not need to get above 30% takeup to payback the cost of build unlike some alts, because their build is much more efficient

Having 2 competitors is healthy. In parts of London there’s OR, VM, HO and CF and while takeup isn’t the best, the business case still works because build costs are cheaper due to the density

There are not many empty towns left

Their actual build might be more efficient but they have costs that other Altnets don’t. For good reasons though.

You won’t see them plonking cabinets out in the road with one fibre back to an exchange. They do it properly and house their racks within BT exchanges, fully supported by the exchange’s engines and possibly with UPS support, though I’ve not checked that but.

Most Altnets don’t do this.

John: “Netomnia does not need to get above 30% takeup to payback the cost of build unlike some alts, because their build is much more efficient”

OK, and they’re a wholesaler so can sell via other ISPs, but there’s still the problem of how they’ll get a 30% takeup when the speed-enthusiasts already have a range of ISPs offering near enough the same high speeds over OR. People in Deal already have a choice of 900 Mbps from BT, Talktalk, Vodafone, Sky, Zen, Shell, all established brands with big marketing budgets – are they going to tell their existing customers that they need a new line installed, because the ISP wishes to save a few shekels swapping to a new network run by a company too new to even have published proper accounts, and likely haemorrhaging cash? Even if using PIA, can Netomnia undercut Openreach and make a return on capital? Netomnia’s XGS-PON may be technically superior to OR GPON, but that’s of little relevance to anyone other than techno-anoraks like us.

I’m all for the plucky upstart but I still can’t see this working out (overlooking that £418m investment doesn’t seem like plucky upstart territory).

You misread my comment, I said they do NOT need 30% takeup. In a typical OR area usually BT has maybe 20% and sky 20% and talktalk 20%. Netomnia just needs a small percentage to recoup the cost of build. Also Netomnia is able to run other ISPs, just hasn’t done so yet but the option exists so it can make a bigger profit outside depending on Youfibre sales

You overrate Zen and She’ll. Youfibre can easily reach their numbers at current pace

Well maybe, but building infrastructure even on a minimum cost basis is a cash hungry business, and the patience of private equity investors limited. With a good plan and long term payback, if you don’t have the cash you still go bust.

Take Netomnia and ask what is the business model? More specifically where’s their differentiated proposition in these two towns or other gigabit overbuild areas, of which there are many? They state they want to reach 1m premises (and they’re on course for that) they’ve got £418m of equity and £230m of debt, assume your 20% capture rate, and that means £3,250 capex per customer. That’s not economically sustainable in a market where other providers exist. You might counter that Netomnia investors are smart and rich, and wouldn’t put the fat end of half a billion quid into something that’s not viable. Unfortunately the overwhelming evidence of history is that every few years there’s a new mania to burn investors’ money.

@Andrew if your cost per customer is correct then that is a payback in a few years and plus you’re forgetting that an entire network is created in the process, which can be used by other entities and has an actual value

If there was no competition then we would still be in a monopoly which is what led to the UK only deploying fibre in past few years

Problem is Phillip, that it’s not as simple as the pure capital cost and a simple repayment time. There’s all the complexities of operating costs, non-operating costs, interest, depreciation, accrued losses – and if there’s anything left over you lose 20-25% corporation tax. I’ve worked many years in the world of regulated infrastructure, managed programmes of hundreds of millions of pounds, so I’m confident that I know the maths on this. As an alternatively to my practical experience, you could ask somebody who’s written a master’s dissertation on measuring financial performance. But that’ll be me too. My dissertation is gathering dust in the library of the University of Warwick if you wish to go and consult it.

The altnet market is a monstrous bubble. Most of the companies involved are making huge losses, they’re never going to make a return on the capital they employ, and the future is consolidation, huge write-downs, and (unless the clowns at Ofcom get their act together) unplanned insolvencies and customers losing service. Maybe Netomnia come out on top in the maelstrom, but if you can predict the winners in this turbid market, you should perhaps choose winning lottery numbers or put a big bet on the outsider in the 4:30 at Chepstow.

Ah you are *that* Andrew G!

Yeah, glad I have never disagreed with you on these matters. If I have apologies.

Worth noting that Netomnia aren’t bound by BT exchange areas, so though the exchanges mentioned are where their racks are located they can cover several exchange areas surrounding that exchange.

The postcode checker on their website should give you the most accurate answer.

I’d just like them to finish one town that’s already 9 months behind schedule before adding more that they inevitably cannot do in the timeframe they give themselves!

To win the customer number game, you do actually have to be able to sell customers something when they want to buy it.

Netomnia are here working but have a weird approach to a specific area with some streets planned, others sometimes around the corner not.

Hopefully it’s just how the planning is done and not the final outcome!

If the streets are more expensive to reach than the budget allows Netomnia won’t build them so perfectly possible that’s the outcome until Openreach repair existing infrastructure or build new.

Netomnia have no qualms at all about not building to all of a town or city. It’s part of the business model to keep costs down and why Netomnia are able to raise new funding while many others are contemplating running out of cash.

Probably a good plan to keep the expectations managed.

Having racks in BTOR Exchanges is an alternative to Street Cabinets or larger Fibre Exchanges, however with the exchange rationalisation programme what will the impact of that be to costs and customer service?

Zero. Netomnia put their kit in the headend exchanges Openreach will be rationalising to.

If it has Openreach OLTs in it it’s safe for the foreseeable.

If they stick to the same buildings as BT group they should be good for a couple of decades at least. The building closure programm won’t be getting up to pace in this decade at least.

You don’t need to visit too many to realise BT need to put some money back into the estate before they can hand them back