BT FTTP and G.fast Broadband Cover Tops 4.2 Million UK Premises

BT Group’s latest results to the end of September 2019 (Q2 19/20 financial) confirm that Openreach’s “ultrafast broadband” (100Mbps+) ISP network has increased its coverage to total 4.2 million premises (up from 3.7m last quarter), which includes 1.81m on FTTP (up from 1.51m) and 2.42m on hybrid fibre G.fast (up from 2.16m).

Overall most of the developments since their last set of results have been related to Openreach, which has launched a new Dark Fibre X product (here), extended new build FTTP discounts to commercial premises (here), started deploying full fibre to more MDUs / apartment blocks, paused their future rollout plans for G.fast (here) and soft launched a new 550Mbps and 1Gbps FTTP tier for consumers (here).

On top of that they’ve also announced their FTTP rollout plans up until March 2021 for 4 million UK premises (here) and begun to trial a series of new roll-out methods and technologies, which are all designed to help cut the cost of deploying fibre optic broadband into rural villages and towns (here).

Advertisement

Elsewhere BT itself has announced a major “fibre broadband“(FTTC) upgrade for 700,000 customers on their slower ADSL based copper line services and unveiled a new converged unlimited 5G and fixed broadband plan called Halo, among various other changes (summary here).

Financial Highlights – BT’s Quarterly Change

* BT Group revenue = £5,780m (up from £5,633m)

* BT Group profit after tax = £563m (up from £505m)

* BT Group total net debt = -£18,347m (from -£17,805m)

Meanwhile BT’s assumptions about clawback / gainshare via the government’s Building Digital UK roll-out programme (i.e. public money that can be returned and reinvested by local authorities to help “superfast broadband” coverage to reach around 98% of the UK by the end of 2020) states that their grant funding deferral at the half year was £622m (oddly this is down from £667m at their last results).

The operator’s previous “life-time view” of their BDUK linked contracts, which predicted that take-up of their FTTC/P network within related areas could in future reach 61%, suggested that up to around £712m of public investment might eventually be returned for the above purpose.

Sadly BT doesn’t provide customer figures for their own retail broadband ISP (likely covering up for declines), although it’s noted that 75.8% of their consumer broadband base now take a “superfast broadband” service (up from 74.3% last quarter – mostly via FTTC) and this drops to just 1.6% (up from 1.1%) for their “ultrafast broadband” (FTTP/G.fast) products. Remember that ultrafast services today have limited coverage.

Advertisement

Openreach’s Network

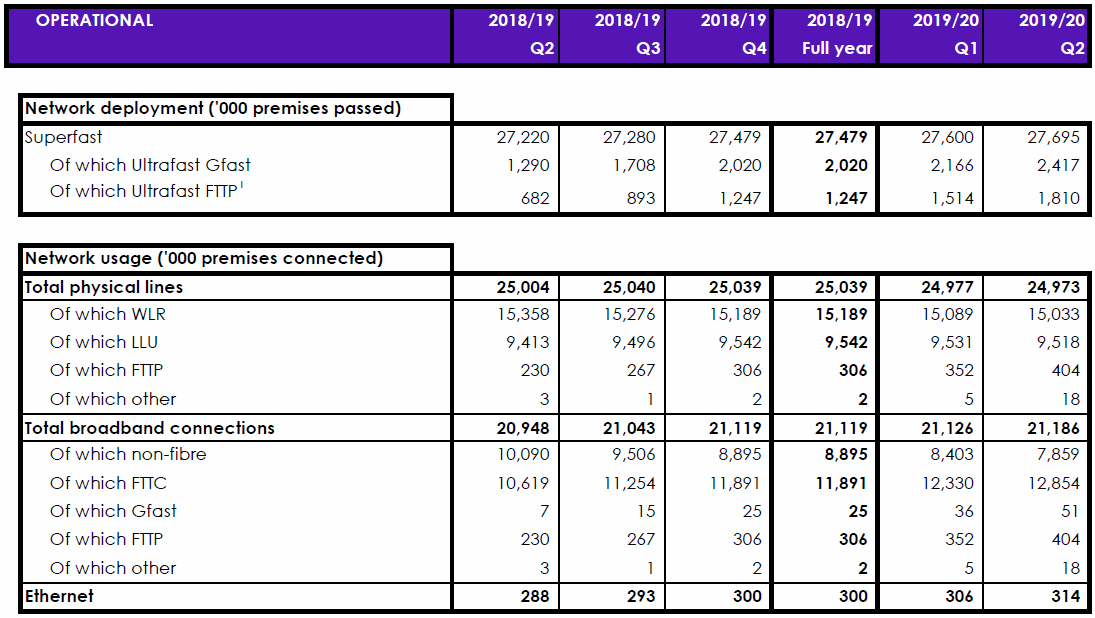

The table below offers a breakdown of fixed line network coverage and take-up by technology, which covers the totals for all ISPs on Openreach’s national UK network combined (e.g. BT, Sky Broadband, TalkTalk, Zen Internet, Vodafone etc.).

We can see here that their rollout of “full fibre” (FTTP) lines is the dominant deployment among the two “ultrafast broadband” technologies (+296,000 premises added in the quarter), although hybrid fibre G.fast has suddenly surged after a slumber (+251,000 premises added).

Elsewhere take-up of FTTP is 22.32% (down from 23.25% last quarter and 24.54% before that), while G.fast stands at 2.11% (up from 1.66% last quarter), although such figures don’t tell the whole story. Both technologies are in their primary roll-out phases and take-up is a dynamically scaled measurement (impacted by lots of factors like consumer choice, awareness and build pace), which means that at certain stages the figure may go up or even down.

Advertisement

We expect the overall take-up for FTTP to fall as Openreach’s roll-out pace increases, which is because a big chunk of related lines were built well before the much more rapid “Fibre First” strategy began and this gave take-up a chance to grow. Balancing against this is the fact that FTTP is a more familiar, attractive product and a lot of it is being deployed to new builds and BDUK areas (i.e. better for take-up).

On the flip side G.fast has very slowly rising take-up, although its deployment pace has been like a yo-yo over the past couple of quarters and in the last quarter Openreach seems to have picked up the pace again as they build toward their current target of 2.73 million premises by March 2020. The technology is currently under review and as such we no longer know how far it will go after March or if they’ll go full steam on FTTP instead.

Equally G.fast has also suffered due to limited adoption and promotion by ISPs, although Sky Broadband’s recent introduction of related packages is likely to give it a boost and we may start to see that having a bigger impact upon take-up from next quarter.

As usual our own ISP Listings page has been displaying both ultrafast broadband products for a long time because we don’t force ISPs to pay a commission in order to be shown, like big commercial comparison sites do.

Philip Jansen, CEO of BT Group, said:

“BT delivered results in line with our expectations for the second quarter and first half of the year, and we remain on track to meet our outlook for the full year.

We’ve invested to strengthen our competitive position. We’ve accelerated our 5G and FTTP rollouts, introduced an enhanced range of product and service initiatives for both consumer and business segments, and announced price and technology commitments to deliver fair, predictable and competitive pricing for customers.

Openreach is significantly accelerating its pace of FTTP build and is now passing a home or business every 26 seconds. Openreach announced a further 29 locations in its build plan to reach 4m premises by March 2021, and we continue to make positive progress with Government and Ofcom on the enablers to stimulate further investment in full fibre.

We continue to make progress on the BT modernisation agenda, delivering over £1.1bn in annualised cost savings, and announcing locations in our Better Workplace Programme.”

On the mobile site of things it’s worth noting that EE (BT) has continued to rollout their 5G network, which is now live in over 20 cities and large towns. On top of that they’re also part of a new Shared Rural Network (SRN) agreement with the other operators, which aims to push geographic 4G coverage to 95% of the UK by the end of 2025.

One other point to make is on Openreach’s build pace for FTTP. At present this is said to be running at around an average of 23,000 premises per week and if you dig deep into today’s results then they now expect to exit 2019/20 with an impressive run rate of around 30,000 per week.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Hints of a Bidder Shortlist for £165m N.Ireland Broadband Project

Comments are closed