CityFibre Builds FTTP Broadband to 3.6 Million UK Premises, with 400k Connected

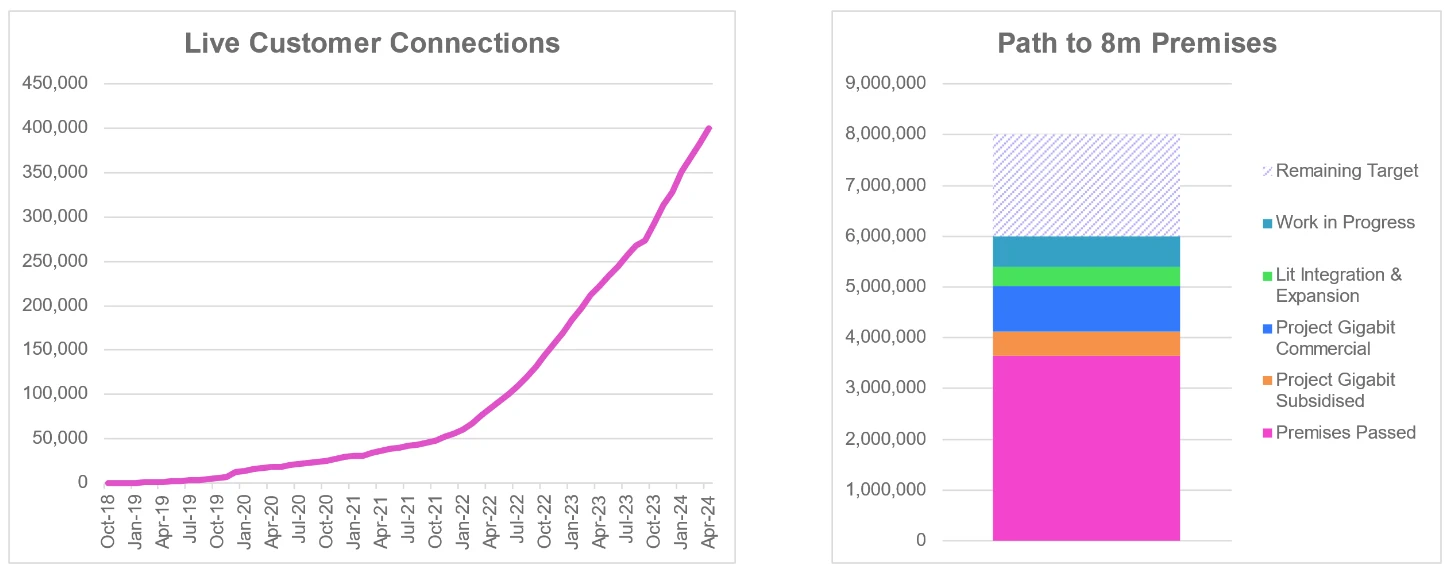

Network operator CityFibre has this morning revealed that their 10Gbps capable Fibre-to-the-Premises (FTTP) broadband ISP network has now grown to cover 3.6 million UK premises (3.3m RFS), which is up slightly from 3.5m (3.2m RFS) in late January 2024. The network is also home to 400,000 customer connections (up 77% year-on-year).

In case anybody has forgotten, the operator currently aspires to reach up to 8 million UK premises (funded by c.£2.4bn in equity, c.£4.9bn debt and c.£800m of BDUK subsidy) – or around 30% of the UK – by the end of 2025 (here). But that target has been put under strain by recent changes in their commercial builds and redundancies (here), which partly reflected a need to refocus a lot of resources toward their Project Gigabit contracts (here).

The operator is now looking to grow their network coverage by another 1 million premises this year, but they’ve also previously signalled their expectation that a big chunk of this could be delivered through mergers and acquisitions (M&A). Looking forward over the next two years, such M&A activity alone could theoretically add up to 1.5-3 million extra premises to their coverage, which recently began with the Lit Fibre acquisition (c.300k extra premises built and planned).

Advertisement

According to today’s results, CityFibre now states that they have a “clear path to over 6m premises of its full 8m target,” although it’s notable that the announcement doesn’t make any reference to the original 2025 completion date. The reality is that it will now almost certainly take longer to achieve the original goal.

In addition, the announcement notes that the operator’s customer connections have now exceeded 400,000, which is an increase of 77% year-on-year. Cityfibre now claims to be regularly installing over 1,000 new customers a day, which are said to be supported by more than 330 field service teams with a Right First Time (RFT) installation rate of over 95%.

On the financial front, CityFibre also delivered a positive EBITDA performance for the full three months ended 31 March 2024, which puts them ahead of their “target to breakeven in the first half of the year”. Quarterly revenues have increased by more than 30% year-on-year.

Advertisement

Greg Mesch, CEO of CityFibre, said:

“2024 has got off to a flying start for CityFibre. We’ve achieved profitability ahead of schedule, increased revenues by more than 30%, reached over 400k customers, secured almost £400m in new Project Gigabit contracts and acquired Lit Fibre.

With a clear path to 6m premises we are making great headway towards, and potentially beyond, our 8m target. Over this entire footprint, we will offer our partners the best product, service and economics of any scaled wholesale platform in the UK.”

In case it wasn’t clear from the data above, CityFibre coverage figure of 3.6m has yet to integrate Lit Fibre’s network, which isn’t surprising as it usually takes quite a bit of time to both complete a new merger and then properly integrate the networks (Nexfibre have a similar lag with adding Upp’s network coverage to their total). But technically speaking, they’re now at around 3.8m – 3.9m premises and the merger is expected to complete during H2 2024.

At the end of the day, CityFibre may end up falling a bit behind on their original 2025 coverage goal, but it’s worth remembering that what they have already managed to achieve – as an alternative network in an aggressively competitive broadband infrastructure market – is still incredibly impressive. The push they’ve given has also played a role in encouraging the more established players, such as VMO2/Nexfibre and Openreach, to up their game.

The network operator has often proven itself to be resilient in the face of strong challenges, and it’s important never to underestimate this sort of progress, however imperfect it may be. Lest we forget, there was a time, many years ago, when few believed they’d ever be rolling out FTTP to the scale we see today.

Mark is a professional technology writer, IT consultant and computer engineer from Dorset (England), he also founded ISPreview in 1999 and enjoys analysing the latest telecoms and broadband developments. Find me on X (Twitter), Mastodon, Facebook, BlueSky, Threads.net and Linkedin.

« Giffgaff Launch £12 UK 40GB Mobile Broadband and Calls Tariff

I hope CF decide to finally restart & finish some of the contracts they suspended like Bath.

You can add Edinburgh to the list too!

Edinburgh’s on hold because their contractor there (GCU) broke the rules and managed to dig through a railway bridge. Given the fallout from that, I suspect it will be a good while yet before that particular build restarts.

And Gloucester…

@RobC Thanks for clarifying. Yes, I remember the chaos that caused on Shandon Place!

While technically it’s Network Rail’s bridge and responsibility, a railway hasn’t run underneath it since the Beeching Axe. A cycleway/pedestrian path now goes underneath it.

If it’s not RFS, then what is it?

PR-BS.

The gap between built+live and RFS is usually down to issues of ISP support (i.e. a network can be live in an area, but there might not be any retail providers able to sell there yet) or wayleaves/mdu access delays etc. Every network will have issues like this, and at least CityFibre gives us both figures – many others do not.

Don’t BT/Openreach have RFS too with actual numbers taking service. Same as any provider.

What is the purpose of the phrase “10Gbps capable” in the opening sentence?

Is the article referring only to those parts of the Cityfibre network lit with XGS-PON equipment or does it refer to the whole of the Cityfibre network.

If it refers to the whole network then presumably Openreach also have a “10Gbps capable” network as well? (Well, I suspect that both networks are probably 50Gbps capable but that might be getting a little too extravagant).

Yes, XGS-PON, and no, Openreach’s network is currently still GPON – until they properly do/launch XGS-PON / ComboPON.

So, for clarity, Cityfibre’s XGS-PON upgrade work is now complete and all Cityfibre areas have 10G available?

I haven’t seen that announced anywhere – maybe I missed it.

[ I’ve managed to get Edge to submit this with the whole of my usual name rather than just a ‘D’ this time – woohoo. ]

Does it matter? They are still ahead of BT using legacy GPON even in deployments as of TODAY’s date even.

BT has 14 million RFS whilst CF has 3.6 million. CF will never be close to even BT bud.

And BT has had decades to get there too, and still deploy legacy tech. 🙂

People are buying it, anonymous, in their droves. It doesn’t matter in the grand scheme but what Openreach are doing or not is quite irrelevant.

Overlaps will be an issue as time goes on. Take Milton Keynes, which was one of their first big pushes. Nexfibre are starting to overbuild and Openreach have already pushed a lot of FTTP there too.

Nice for the customer to have a choice of not just ISP, but infrastructure, but if CityFibre only have 11% uptake, that is surprisingly low.

Cityfibre have a 27% Take-up in Milton Keynes.

City Fibre need to merge all the other Altnets with themselves so they can be a true national third telecoms infrastructure provider. Be easier to have three than the current amount we have now. Plus allows for better investment and ROI.

Only where it makes sense and for areas where they haven’t already built. Also, can’t see Netomnia being swallowed up yet – they are more likely to buy other ALTNETS when time is right.

Would like to see CityFibre and Netomnia have a joint business venture, would boost there

coverage across the country and get more ISP’s on board.

Wouldn’t hold your breath on that one, Mike.

Are they celebrating 11%?