Report Reveals the Barriers to UK Gigabit Broadband Adoption

The Broadband Stakeholder Group, which is a think-tank that advises the UK Government, has today published a new report from WIK to help highlight some of the barriers that remain (other than coverage) to getting customers to adopt “gigabit-capable” broadband ISP connections ahead of the copper switch-off.

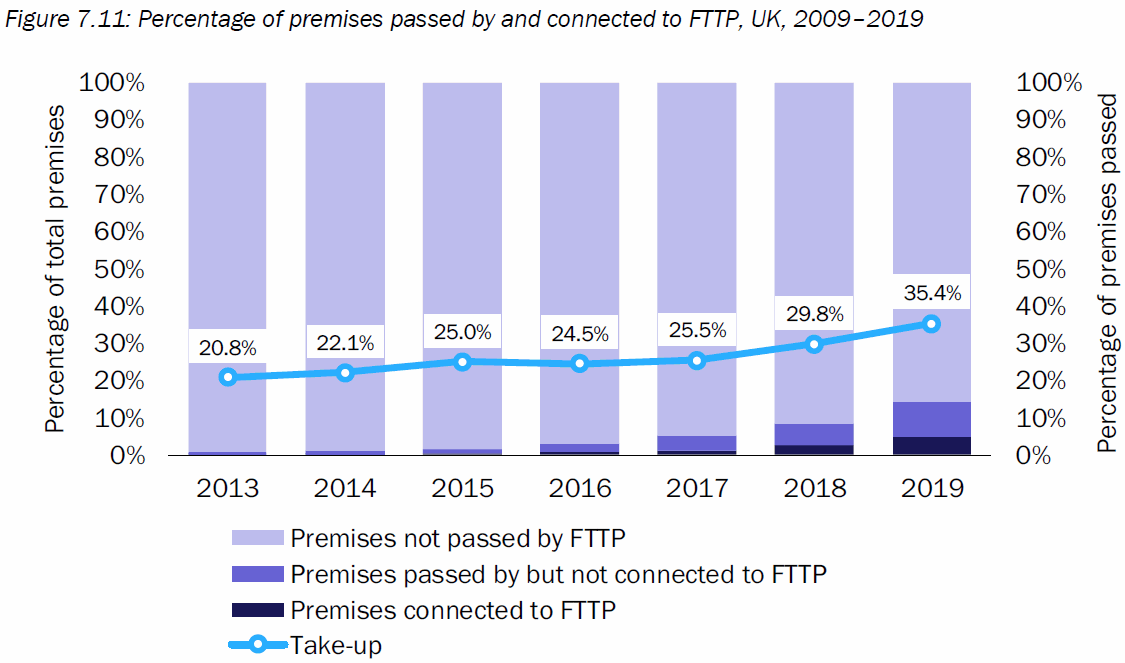

At present nearly 97% of the United Kingdom should be able to access a fixed “superfast broadband” network (download speeds of 24Mbps+), although over the past few years the Government has gradually switched its focus to fostering “full fibre” (FTTP) and other “gigabit-capable” (1000Mbps+) networks that currently only cover around 20% of premises.

Most of the “gigabit” class coverage that exists today comes from Fibre-to-the-Premises (FTTP) based infrastructure from multiple operators (Summary of Full Fibre Progress) and also Virgin Media’s hybrid fibre DOCSIS network (Virgin’s D3.1 upgrade will enable 1Gbps+ download speeds to half of all homes by the end of 2021).

Advertisement

On top of all these existing deployments, the Government has also committed £5bn to help ensure that every UK home can access a gigabit capable connection by the end of 2025 (here), which will primarily target the final 20% of premises (i.e. the hardest to reach rural and some sub-urban areas) where pure commercial investment models tend to fail.

The current focus on deployment is all very well, but it’s also important to consider the other side of this coin – adoption by consumers.

Seeking Gigabit Adoption

Attracting take-up of gigabit services is vital in order to support the investment that operators are making. At this point we’re also assuming that any future framework under the Government’s £5bn investment will probably involve an element of clawback (i.e. public money being returned by operators as take-up rises), which may be similar to the one seen under the Building Digital UK contracts that helped to boost “superfast” cover beyond 95% and is continuing to do so today.

Clare MacNamara, CEO of BSG, said:

“No gigabit nation was built in a day, but several, like Sweden, have largely been achieved in the course of a decade, with favourable demand-side conditions a critical factor. As the UK seeks to leverage its position as an evolved digital nation, and deployment of new digital infrastructure accelerates, we need to aim for a similar level of fibre adoption to international competitors so that consumers and businesses benefit from the investments being made.

Now is the time to grasp the opportunity to build on the constructive collaboration achieved between industry, government and the regulator. During this national crisis we must implement these recommendations to speed up our recovery and so that we create the conditions needed to bring consumers and businesses with us towards a fibre-enabled UK.”

On the surface it may seem like a simple matter of “build it, and they will come.” Indeed full fibre networks seem to do quite a good job at organically growing take-up, which is partly down to the significant step change they bring in performance and reliability. The chart below, which is from a separate report by Analysys Mason, is certainly showing some promise.

Advertisement

However, despite those positive signs, attracting take-up remains a slow and complicated process due to various obstacles. For example, consumers may be discouraged by the higher prices of a new service or any loss of existing functionality (e.g. copper extension sockets won’t work with FTTP as calls are made via VoIP and such lines won’t work in a power cut without a battery backup). Meanwhile others might not even desire a faster service (e.g. users with only basic needs).

The rising number of gigabit-capable alternative network (AltNet) ISPs also make the market much more confusing for consumers and some people may not even be aware that they can access a faster connection. On top of that you also have the more predictable problems, such as people being tied to long contracts with their existing ISP, which could hamper their ability to switch, or simply being fearful of switching in general.

Lest we forget that gigabit broadband somewhat lacks a “killer application,” although admittedly the ability to transfer data so quickly does make everything feel much more seamless. Indeed people are often attracted just as much by the idea (marketing) of 1Gbps, perhaps even more so than the reality of its practical benefits.

Advertisement

One issue here is that you’d struggle to take advantage of a full 1Gbps+ connection today as most internet services simply can’t run that fast and hardware limits often get in the way. For example, even those 1G LAN ports on your router can’t individually hit 1000Mbps due to limitations of their design (960-970Mbps is closer to the real max) and slow WiFi is another issue, although the addition of the 6GHz band in the future may help.

Looking to the future

Openreach (BT) currently has the biggest job here because of their massive legacy copper network and they’re only just starting the transition to FTTP (here). The current process will give consumers a few years to make a natural migration (supported by messaging and adverts from ISPs), although eventually some users may need to be forcibly switched (this needs to be handled very carefully).

Openreach expects to switch-off their old analogue telephone (PSTN) services in favour an all-IP (e.g. VoIP) platform by the end of 2025 (here), which is a process that has already started with existing copper networks adopting IP solutions via SOGEA (here). However it will take years longer, through a phased approach, to fully withdraw the old physical copper line network itself (Openreach will start this process once 75% of an exchange area can access FTTP).

The new report from WIK – ‘Moving to a fibre-enabled UK: International experiences on barriers to gigabit adoption‘ – essentially looks at how other countries (i.e. France, Germany, Italy and Sweden) have handled the various challenges involved with growing take-up and makes a series of recommendations for the UK. WIK also did a related report for the FTTH Council Europe last year (here).

The research found differences in approaches and some commonalities. Across the board it found that there isn’t always a direct correlation between the pervasiveness of gigabit networks and the pace of consumer and business adoption. The latter may have more to do with attractiveness of alternatives, such as FTTC, which may be perceived to be adequate.

The above is particularly true in markets when triple-play (i.e. bundles of broadband, TV and phone) is offered at the same price on lower-speed networks, such as in France and Italy. Conversely, where there are currently only low speed broadband offerings, as in many rural areas, migration on to high speed gigabit services becomes an attractive proposition, particularly when well-marketed in those localities. “There is evidence of this in Germany and France as well as in the UK,” said WIK.

Overall WIK has identified four broad areas where the BSG believe there could be useful lessons for the UK.

WIK’s Four Recommendations

1. Address advertising and customer communications to improve consumer and business understanding of the benefits of gigabit broadband – and ability to distinguish between the broadband networks available to them.

The UK Government and Ofcom could consider developing and adopting a labelling system that enables consumers to make informed purchasing decisions, including by allowing them to better compare services they are contemplating. Options pursued in other countries include labelling systems based on “traffic lights.”

The Government could also consider providing funding to local authorities to support the marketing of gigabit broadband which is being deployed through Government aid programmes.

2. Incentivise take-up of new gigabit broadband connections and address issues of affordability for businesses and consumers.

Building on previous experience, the Government could consider expanding on its existing voucher schemes. Besides extending schemes which subsidise the cost of new connections, the Government could consider whether there may be value in schemes which incentivise customers to upgrade to gigabit-capable broadband lines in areas where such lines have been deployed.

Such support could be universal, or, if desired, could be targeted towards those facing specific challenges with affordability or groups which risk being left behind. Vouchers to support the provision of gigabit connectivity for public institutions including schools and hospitals could also be considered.

3. Leverage digitisation to support the economy and society in a post COVID-19 era.

The Government could consider revitalising and refocusing initiatives around the digitisation of industry and public services to leverage lessons from the coronavirus experience. Such initiatives could support and extend the potential for remote working, delivery of healthcare and education services, as well as supporting businesses in utilising new technologies such as AI and robotics to aid production and increase efficiency.

Support could for example include funding for central as well as local Government to support the delivery of remote healthcare, social care and monitoring, and innovation vouchers for SMEs to support their purchase of consulting and training services to adapt to the use of new technologies.

In this context, the Government could also highlight, for example through a national marketing campaign, how gigabit broadband connections could support SMEs in pursuing flexible working and implementing digital solutions and could potentially consider a voucher scheme for this purpose. Tax incentives could also be explored.

4. Facilitate eventual switch-off of the legacy copper network by securing buy-in from all relevant broadband industry stakeholders.

Ofcom and Government together with industry, could consider what role if any, could be played by co-investment, in the context of ongoing discussions on migration to fibre networks and switch-off of copper networks.

Consideration is also needed, through industry dialogue supported by Government, of how migration to gigabit networks and switch-off of the copper network can be achieved in areas where fibre has been deployed by alternative investors or where there are competing networks.

Government, together with Ofcom, could also consider whether any additional measures may be needed to support the deployment of 5G fixed wireless access, especially in the most remote areas. A holistic solution will be needed across the different operators and technologies present to achieve nationwide copper switch-off.

We’d add to the above that Ofcom could also do more to require that network builders share their existing coverage data, particularly Openreach and Virgin Media, in order to make it easier for third-parties like ISPreview.co.uk to build more effective broadband coverage checkers that work across multiple networks. At present trying to get any progress on this front is often akin to hitting your head against a brick wall and the industry would benefit from a clear standard.

At the same time we shouldn’t forget that building gigabit-capable networks isn’t just about achieving the top speed, it’s also about creating a network that will last for decades to come and give people greater reliability and performance from whatever speed they choose. Consumers are generally happiest when they get what they pay for, as opposed to today where for many areas achieving what is advertised by an ISP can be rather more challenging.

Overall WIK’s report provides quite a good summary of the challenges, even if they are issues that regular readers of ISPreview.co.uk will have seen repeated on these pages more than a few times before over the past few years. Finally, credits to Thinkbroadband for the most recent broadband statistics.

Greg Mesch, CEO of CityFibre, said:

“Delivering the Government’s goal of nationwide rollout of full fibre by 2025 has never been more important. As CityFibre and others invest billions to future proof the digital connectivity that increasingly supports our lives and businesses, it’s essential that consumers are able to easily choose and switch to these new networks. This timely report outlines the steps required to enable consumers to benefit from the rollout, including the need for clearer broadband advertising. We look forward to working with industry colleagues, Government and Ofcom to deliver them.”

Catherine Colloms, Director of Corporate Affairs and Brand at Openreach, said:

“We know that new, ultrafast and ultra-reliable broadband can help the UK bounce back more quickly from the Covid-19 crisis. Our new network’s going to boost productivity, slash carbon emissions, and level-up our rural and local economies – and that’s why we’re aiming to reach 20 million UK homes and businesses with full fibre by the mid-to-late 2020s. But all that won’t happen from Openreach building it alone. It is vital that the industry and Government work together to drive faster deployment and rapid adoption, making sure everyone can reap the benefits of full fibre broadband as soon as possible.”

Lucy Thomas, Corporate Affairs Director at TalkTalk, said:

“Now more than ever, the whole country needs fast, reliable connectivity, so the race to deliver a full fibre Britain is on. These findings make clear that two things are vital to making it happen: cost, so that consumers and businesses can afford the product and are not priced out; and communications – so that people understand all the benefits it brings. By learning the lessons from Europe and elsewhere, we can incentivise take-up and ensure that the full advantages of full fibre are available and affordable for everyone. So it’s down to industry, the Government and regulators to take this on board.”

Andrew Wileman, Director of Regulatory Affairs – Virgin Media, said:

“The importance of connectivity to our lives has never been more apparent than it is right now. Next-generation connectivity has the ability to turbocharge the nation’s economic recovery and Virgin Media is making significant progress to bring gigabit broadband to more than half of the country by the end of 2021. Take up is vital, which is why we welcome the recommendations in the report and urge Government, regulators and industry to come together to explore how they can help drive adoption in this vibrant market.”

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« ISP TalkTalk UK Sees Job Losses in York After FibreNation Sale

ISP Trooli Covers 26,000 UK Premises with FTTP Broadband »

Be Nice if they simply focused on the areas with only ADSL or FTTC broadband and upgraded those to FTTP.

So many times on here you see X area to get X provider providing FTTP when they already have Virgin or FTTP with another provider.

If the UK wants full FTTP (or 1GB internet however they are classifying it) then stop building in the same areas someone else has covered.

From a bitter customer desperate for our town to get FTTP/ anything over 25 I get now.

I know what you are saying. I waited years for fttp only for after they had done every other street near me to, cancel my street and give us fttp instead

The downside to this approach is that it could also reduce competition, so people may end up either paying more or not upgrading as a result.

I’d like to see the fibre lines being shared across ISPs similar to the old copper lines for ADSL/VDSL so at least we can retain/improve competition.

The areas without superfast broadband are seen as the least profitable areas – that’s why they don’t have superfast yet. Almost no company will build there without financial incentives (and many not even then). It is the job of the BDUK bodies to bribe companies to build, but unfortunately most of them seem to have run out of steam, and several are now waiting for the next round of state money to become available in a year or two. Meanwhile areas with superfast or ultrafast broadband are getting FTTP at pace, while those in ADSL only areas are getting eye-watering quotes for USO solutions.

After 20 years of putting up with rubbish service from BT Openreach with the best download speed of 1.1 meg, I have up. Bought a 15dn gain Arial and a phone chip plus an RTL Router. Now on a good day I get 48meg download. I bought a VOIP phone service and retain my old number from BT. Cost is less than the line rental was and I get TV from Amazon as part of my Prime Membership.

High speed cable is installed on the pole outside my house but no one will provide a cabinet near enough for it to work. That is the sort of backward thinking that leaves the UK walking when it would be running. If the market had not been removed from BT and handed out to all these other companies,they would have been able to keep the UK at the front of the telecoms table as it was when I used to work for them on the 70s. Whenever government interferes, it messes things up.

A big issue is companies saying it’s not viable for them to connect and offer the install for quite a high fee. But it would’ve been free 2 years ago.

A question could be, are the FTTP providers going for areas where there is a better “look” for them rather than the areas that have enquired signed wayleaves but simply can not afford the install cost? They would start getting there money back if they installed to these areas. Rather than over build when the cost will be the same but there is more competition. Leading to lower returns.

Providers know their costs and RoR a lot better that you do. They are building where in makes sense to build for them.

In my more cynical moments I think adoption might improve rapidly if the gov legislated against all this fast/superfast etc use except where it hit specific high minimum speeds. Otherwise providers have to call their package a Slowband product!

The majority already think they have got fibre! This can be squarely blamed on the ASA for allowing copper cable to be called fibre in advertisements..

@Guy Cashmore, Guy you hit the nail firmly on the head, the ASA is a joke, in this regard.

Trouble is Guy, the ASA court case does not help, https://www.asa.org.uk/news/asa-wins-judicial-review-on-broadband-fibre.html#:~:text=In%202018%2C%20CityFibre%20judicially%20reviewed,found%20in%20the%20ASA's%20favour.

@ Chris Sayers

Utterly unbelievable isn’t it.

The sales staff can also be a pain over this, as I found out when I was making enquiries over FTTP where they regularly kept mentioning FTTC connection.

In the end it was only through my own research that I found out about several of them using their own FTTP network. So where I thought Openreach enabling it was enough, I was wrong, despite at no point being told otherwise when I enquired about Openreach FTTP.

No mention of the UK core network and its support or capability of supporting a boost in bandwidth being passed around it.

It’s not a relevant issue so no need to mention it. The UK backbone infrastructure is fine.

Based on issues recently with demand bringing issues to light I somewhat dissagree.

Given demand peaked this year on 10th / 11th March and that alongside a night in December last year are the two high points for load on the past 6 months I guess we have different definitions of ‘recent’ and of what issues actually are given the UK as a whole has been fine.

The only capacity issues have been Virgin Media upstream. Those are nothing to do with the ‘UK core network’ whatever that may be.

Uplink from Virgin Media has been an issue, and this is my point, as nd users start getting more bandwidth uplinks from providers are going to see a lot more demand, I believe Virgins issues are a good insight based on their services already being much faster on average than other suppliers.

Virgin Media’s capacity issues are with their access network. Given they are the only provider of any scale using that type of access network they aren’t representative.

You could be sharing less than 100 Mbit of upstream capacity with 200 other customers. I share 1.2 Gbit of it with 31.

Didn’t mean to post.

The highly asymmetric speeds and capacity on VM are due to it being a network originally built to carry downstream TV signals with limited upstream spectrum.

Their issues with upload capacity are shared with other cable companies around the world, but apart from Wightcable, Isle of Wight only and replacing that network with full fibre, they have no peer in the UK.

Definitely no upstream capacity issues deeper into their network, it’s strongly utilised downstream delivering content to customers way more than upstream.

I mentioned the upstream capacity you share, potentially as little as 100 Mbit, you share 1.6-1.8 Gbit or more downstream.

VM are upgrading. They are the only ones having these issues though as everyone else’s access networks are far less asymmetric or capacity on the access network isn’t shared at that stage and isn’t until symmetrical backhauls that have to be dimensioned around the higher downstream usage.

Andrews and Arnold don’t meter upstream on at least some of their packages for a good reason – it’s never where their capacity is maxed or billing needs to happen.

Hope that helps.

Carl, I feel like your talking about thw connection at docsis side, I’m talking about how much can move downstream from outside their network.

I’m moving data around most of Virgins network fine, however as soon as peering outside the Virgin/LG network its a different story depending on where in loading from

That’s nothing to do with the UK’s infrastructure as a whole but peering and transit policies decided on by LG alongside latency impact.

Most of the content on the network comes from CDNs. Virgin Media / Liberty have a restrictive peering policy and continue to have an ongoing migration of VM’s resources more and more behind Aorta.

Then of course there’s simply that some nations don’t have as much abundant capacity as we do.

Either way I repeat my earlier comment about peak loading period not being recent and VM still not being indicative of the UK as a whole due to the increasing reliance on Aorta and Liberty Global’s interconnect policies.

Peering and transit in the UK is fine. Loads of capacity available and more easy enough to add if people are willing – which Liberty sometimes aren’t and are expecting people to pay for.

There is very little buffering on such links. If they are saturating it’ll be pretty obvious as latency and then packet loss kick in.

What do you mean by ‘UK Core’? Each ISP will either have their own backhaul network or will lease from someone else. There’s no single network. I’ve never met an ISP who didn’t properly manage the capacity available, but different ISPs will have different policies around how hot they want to run their networks. If you buy the cheapest broadband you can find don’t expect it to be great – if you buy a DIA product it will be virtually the same as having a private circuit all the way to the peering point.

There is demand for cheap but not much demand for ultrafast.

My house was just REMOVED from the fttp rollout and given fttp

Edit:

Was given fttc instead of fttp