BT See Openreach UK Broadband Lines Fall by 242k as FTTP Covers 20.3M Premises

The BT Group has today published their H1 FY26 biannual results to Sept 2025, which reveals that Openreach’s full fibre (FTTP) network added 2.2 million premises to their UK coverage to total 20.3m (level with H2 FY25 growth); including 5.5m in rural areas. But broadband line losses to rivals jumped to 242k in the last quarter (up from 169k).

The group’s consumer divisions – including BT, EE and Plusnet – reported being home to a total of 8,210 million broadband connections (up slightly from 8.198m in H2 FY25), which included 3.677m FTTP customers (up from 3.202m). BT’s business division similarly had a total of 576k retail broadband lines (down from 595k) and 144k of those were FTTP lines. BT Wholesale also supplied a total of 688k broadband lines to other ISPs (down from 697k) and 131k of those were FTTP (up from 93k).

In terms of consumer mobile connections, EE reported total mobile customers of 13.924m (up from 13.863m), including 11.199m using 5G (up from 10.806m). BT also reported that their fixed broadband consumers gobbled an average of 444GB (GigaBytes) of data per month (down from 446.1GB), which falls to 18.2GB for EE’s post-paid mobile users (up from 17GB).

Advertisement

Elsewhere, some 59.1% of BT’s fixed consumer base take a “superfast broadband” product (down from 62.9% in H1) and 37.1% have adopted one of their “ultrafast” products (up from 32.6%), which these days largely reflects FTTP cannibalising customers from slower FTTC and ADSL lines. ISPreview also noted that 25.9% of BT’s customers are now taking both mobile and broadband (converged), which is up from 24.6%.

Finally, BT confirmed that EE’s 5G Standalone (mobile broadband) network had so far been rolled out to cover over 66% of the population (up from 40%). The provider aims to reach 99% by the end of 2030.

Financial Highlights – BT’s Half-Yearly Change

* BT Group revenue = £9,806m (down from £10,232m in H2 FY25)

* BT Group total reported net debt = £20,853 (increased from £19,816m)

* BT Group profit after tax = £651m (up from £299m)

Openreach’s Network

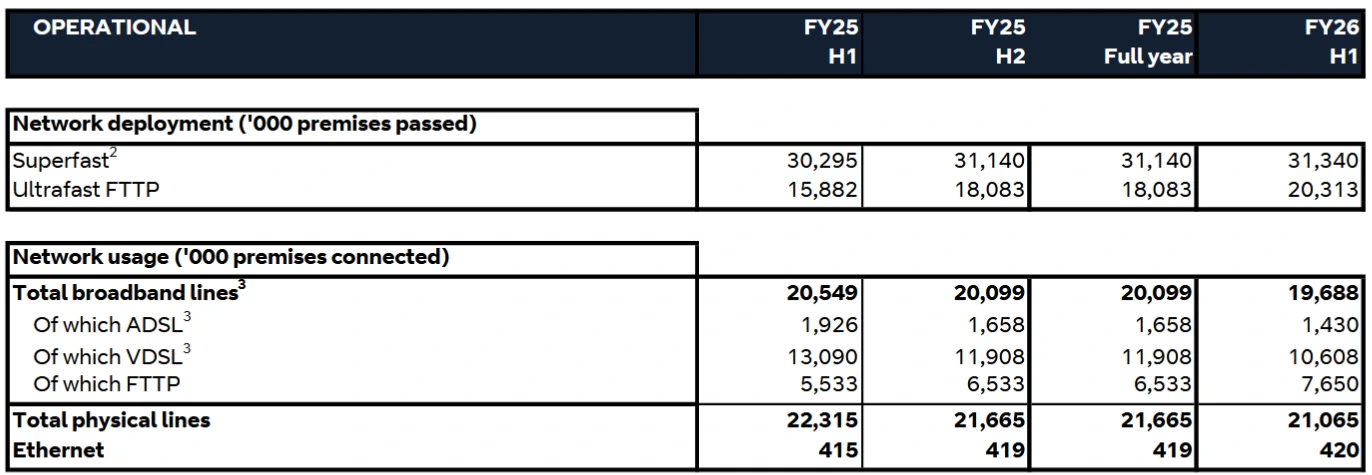

The table below offers a breakdown of fixed line network coverage and take-up by technology on Openreach’s UK network, which covers the totals for all ISPs that take their products combined (e.g. BT, Sky Broadband, TalkTalk, Zen Internet, Vodafone etc.).

Advertisement

The rollout of their FTTP lines continues to grow, with 2.23 million premises being added to their network coverage in H1 FY26 and that’s level with 2.2m in the previous half. As for take-up, some 7.65 million FTTP broadband connections have been made on Openreach’s network (up by 1.11m), which equates to a take-up of 37.66% (up from 36.13%). This is a healthy figure for the incumbent.

However, rival networks have managed to peel plenty of consumers away from the industry giant’s older network (mostly from the areas where OR has yet to build FTTP), with Openreach reporting that total broadband lines fell from 20.09m to 19.68m in the last half year (down by -411k vs -450k in the previous half). The latest bleed in customer lines may well have been given a boost by Sky Broadband’s launch of CityFibre based packages (here).

Allison Kirkby, CEO of BT Group, said:

“BT is delivering on its strategy in competitive markets. We’re building the UK’s digital backbone, connecting the country like no one else and accelerating our transformation. Openreach full fibre broadband now reaches more than 20 million homes and businesses and our award-winning EE network is live with 5G+ coverage for 66% of the population.

Since the start of the year, we’ve driven customer growth across Consumer broadband, mobile and TV and we’re stabilising our UK-focused Business division. Outside the UK, we’ve completed strategic exits and we’re reshaping our International unit. BT’s transformation is delivering ahead of plan, as our UK focus and radical simplification and modernisation are helping to offset declines from our International and legacy businesses and higher labour-related costs since the start of this tax year.

We remain on track to deliver our financial outlook for this year, our cash flow inflection to c.£2.0bn in FY27 and c.£3.0bn by the end of the decade, and we’re announcing an increased interim dividend to 2.45 pence per share.”

Take note that BT now only publishes detailed results biannually for H1 and H2 (financial quarters), thus they release very little data for the other two intervening quarters and that similarly means we will only be able to do two detailed reports – like the one above – twice every year.

Just a quick reminder. BT introduced a new metric in 2023, which predicted that their total labour force would shrink from 130,000 to between 75,000 and 90,000 by 2030 (inc. subcontractors). The operator also predicted that Openreach’s FTTP coverage would grow to between 25-30 million premises and deliver take-up of between 40-55% by that same date. The latest report includes a quick progress update on this.

Advertisement

BT Group’s Progress Against Strategic Metrics:

• FTTP premises passed increased by 2.2m to over 20m; target of 25-30m.

• Openreach take-up increased to 38% and retail take-up increased by 0.6m to 4.0m; targets of 40-55% and 6.5-8.5m respectively.

• 5G UK population coverage increased to 89% and 5G retail connections increased by 0.7m to 13.9m; targets of 99% and 13.0m-14.5m respectively.

• 5G+ population coverage increased to 66%; target of 99%.

• Total labour resource decreased by 5k to 111k; target of 75-90k.

• Group Net Promoter Score increased to 30.5, up 5.2pts year-on-year; target of 30-35.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« BT and EE to Sell Starlink as UK Rural Broadband Solution to Customers

My prediction is they’ll bottom out at around 15-17 million lines. Would be bad news for the altnets if they don’t.

nearly 1.5 million homes still have ADSL?

It seems a lot. Mostly rural, I’d guess, in places with no FTTP and too far from the cabinet for FTTC to be viable.

Some might be people happy with the lower speeds, but there are large areas that didn’t even get FTTC so are stuck on ADSL.

I know of one village which the oldest and newest parts have FTTP, but the main part of the village built in 1970s only has ADSL fed from an exchange several miles away and a lot of the cables are aluminium. The three different parts are fed by three different exchanges.

There is VMO2 in all of the village but people complain it is very unreliable. They’ve just completed the XGS-PON upgrade so once that is simple to order more people might move to that, but if you don’t want VMO2 the only option is ADSL.

CityFibre stopped just before the village and are now building BDUK just past the village but they’ve just run their fibres past without connecting any homes.

And also people who are genuinely not fussed about having upgraded speeds, there are people who exist who are content, don’t want anything different or new. Not everyone is itching to have 1gb fibre links

Quite a few ADSL lines used for remote access / telemetry where bandwidth isn’t essential.

Well I’ll be another ex Openreach customer early next year, poor customer service & incompetence is what drives people away.

EE is a other company I can’t wait to escape, how they keep winning UKs best network is beyond me.

I also know a company owner who is currently in a legal dispute with BT & Openreach for repeated failures to fix a problem with there business broadband connection over several months.

OR deserve to lose customers. 6 years ago they said FTTP was coming to our area. Every single year it’s pushed back by another year.

Now Netomnia have turned up, rolled fibre into the OR ducts, none which were blocked and will be going ready for service in the next few weeks.

Simple tasks just can’t get done by OR. Netomnia are using the same ducts without issue and cabling from the same exchange. The only blockage is ORs willingness…

At what level do OfCom decide that a player with significant market share does or does not need to be regulated and can compete by offering market driven pricing?

Tesco can offer whatever prices they want, without Sainsbury’s and Asda being able to complain to a regulator. So there’s no hope for the village store to see bread prices regulated in the supermarkets.

It’s a double sided coin.

In urban areas they can lower prices to compete with altnets. In rural areas, often with slower connections and lack of FTTP they would also be able to charge what they like. I don’t think it is a good idea unless you protect those areas with a price cap.

We can’t be having someone paying £36.50 for 35Mb FTTC and someone in a city paying £32 for 500Mb FTTP to match an alt net.

Interesting that BT Consumer are adding customer numbers whilst Openreach are losing lines during the reporting period. Makes me wonder if Sky shifting to CF is the real driver for line losses rather than individual altnet activity.

Fall by 242k, is that all? Pity it is not a lot more, still better than nothing.

A large chunk of that 5k fall in headcount would have come from the sale of the overseas units. The numbers for the UK might be expected to accelerate after 2026, with the rate to be determined in part by the outcome of the Ofcom review.

Openreach apparently reckon the fault rate on FTTP lines is 1/3 that of copper so the logic is that you will only need about a third of the engineers you have today. if you add that to the fact that they are going to end up with less with less lines than they have today then it could end up being even less.

Only really true if field technicians only fix faults. It’s only one part of their workload

@Big Dave & @125us:

BT Group has already published their projections, so there is no speculation necessary in that regard.

The concern is that the group may decide that further job reductions are required because of the possibility of additional, regulation-driven, cost increases.

If the government continues with proposals around employment law, for example, then the viability of existing business plans will be, without doubt, undermined.

Furthermore, government policies will impact all businesses operating and providing services to the sector.